UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 6 minutes

There is a lot of misinformation on the internet about the minimum wage. The reason for this is it is a politically charged topic. If your goal is to push an agenda, it’s easy to manipulate statistics in your favor.

The phrase popularized by Mark Twain is applicable in this situation:

“There are three kinds of lies: lies, damned lies, and statistics.”

The goal of this article will be to approach an objective conclusion regarding whether minimum wage helps or hurts people.

Minimum Wage Laws Hurt Job Creation

The first common mistake made is to claim that the current 4.3% (as of May 2017) unemployment rate suggests that minimum wage hikes are not hindering job growth. Firstly, the unemployment rate is a very inaccurate measurement, unlike the participation rate which may be more reliable and which suggests a much higher true unemployment rate. Secondly, correlation doesn’t equal causation.

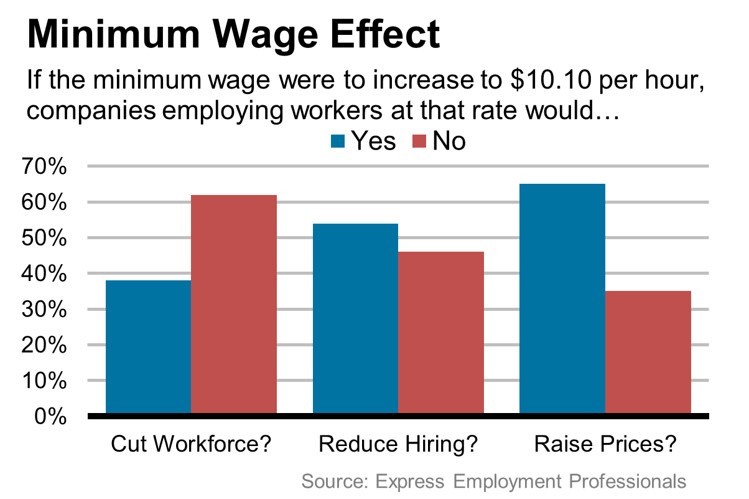

The chart below is a survey done of employers.

Just under 40% of employers said the minimum wage would cause them to cut their workforce. Don’t be deceived by the red bar being higher than the blue bar. Those who said it wouldn’t cause them to cut their workforce didn’t necessarily say it would help them. As you can see, over 50% of businesses said they would reduce their hiring. This proves the economy is grinding despite the headwind of minimum wage hikes.

A final point made in this survey is that over 60% of employers would raise prices to combat the minimum wage hike’s impact on their profits. This increases inflation for Americans. Inflation, as measured by the CPI, has been low in this business cycle, but that doesn’t mean the increase in the minimum wage doesn’t cause inflation. To clarify however, inflation in financial assets such as stocks, bonds and real estate has skyrocketed. Not to mention the increase in your grocery bill or the cost of fuel despite the fall in price of a barrel of oil. Inflation, as measured by the CPI, is low despite the effect of minimum wage laws. Thankfully, minimum wage laws only affect a small part of the labor force which isn’t enough, in of itself, to cause overall economic inflation to rise.

As reported by the Bureau of Labor Statistics:

In 2016, 79.9 million workers age 16 and older in the United States were paid at hourly rates, representing 58.7 percent of all wage and salary workers. Among those paid by the hour, 701,000 workers earned exactly the prevailing federal minimum wage of $7.25 per hour. About 1.5 million had wages below the federal minimum. Together, these 2.2 million workers with wages at or below the federal minimum made up 2.7 percent of all hourly paid workers.

The percentage of hourly paid workers earning the prevailing federal minimum wage or less declined from 3.3 percent in 2015 to 2.7 percent in 2016. This remains well below the percentage of 13.4 recorded in 1979, when data were first collected on a regular basis.

The minimum wage distorts the market because it makes it illegal to pay someone a wage they would normally accept. Whether it’s hiring less workers or firing workers, some people on the bottom rung of the employment ladder will be hurt. In particular this hurts young workers who are just beginning to earn an income, and as such, provide less economic benefit than someone with an education and experience. Since by definition, raising the minimum wage makes it illegal to hire people below a certain price point, this means that companies can afford less people for the given position. As such, this makes low paying jobs even more stressful for workers as this requires them to do the work that was previously done by more than one person.

