UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

With this expansion nearly reaching the longest since the 1800s, one of the top discussions among economists is whether the business cycle exists anymore. Spoiler alert, it does. Thinking one long cycle means recessions have been abolished is falling into the trap of recency bias. This cycle has been helped by the consumer’s deleveraging. If the consumer would have leveraged up, annual growth would have been higher, but then there would have been a risk of a bust like in 2008. Low leverage might have allowed the past 3 slowdowns during this long cycle to not turn into a recession (assuming the current slowdown doesn’t become a recession). Housing debt is down from its peak because it took a few years for the housing market to get back to normal after the bust.

Business Cycle Less Volatile

The expansion has also been helped by the fact the labor market started with a lot of slack (supply) as the recession of 2008 pushed up the unemployment rate and made many people give up looking for work, so they weren’t counted as unemployed. Even after about 10 years, the prime age labor force participation rate isn’t at the previous cycle’s peak. Another factor that has lengthened this cycle is the lack of sustained above trend inflation. Some economists believe inflation picks up at the end of the cycle as the economy runs into overdrive. The somewhat tight labor market hasn’t pushed up inflation enough for it to be problematic. Lately goods inflation has been near zero. Low inflation allows the Fed to keeps rates at or below the long run rate instead of setting hawkish monetary policy that stifles economic growth.

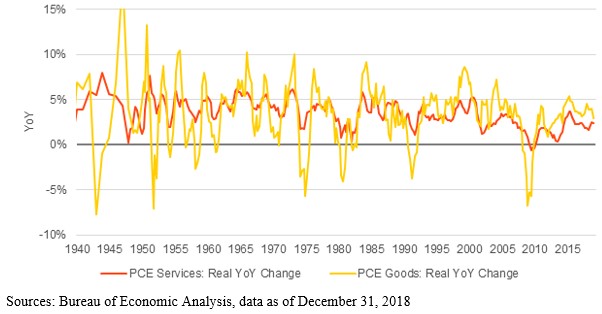

The economy’s reliance more on services and less on manufacturing has made it less volatile. We use manufacturing as a leading indicator, but it has become noisier since manufacturing has been shrinking as a percentage of the economy. We mentioned this point in an article on the labor market. Even when manufacturing hemorrhages jobs, it’s no match for the normal job gains in healthcare and education. The 2015-2016 manufacturing recession wasn’t enough to cause an overall recession.

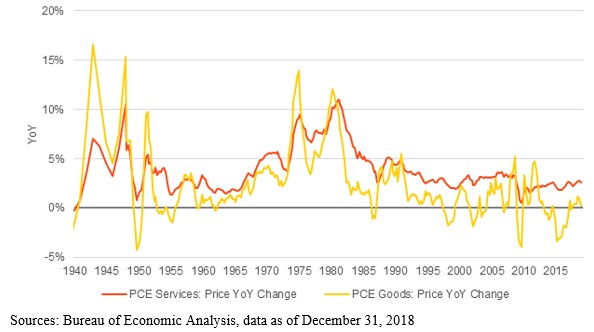

Year over year nominal services growth has only been in a recession once since the Great Depression, while goods PCE has been in a recession 6 times. As you can see in the chart above, yearly real services PCE growth was only in a recession in 2008. The goods part fell into a recession 10 times. In the same sense, services PCE inflation is less volatile than goods PCE inflation. The chart below shows yearly services PCE price growth has never been negative since the Great Depression, while goods prices fell 8 times. To be clear, both were high in the 1970s and 1980s and both have been low in the past 3 decades.

Goods inflation has mostly been below services inflation. This partially explains why bouts of deflation have become much rarer. Maybe the cover of the Bloomberg Businessweek magazine should have read “Is deflation dead?” instead of “Is inflation dead?”

The Slowdown That Never Was?

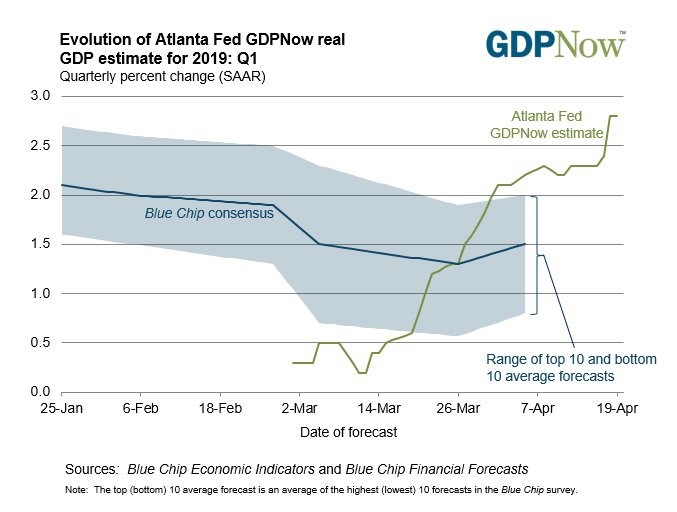

The final determination of whether the late 2018 to early 2019 period was a slowdown will be made way after it matters to investors. While the ECRI leading index called for a slowdown, Q1 GDP growth doesn’t look problematic as of mid-April. The initial GDP report will come out on Friday April 26th. The Fed Nowcasts don’t look problematic and the median of 11 analyst estimates forecasts 2.4% growth. As you can see in the chart below, the Atlanta Fed Nowcast is expecting 2.8% growth which is above the blue chip average of 1.5%.

