UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Back To What Matters: Earnings

The bulk of Q2 earnings season is approaching as many of the biggest firms will be reporting in the second half of July and the first half of August. Earnings season is great because it brings investors back to the central point of what moves markets: the fundamentals. With the headlines reporting on whichever story generates the most clicks, it’s easy to forget about earnings. Earnings matter every day, not just during earnings season since estimates are always changing.

Earnings season is the most important time of the quarter because it gives us the newest information about how firms performed during the previous quarter and provides an update on the performance in the current quarter. It’s an indicator that tells us which headlines matter and which don’t. The biggest story is obviously, the trade war, so any perspective from companies directly on how that is affecting business will be pivotal. Delta Airlines CEO said the tariffs haven’t hurt business at all. If the tariffs aren’t a worry for businesses, the S&P 500 can easily reach a new record high.

Review Of The Start Of Earnings Season

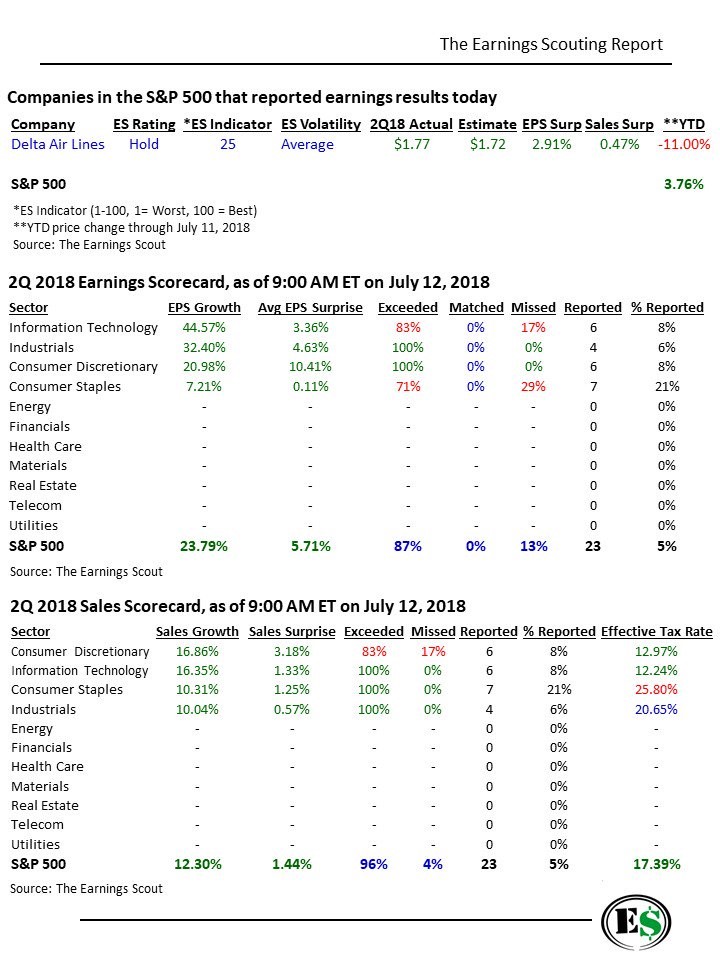

As of July 12th, 23 S&P 500 firms reported earnings. The table below from The Earnings Scout breaks down the results.

Source: The Earnings Scout

The sector with the most firms reporting already is consumer staples. This is a low growth sector which won’t lead the market higher. The numbers below prove that point as the sector has 7.21% EPS growth which is below the average of 23.79% for the S&P 500. The average EPS surprise is only 0.11% and 71% beat results. That’s okay because the market doesn’t need these stocks to explode higher. Some contrarian investors don’t like to buy the biggest momentum names which have high earnings growth, but it’s impossible to ignore their effect on the overall market.

The sector with the most of these names is tech. The tech sector has earnings growth of 44.57% with 6 firms reporting results. 83% exceeded estimates and the average surprise was 3.36%. It’s still very early, but the fact that all 4 firms in the industrials sector beat estimates and had a positive surprise of 4.63% is encouraging as well because it’s a sector expected to see one of the largest impacts from the tariffs. Finally, we have the consumer discretionary sector which has done the best as its beat rate was 100% and the average surprise was 10.41% to the upside. This helps support the notion that Q2 consumer spending growth will accelerate from the very poor 0.9% growth seen in Q1.

