UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The fact that households have a large allocation to equities is viewed as a positive by some because it provides a floor for the market. Others view it as a negative because the ownership rate is unsustainably high. The logic that households need to invest in equities is the same logic which supports a house of cards. You’re betting that because Americans have so many assets and need a place to invest, stocks will go up or at least avoid long term underperformance. Specifically, Americans have $28.3 trillion in retirement assets, 19% of which is in 401(k) accounts which equates to $5.3 trillion. There 550,000 plans and 54 million participants. The money flows in every month when the economy is strong and investors are optimistic.

However, it’s not fair to act as if US equities are the only place to invest. There’s no rule that Americans can’t switch to emerging markets or other foreign markets which are cheaper. The problem of course is that most retail investors have home country bias when investing. A lot of America’s high valuation is based on technology companies. There are always new technologies which garner attention and investments. American internet firms are currently dominating the world. However, if new technology firms from other countries out-innovate them or regulations stop their momentum, America won’t continue its amazing run.

Secondly, sentiment is important. Real estate was a great source of returns in the 2000s, so it garnered a lot of capital; investors always chase returns. When stocks crater most Americans won’t be ready to buy more. It takes a seasoned investor with great patience to buy when markets crash. However, those who blindly chased momentum to the upside (buying), will begin chasing the momentum to the downside (selling). Obviously, it was a bad idea to sell stocks after they fell 40% in 2008, but investors still sold until buyers overwhelmed them at the bottom in March 2009.

The final point on this topic is you can’t use household assets to support the narrative that stocks will rise because assets grow in expansions and fall in recessions. Since households own so much stock, assets will fall drastically in a bear market. High investment in stocks can’t save the U.S. from a bear market. That’s circular reasoning.

High Equity Allocation Bad For Returns

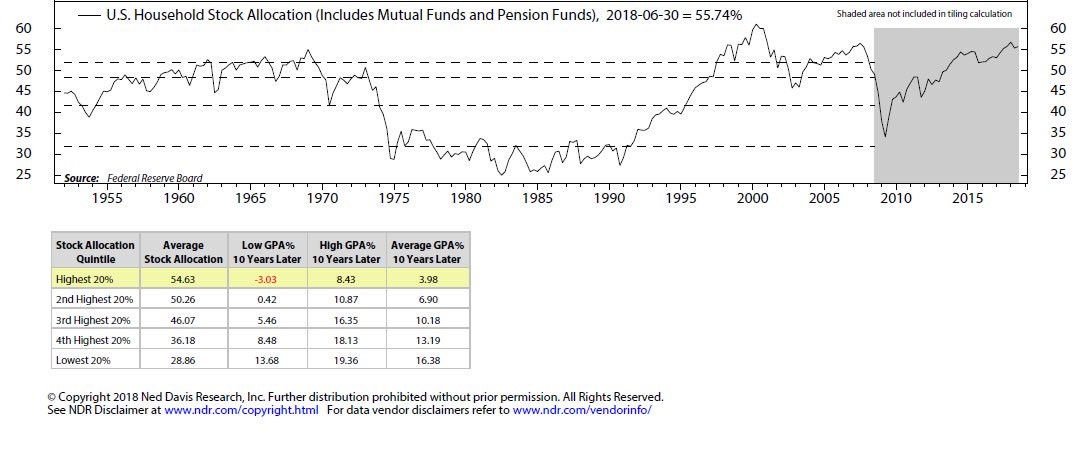

Saying stocks will go higher because Americans will put money to work in stocks is at least better than the argument that states households have cash on the sidelines and have money to invest. That second argument is factually incorrect as households have a very high exposure to equities as shown in the chart below.

Household stock allocation is 55.74% which is in the top quintile of historical allocation. As you can see from the bottom box below, the higher allocation percentage households have to equities, the worse US equities perform. In the top quintile, the average performance per year is gains of just 3.98%. There was similar allocation before the 2007 top as there is now. The 2000 peak had the highest allocation percentage.