Teenage Unemployment Not Declining Because Minimum Wage

Although teenagers are mainly the ones affected by minimum wage laws because they usually don’t have skills or experience to warrant high pay, the reason why the labor force participation rate among teenagers has fallen in the past few decades isn’t entirely because of new minimum wage increases.

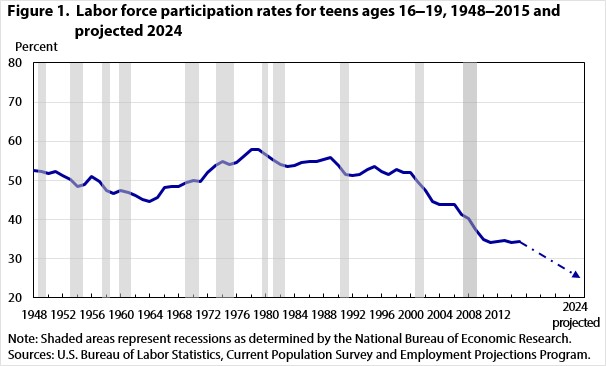

The chart below which shows the decline in the labor force participation rate for those ages 16-19 is often blamed on the minimum wage, but that’s another case of correlation not equaling causation.

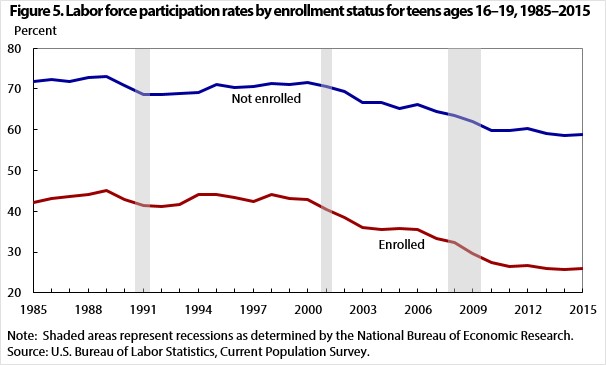

There are a few reasons why teens are leaving the labor force. The biggest reason for this change is because more teens are in school now. As you can see from the chart below, those enrolled in school have a lower labor force participation rate. Also, the labor force participation rate has dropped more for those enrolled in school than those not enrolled as the coursework intensifies. Those enrolled in school during July has skyrocketed in the past few decades. July is the prime time for employment for teens because they used to not have school. In 1985 only 10.4% of teens were in school in July and in 2016 42.1% were in school in July.

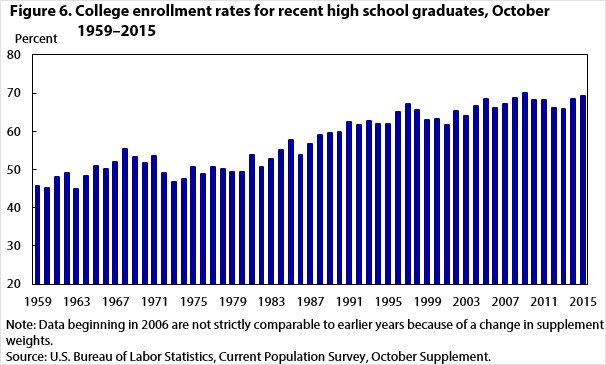

Not only are students spending more time in school during the summer, they’re also enrolling into college at a higher rate as you can see in the chart below. Students have decided that investing in their future is worth more than a minimum wage job. This is a free decision. That provides the argument against the minimum wage. No one is forcing workers to take low paying jobs. In a free society people get to choose how they live their lives.

