UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The yield curve inversion was a hugely popular topic in March as treasury yields were crashing and the near term part of the curve inverted. The difference between the 10 year yield and the 2 year yield never inverted and the percentage of the curve that was inverted never got to threatening levels. Also, its important to point out the the length of time that the curve is inverted matters, which was also a nonevent. The longer it’s inverted, the greater risk it poses to the economy. Since late March, yields have soared which implies expectations for nominal growth improved. In the first 2.5 months of the year, bonds saw the economy weakening and almost priced in a recession, while stocks soared. In the past few weeks, order has been restored as yields have risen with stocks.

Rate Cuts Are No Longer Priced In

The 10 year yield has increased from 2.34% to 2.59% as it is back above the Fed funds rate. The 2 year yield has increased from 2.16% to 2.41%. That means the difference between the two is 18 basis points. There’s nothing to worry about now. The 2 year yield being back near the Fed funds rate implies a lower chance of a rate cut. The CME FedWatch tool agrees as it only shows a 41.7% chance of a cut this year. Not that long ago, cuts were expected by the majority. The stock market has gone from leaning on the Fed back to leaning on a potential economic recovery.

Yield Curve Inversion Not An Issue

As you can see from the chart below, the Bank of America global fund manager survey shows about 85% of respondents stated the U.S. yield curve inversion doesn’t signal there will be a recession in 2019.

Only about 10% went along with the recession call. There’s a tendency for recession calls to be about 2 years in advance. That prediction is long enough in the future to not need to be supported by near term data, but close enough to signal worries are high.

There isn’t evidence of a recession this year. You’d have to really stick your neck out to call for one. If you call for this expansion to last another 3 years or more, it would have unprecedented length on a domestic basis. Other countries have had longer expansions though. Keep in mind, even if the yield curve fully inverted for a prolonged period of time in the spring of 2019, there likely wouldn’t be a recession this year if historical averages are used as guidance. The lack of consumer leverage has prevented potentially 3 slowdowns from becoming recessions (if this slowdown ends without one).

Investors Love Utilities & Hate The U.K.

Investors are the most overweight utilities and for good reason. Rates have fallen along with growth. Low rates make utilities’ dividend yields attractive as they trade like bonds. If you think the cycle is near its end, you want to buy utilities and staples. As you can see, cash has a lower z-score than last month as stocks have rallied sharply in the past few weeks. Fund managers had to chase performance as many were caught bearish in March even though stocks were having an amazing year.

On the negative side, fund managers are the most bearish on U.K. stocks. The Brexit deadline was moved back to October 31st. Without a deal, there will be a hard Brexit which is a harsh separation from Europe. That doesn’t seem like a likely scenario because the Brexit is much less popular than it was when the referendum took place in 2016. In the meantime, the U.K. economy is weakening because of the uncertainty a potential hard Brexit has created. According to the March Markit services PMI report, business activity in the U.K. fell for the first time in over 2.5 years. The services PMI fell from 51.3 to 48.9 in March. Markit expects 2019 U.K. GDP growth to be 0.8% which is below the consensus for 1.3% growth. If you think a deal to prevent a hard Brexit will be forged in the divided Parliament, you should buy U.K. stocks hand over fist. If you are more skeptical of a deal occurring, you’re in the majority and probably shouldn’t short the country.

Pessimism Is Gone

Fund managers aren’t optimistic on the real global economy yet, but they aren’t pessimistic anymore. As you can see from the chart below, the net percentage expecting a stronger global economy in the next year fell to the 2008 recessionary lows in late 2018/early 2019.

In the past few readings, the percentage expecting a stronger economy has increased quickly. If you are America-focused, you might say these fund managers were wrong because the American economy never had a recession and probably won’t have one this year either. However, the global economy may have fallen into a recession sometime in 2018 or 2019. These managers weren’t wrong.

Mini Global Recession Of 2018/2019

The chart below shows the OECD global leading indicator fell lower in February 2019 than the previous 2 troughs earlier in this cycle.

Those troughs were economic slowdowns in America and global recessions. This is the 3rd mini-recession (slow down) as trade growth has been weak and Chinese growth has slowed. This OECD leading indicator might be near a trough rather than being on the cusp of another 2008 like crash.

The Start Of A New Global Cycle?

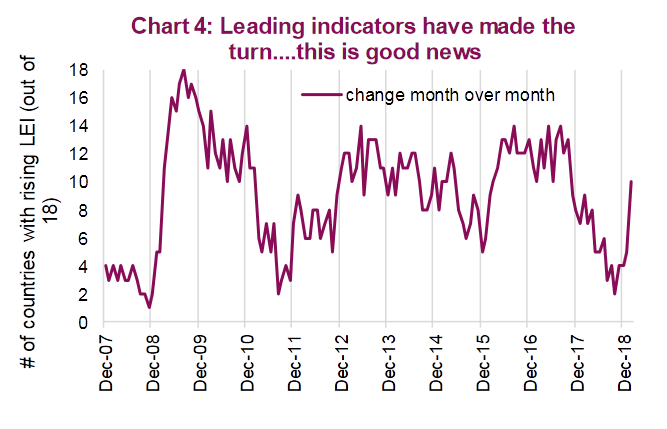

Global equity markets have been screaming about a renewed global expansion all year. It was very tough to buy stocks in late 2018 and early 2019 because it looked like an American and European recession could happen; it also looked like the Chinese data was only going to get worse as the economy wasn’t responding to the stimulus yet. When you go against the grain, there will be extreme upside if you are correct. As you can see from the chart below, the number of countries out of 18 with leading indicators rising has increased in the past couple of months. This type of bottom is usually the start of an intermediate term rally in stocks.

Conclusion

Fund managers aren’t pessimistic on the global economy anymore. They don’t see a U.S. recession in 2019. However, they are still long utilities. That might change if rates rise. It was extremely smart to buy stocks in late December/early January because there are early signs that the global recession that was predicted by Ned Davis Research, might be ending. The U.S. ECRI leading index suggests the U.S. economy will recover in late 2019/early 2020. You won’t make much money if you wait until the economy looks great to buy stocks. 2017 was the year of the global synchronized expansion. Weak stock performance followed in 2018.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.