A New Kind Of Cycle

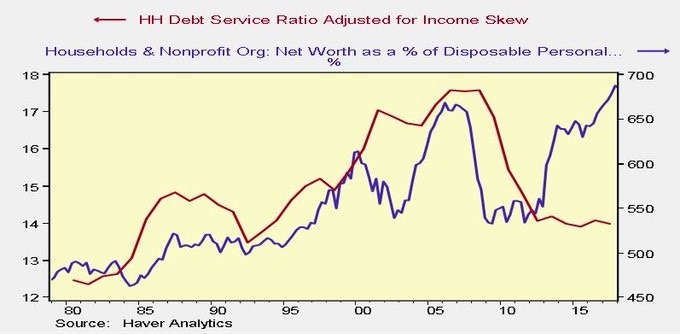

The point of this article isn’t to be negative. We’re just trying to find the best arguments. That will prevent you from going long based on high household equity allocation, because you would be betting against historical results. This cycle is unique because while household net worth as percentage of disposable income is at a record high, the household debt service ratio adjusted for income skew is low.

As you can see in the chart below, households have increased their assets without taking out more leverage.

We’re in an unusual cycle because household leverage is what creates problems during recessions. Some indicators are showing stocks will underperform and the economy is near the end of the cycle, but the economy doesn’t have the two most important ingredients for a recession: high inflation and high household debt. Inflation catalyzes recessions and household debt makes them worse. Consumers deleverage during recessions to improve their balance sheets.

