UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 6 minutes

The conventional wisdom during the baby boom generation was that buying a house was a ticket to financial freedom. Because policy makers believed in this concept, since the late 90s there was an aggressive attempt to get people into homes they couldn’t afford. Obviously, over leveraging yourself with the purchase of real estate may not be the best idea. You also shouldn’t assume by default a continuation of high price appreciation following a prolonged bull market in housing. Just like in most periods of overvaluation and in instances where bubbles are formed, retail investors assume the best at the worst time. When the economy is doing well, that is the best period to save capital in preparation for an inevitable decline in the economy which happens every business cycle.

Many Americans however, primarily driven by the largest demographic, the millennials, have a less enthusiastic opinion on housing partially because they witnessed the housing bubble crash first hand. Aside from increasing costs of owning a home, this has created a tiny house movement as well as an increase in the number of renters vs owners.

Can You Make More Money Elsewhere?

Millennials and other Americans who would rather rent think putting your money in house which is your primary residence ties up too much of your capital. This is a broad argument which can only be analyzed upon understanding someone’s personal finances. If someone spends a majority of their savings on a down payment, they aren’t diversified. The counter point is if their future earnings are invested into stocks and bonds for a retirement account, they regain diversification – perhaps not this late in the business cycle, but that’s a discussion for a different day. If your goal is perfect diversification, then owning one home would be like having one stock in your equity portfolio. Theoretically, as the argument goes, it would be better to own REITs. However, even perfect diversification is far from a protection against losses.

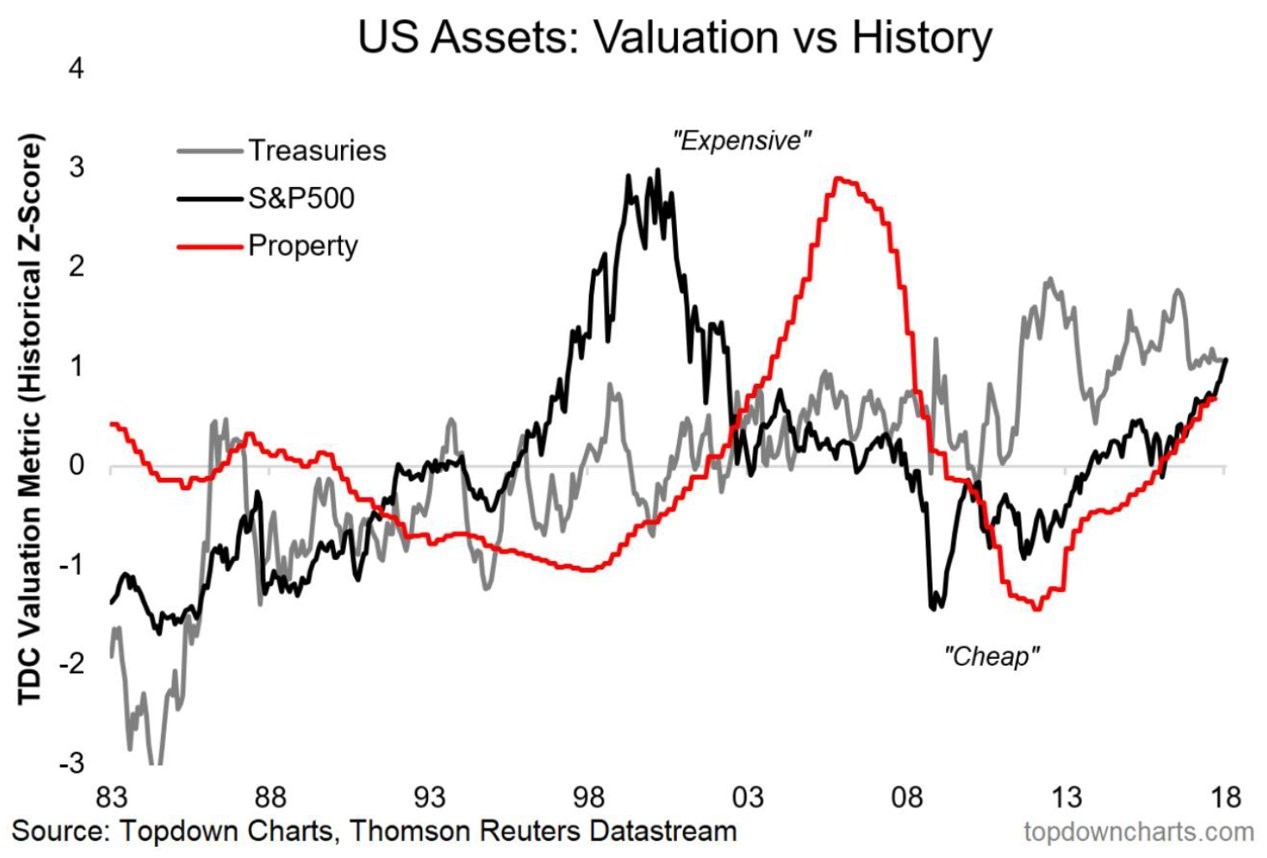

As you can see from the chart below, property, the S&P 500, and treasuries are all expensive by historical measure. This means you might need to have international exposure to have a decent shot at real long term gains considering present valuations in the US.