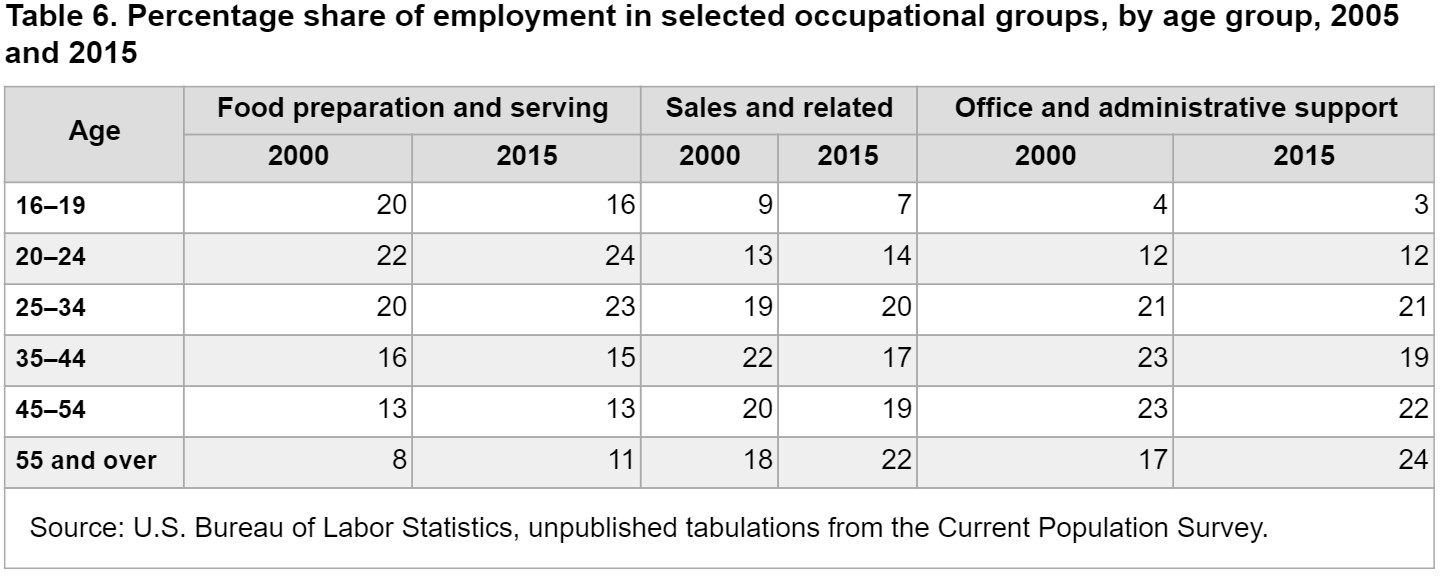

The final reason why the labor participation rate is lower among teens than it was in the past is because older people are providing more competition for the low paying jobs. As you can see in the table below, in the food preparation and serving, sales and related, and office and administrative support categories, the percentage of older workers is increasing and the percentage of younger workers is decreasing.

Productivity Isn’t Growing Equally For All Workers

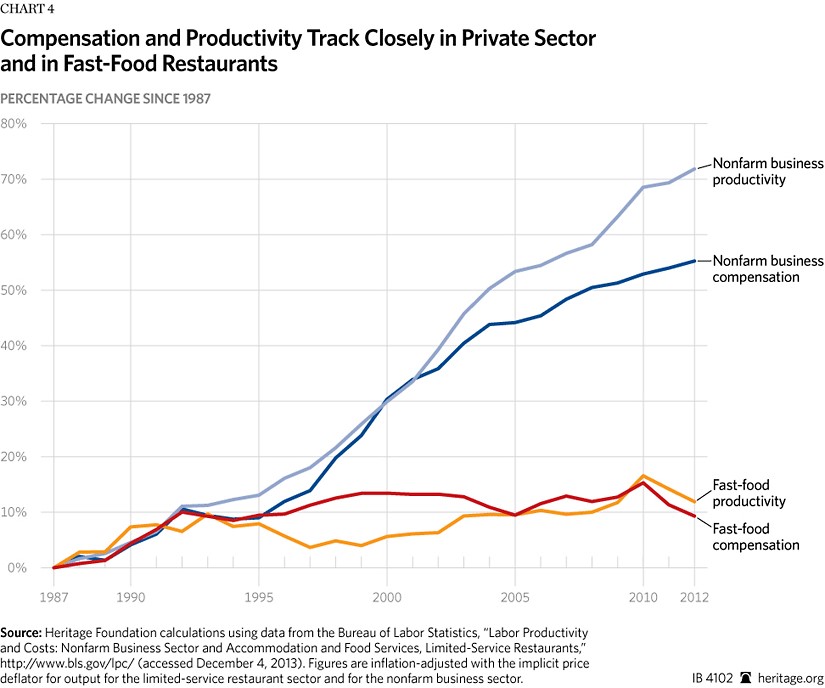

The final misnomer that is repeated incorrectly is that proponents of the minimum wage claim wages haven’t kept up with productivity growth in the past few decades. They say to adjust for this issue, the minimum wage should be raised. That’s wrong because they compare total productivity to the minimum wage even though the worker productivity measures all workers’ productivity, not only low-wage workers. As you can see from the chart below, business compensation has increased less than business productivity, but fast-food productivity has matched fast-food compensation. Low-wage workers aren’t becoming more efficient at a fast-enough clip to warrant large pay increases.