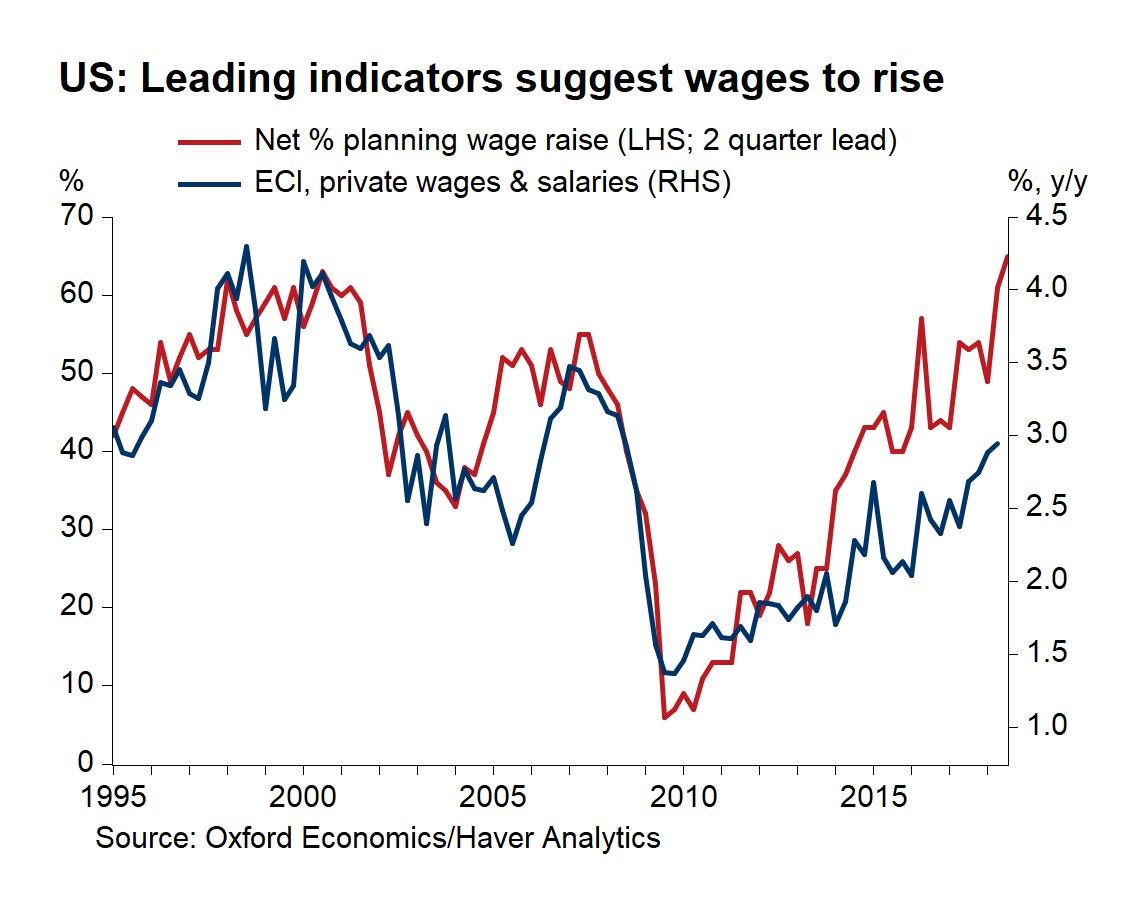

Wages Expected To Grow Quicker

2019 will be interesting because wage growth is set to make new cycle highs. The question is if wage growth catalyzes heightened inflation. While inflation increased in 2018, that was in part caused by high oil prices and easy comparisons. It will be interesting to see if core inflation can get much above the Fed’s 2% target. If inflation keeps rising, the cycle will end quickly. If it doesn’t rise because of tough comparisons in early 2019, real wage growth should be great. As you can see from the chart below, the percentage of small businesses planning wage increases is high. This signals ECI private wage and salary growth will accelerate in the next 2 quarters.

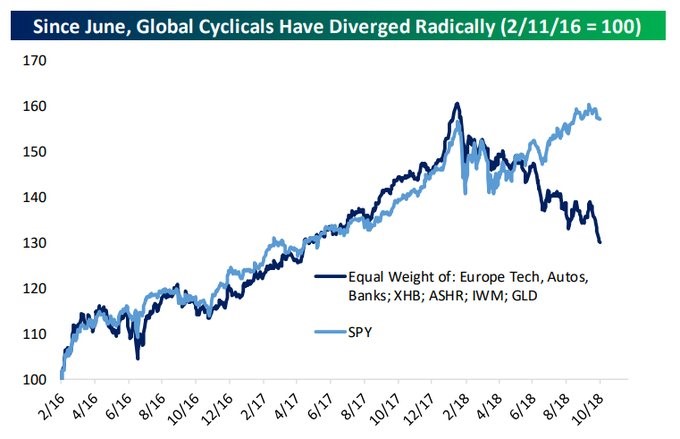

Will The S&P 500 Keep Outperforming?

With S&P 500 EPS growth staying above 20% for the first 2 quarters of 2018, it’s not a surprise the S&P 500 has outperformed global stocks. The question is how long the S&P 500 can keep rising with global cyclicals tanking. As you can see in the chart below, the basket of cyclicals had an r-squared of 0.974 from February 2016 to May 2018. Since then, the r-squared is only 0.531.

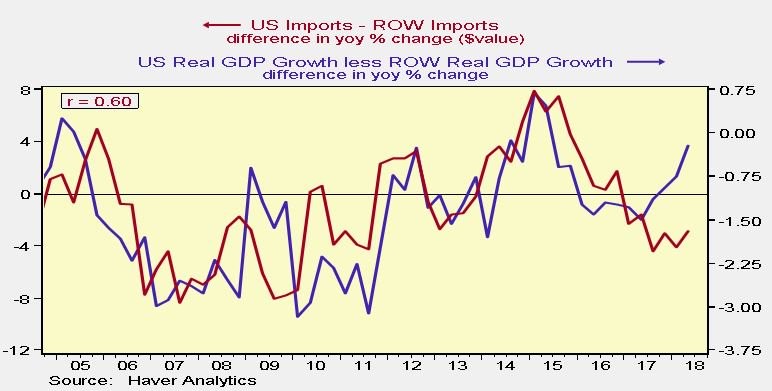

The chart below shows relative economic performance by looking at the difference between U.S. real GDP growth and the rest of world’s GDP growth along with U.S. import growth subtracted by the rest of world’s import growth.

America’s relative GDP growth has improved; its trade deficit has widened. Imports are growing quicker than exports because American growth is strong in relation to the rest of the world.

Conclusion

American households have a high percentage of their assets in equities and have deleveraged this cycle. If households started taking out more debt, it would be possible for this expansion to last several more years. That might not occur though because there won’t be another housing bubble and the savings rate is heightened in relation to the household wealth to disposable income ratio. Wage growth will accelerate. Time will tell if wage growth translates into higher inflation in 2019. American markets have done well even though global cyclicals have not. American imports have expanded faster than exports because the fiscal stimulus has boosted growth. This is against President Trump’s best efforts to close the trade deficit.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.