Will Stocks Appreciate?

Another criticism of buying a house is that renting provides no risk of loss. As of early 2018, there were still 2.5 million mortgages underwater from the 2008 housing crisis. An underwater mortgage is one that is higher than the value of the home. It’s not a great situation to be in because the equity the buyer has built up essentially vanishes.

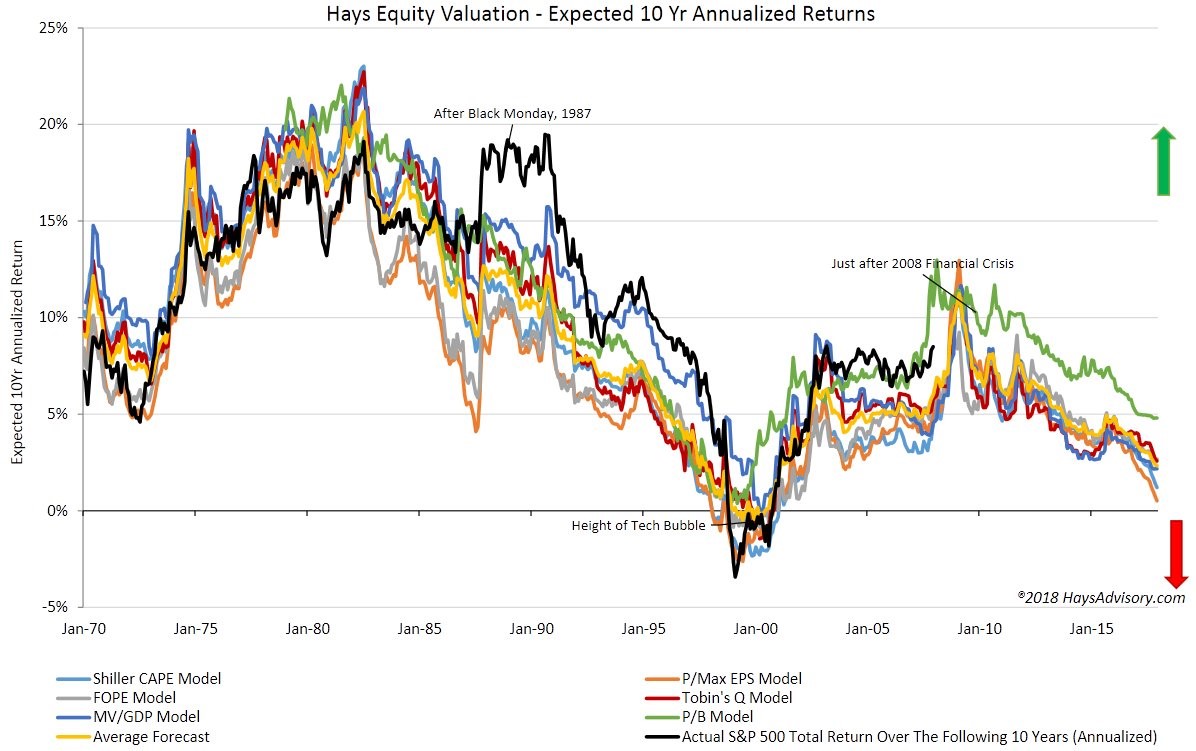

On the other hand, saying there’s no risk of loss if you rent is a straw man because you will need to invest your capital somewhere else which has risk. Buying a house is a risk and so is investing in the stock market. If you assume stock returns are in the double digits each year, it might be better to rent instead of buying a home, but that assumption has recency bias. The bull market of 2009-2018 had great returns, but that might not occur in the 30 year life of a future mortgage. The chart below breaks down what a few valuation metrics are implying for future returns.

Future returns have mostly matched the actual returns seen in the black line, which makes them a good estimate of how stocks will do in the next 10 years. The average forecast is about 2.5% in annualized returns so it might not be that great of a decision to rent and put the extra money in the stock market.

Will Real Estate Do Well?