The bottom table shows the sales results. Since the tax cuts are a major reason earnings growth is above 20%, bearish investors like to dismiss the growth as a one off occurrence. It definitely is a special year for earnings, but there has been a cyclical improvement underway since the 2nd half of 2016. The Q2 sales growth shows this improvement has accelerated to high levels, justifying stock price increases. All 4 sectors have double digit sales growth and the average surprise has been 1.44% with 96% beating results. The column on the right shows the tax rates of each sector. The average has fallen to 17.39% since the corporate income tax was lowered from 35% to 21%.

Breakdown Of Earnings Growth

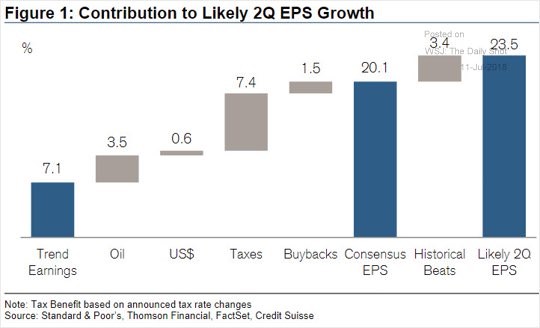

The chart below from Credit Suisse breaks down each contributor to this great quarter of earnings growth.

Source: Credit Suisse

The lower tax rate has the biggest impact since it helps growth by 7.4%. The trend in earnings helps it by 7.1%. The historical beats are the average earnings beats. Because firms are expected to beat earnings, the implication is the growth rate will be 3.4% higher. If earnings growth is 2% higher, that’s a disappointment masquerading as a success. Oil has helped earnings by 3.5%; the energy sector will have the quickest earnings growth this year.

Even though buybacks are going to set a new record in 2018, they only helped EPS by 1.5%. This further supports the notion that the S&P 500 isn’t one giant bubble propped up by buybacks. Buybacks are simply capital returns to shareholders which have a marginal impact on earnings growth. To be clear, there’s a big dispersion among firms as some in this index don’t buy back stocks and some have massive buybacks.