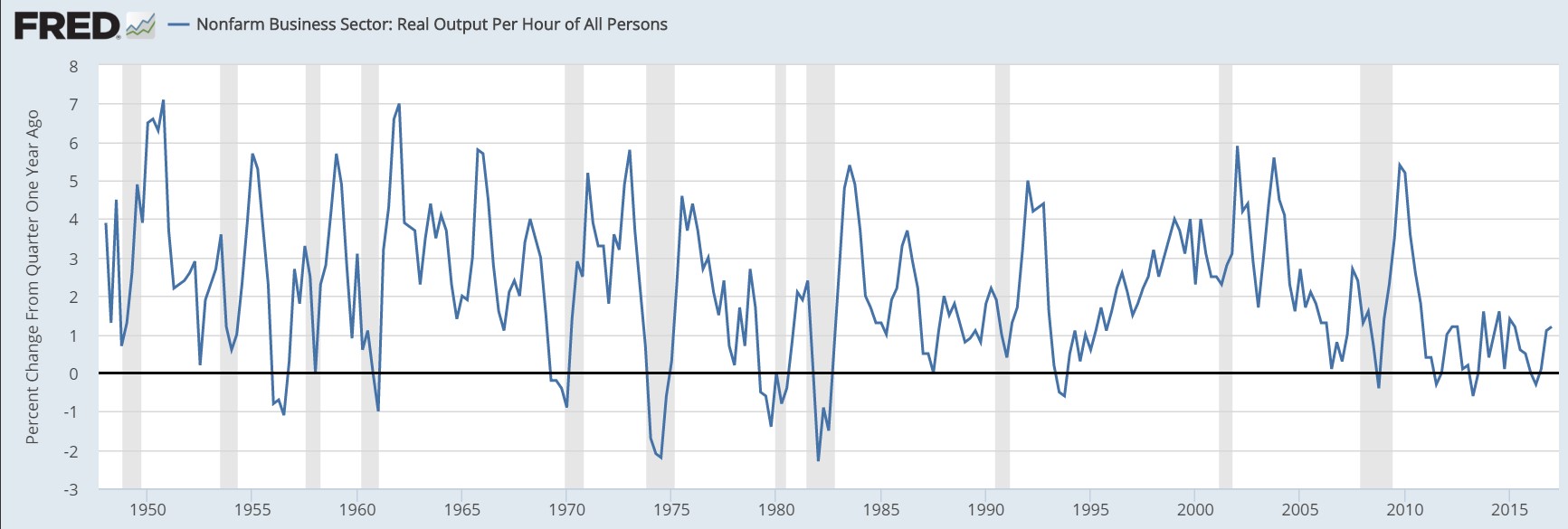

As you can see from the chart below, in the latest cycle most workers aren’t seeing their productivity rise which stifles wage increases. The only way to grow wages is to grow productivity, not to make legislation which forces employers to pay workers a certain rate.

Conclusion

The takeaway from this article is that many arguments about the minimum wage are faulty on both sides of the debate. Those who support minimum wage hikes wrongly say that the current supposedly illusion of economic growth, as measured by the increase in the stock market, bonds and real estate, proves that minimum wage hikes do not create unemployment. Fueling the growth of financial assets, as opposed to the economy which continues to grind at sub par growth not seen since the great depression, has been central bank intervention in the form of quantitative easing. Secondly, the low-wage productivity growth of fast-food workers indicates that it would be counterproductive to hike wages, as this would force more people out of the labor force. On the other side of the argument, minimum wages laws currently are not the leading cause of teens dropping out of the work force; they are choosing to because they want to pursue their education, forcing them to take on record amounts of student loans, something that is not paying off for them.

Want to learn more about economics? Subscribe to our free email newsletter by entering your email.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.