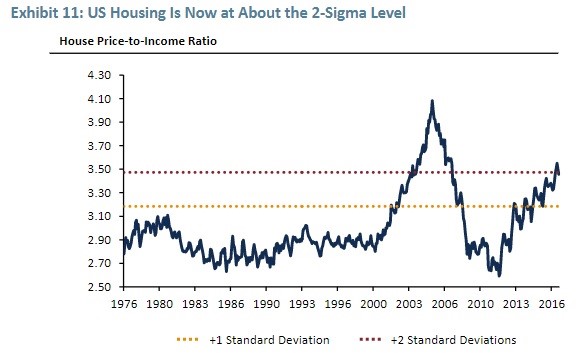

As we mentioned, property values might be expensive. As you can see in the chart below, the price to income ratio suggests the housing market might be in an echo bubble.

Mortgages haven’t been given out with zero documentation in this market as was prevalent before 2008, but wage growth has been nonexistent for the majority of the population. There’s also zoning restrictions which push prices up artificially. It all comes down to location when you buy a house. This is what makes the comparison between stocks and a primary residence apples to oranges. A house is one purchase, while most equity investors either own a few stocks or a basket of companies representative of the larger market, such as the S&P 500. If you don’t want to move to an area where the housing market has good fundamentals, you might want to rent and invest the capital elsewhere (vice versa). It takes research which involves looking at historical prices, the school districts, the city and state’s budget, and which industries provide the most jobs to decide if buying house in a specific area could be a better bet than owning stocks which are expensive.

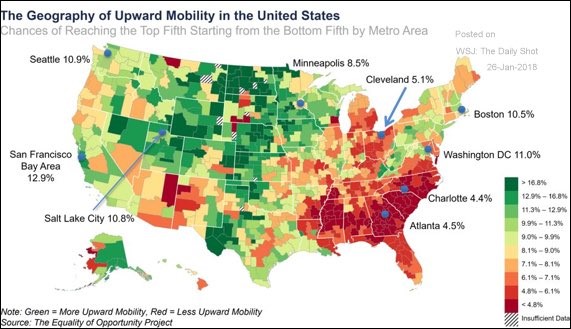

The chart below gives you a primer which can help understand your local economy if you live in America.

The upward mobility is the highest in the middle of the country. It’s the lowest in the southeast. If these trends continue, the housing market will probably have low returns in Atlanta, Charlotte, and Cleveland as there won’t be a new class of people who are able to buy a house. The areas with the highest chance of the people in the bottom fifth reaching the top fifth are Salt Lake City, Seattle, San Francisco, and Washington D.C. which is why they’ve had great housing markets recently.

Interest Rates

The other aspect to consider when deciding to buy a house or invest the money elsewhere is interest rates. On the positive side, a fixed rate mortgage allows home buyers to lock in these historically extremely low interest rates. However, if interest rates go up, the ability for prospective buyers to get a mortgage falls, so the value of house will decline. Low interest rates are one catalyst for the increasing price to income ratio. Home prices will lose less value in the next downturn compared to the previous one if interest rates stay low.

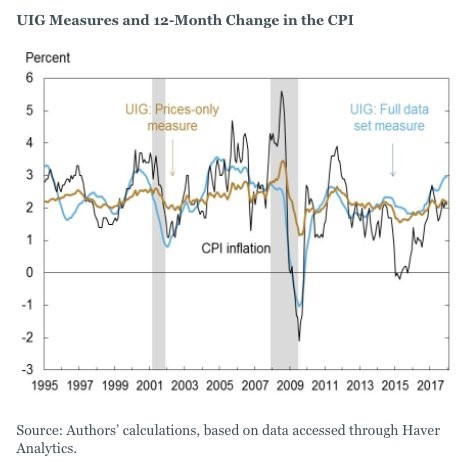

The issue for investors deciding what to do is that stock and bond valuations are not a significant diversifier from housing given that they are also up in price because of low interest rates. You need to do a sensitivity analysis for houses in your area to see which investment will perform best in a rising interest rate environment. The chart below shows inflation is expected to increase in 2018 which means we might be in a rising interest rate environment.

Conclusion

It’s impossible for our article to cover every possible scenario as it relates to deciding between buying or renting a home. Applying blanket statements to the housing market that its entirely in a bubble is not accurate either. Some areas are, many are not. The goal of the article was to discuss the opportunity cost and diversification risks involved with deciding between owning a home or renting one and investing capital elsewhere. Long term expected returns on stocks are weak, making it a less compelling argument that you can outperform normal house price appreciation by investing in equities. At the same time, the argument of over leveraging yourself in deciding to mortgage a home is problematic because the value of the property relies on the low interest rates.

If you are interested in reading more housing related articles, here are a few recent ones:

- Is US Housing About To Explode In Value?

- What Comes Next For Housing Prices/Rent?

- The Future of US Housing Market

- Is US Housing In A Bubble, Again?

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.