On April 19th, the Nowcast didn’t change from April 18th after rounding even though the new residential construction report caused the estimate for real residential investment growth to fall from 4% to 3.5%. Any positive residential investment growth would be better than last year.

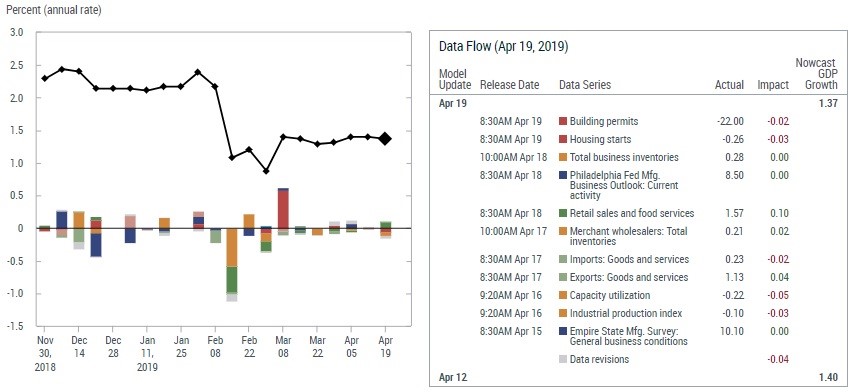

Usually, the St. Louis Fed Nowcast is very bullish, but this time it only expects 1.89% growth. Some bulls are only showing the Atlanta Fed Nowcast because its estimate is the highest. Show all the Nowcasts instead of cherry picking the best or worst one. As you can see in the chart below, the NY Fed Nowcast is the most bearish as usual. It shows Q1 growth will be 1.37%.

The NY Fed Nowcast fell 3 basis points from the previous week as industrial production and housing starts and permits hurt the forecast. April 26th will be its final reading. Its Q2 forecast anticipates growth of 1.92% which was down from 2.04% in the previous week. Q2 could be helped by the bounce after the government shutdown or that could have been included in Q1. We will find out when the initial Q1 reading comes out. Keep in mind, GDP gets updated a few times, so the initial reading can be way off.

Housing Starts & Permits Miss Estimates

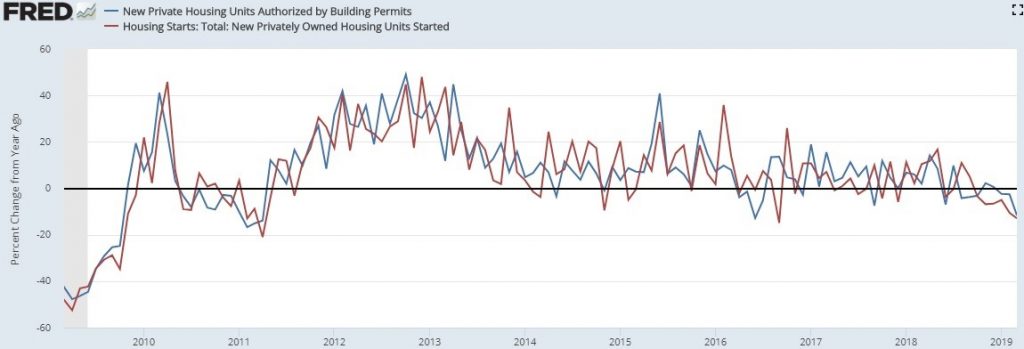

Even though MBA purchase applications have increased, March housing starts and permits missed expectations. As you can see from the chart below, on a non-seasonally adjusted basis yearly building permits were down 11.6% and yearly housing starts were down 13%.

Housing is a leading indicator for recessions. It seems like the call is still being made for one sometime in 2020 or 2021. Keep in mind that the housing market isn’t as big as last cycle so it can’t do as much damage to the economy.

Specifically, housing starts fell slightly from 1.142 million to 1.139 million which missed estimates for 1.23 million. Permits fell from 1.291 million to 1.269 million which missed estimates for 1.3 million. Seasonally adjusted starts were the weakest since May 2017 and permits were the weakest since last August. The good news is monthly single family completions increased 11.9%; the bad news is single family permits fell 1.1% monthly and 5.1% yearly. All regions had negative yearly growth in starts and permits.

Conclusion

Where is the slowdown? It might not be prominent in Q1’s initial GDP reading if it hits the median consensus of 2.1% growth. The economy might have become more stable because of the transition to services away from manufacturing. The recent manufacturing recession from 2015-2016 didn’t cause an overall recession. On the other hand, even though mortgage rates have fallen quickly, March housing starts and permits fell. That puts a dent in real residential investment growth. The optimistic Atlanta Fed GDP Nowcast expects real residential investment growth to be 3.5%. Last year, it was negative every quarter.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.