Lower Taxes For Firms & Individuals

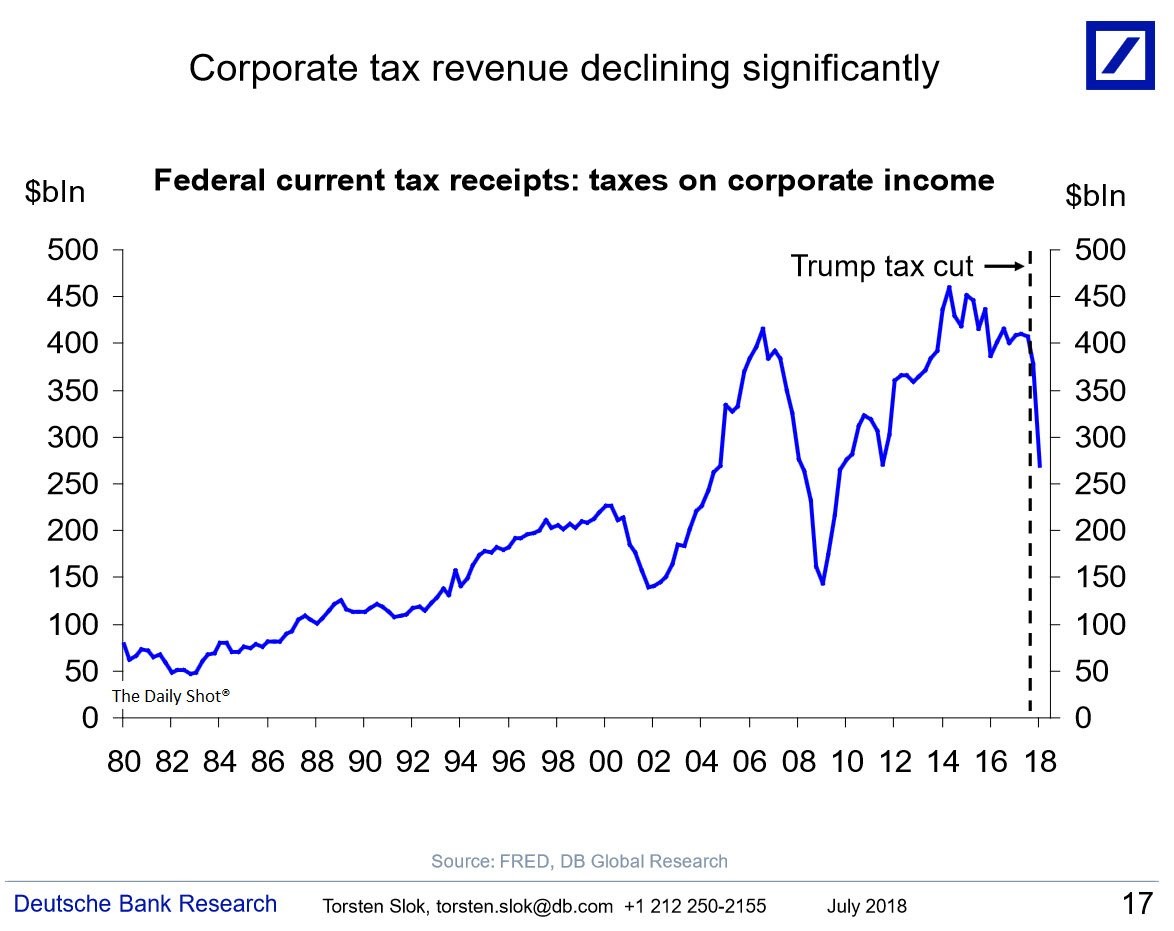

The tax cut was from 35% to 21%, so it’s not surprising that less taxes are being paid. However, the size of the decline in corporate taxes paid is dramatic and worth reviewing. As you can see from the Deutsch Bank chart below, the taxes paid declined from above $400 billion to slightly above $250 billion. If you didn’t know taxes were cut, you would think the economy was in a recession.

Source: Deutsch Bank

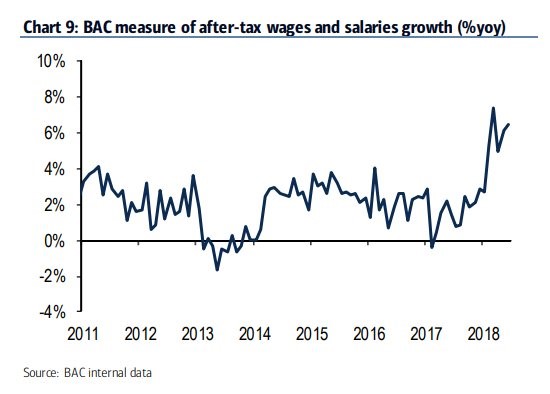

The Bank of America chart below uses their internal data to show wages and salary growth.

Source: Bank Of America

From the publicly available data, we know nominal wage growth has increased while real wage growth has fallen to the flat line because inflation has increased. We haven’t seen the tax cut have a clear impact on wages. The chart above differs from the BLS numbers as it uses after tax wages and salaries. It shows a evident increase in the year over year growth rate after the tax plan was put in place in 2018.

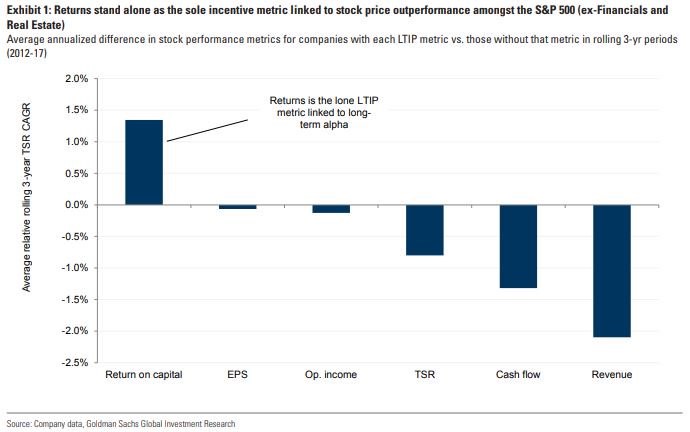

Best Management Incentives

Since we reviewed fundamental performance in this article, we’ll leave you with the chart below which shows the best metrics to measure management teams by.

Source: Goldman Sachs

Generally, higher CEO pay is actually consistent with lower stock performance. Therefore, the best combination of the two is below average pay and having incentives structured around a high ROIC. Firms need to get a good return on the money they invest, or it should be given back to shareholders. Wasted money is a disaster.

Conclusion

This has been a great earnings season so far, but it has just begun. The results and current quarter guidance will tell us if the trade war is affecting businesses. Since only small tariffs were in place in Q2, the most important factor will be forward guidance which will tell us how potential tariffs could affect business and how the latest tariffs levied in the past few weeks have affected capex plans. The tax cuts helped corporate profits and nominal wages. Will the tariffs prevent further gains?

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.