UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

One of the biggest generational differences which causes a disconnect between baby boomers and millennials is student debt. Many baby boomers are confused why college graduates don’t immediately move out of their parents’ house like baby boomers did. The issue is that once a student graduates, they become debtors. It’s a vicious cycle which turns compound returns against borrowers.

For example, say you graduate with $40,000 in debt, your loans have a 4% interest rate, and they will be paid back in 15 years. While the federal government expects the loans to be paid back in 10 years, it takes the average Wisconsin graduate 19.7 years to pay off a loan for a bachelor’s degree. Therefore, it’s a reasonable example. In this mock example, monthly payments would be $295.88 and $53,257.53 in total. If you don’t have student loans at graduation like many baby boomers and you put $295.88 in a diversified portfolio which returns 6% per year, you will have $86,477.68 after 15 years. Therefore, the difference between someone with student loans and without them ends up being $139,735.21. The difference grows exponentially as the student loans grow because the interest paid and the returns on the potential savings increase.

Big Hole For Graduates & Dropouts

Starting your adult life in a $140,000 hole makes it very difficult to be financially stable even 5 years after graduation. Student loan default rates are higher than graduation rates at 514 American colleges. Over half of those are for profit colleges and a third are community colleges. The situation can also be terrible for college dropouts because the average indebtedness of college dropouts is $7,174. There were 3.9 million dropouts which had student loans in 2015 and 2016. Dropouts tend to have less student loans, but they didn’t get the degree, so their job prospects are relatively dim.

Finances By Degree

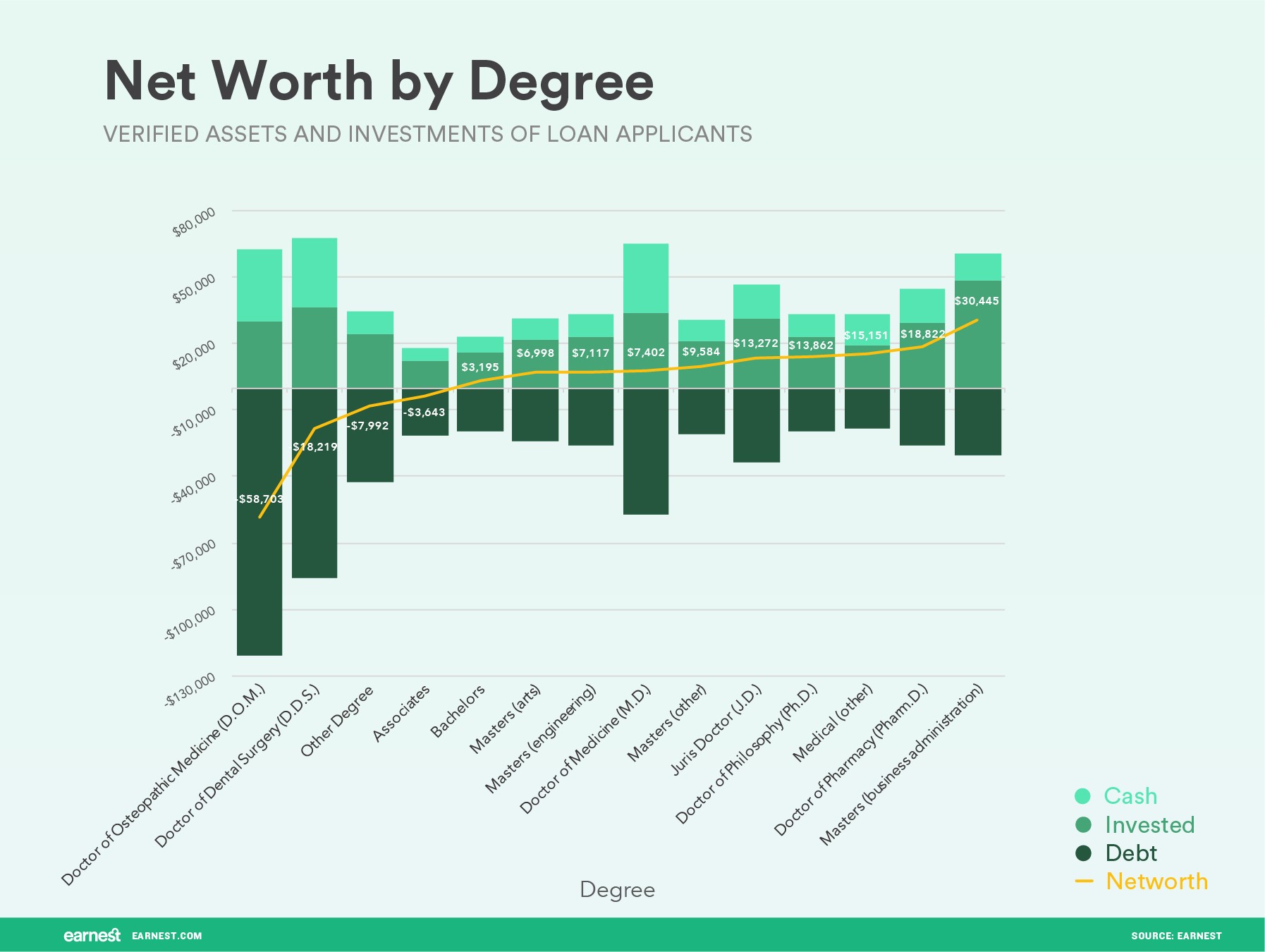

The chart below shows the net worth of loan applicants for various degrees.

In our abstract example, we didn’t go into much financial detail because we just knew about the new debt that was taken on and we estimated a rate of return for a diversified portfolio which served as the opportunity cost of the capital spent on loans. This graphic gives actual results for where prospective students start out before they borrow. As you can see, the median net worth of those seeking a bachelor’s degree is $3,195. This isn’t enough to pay for a semester unless it’s a community college. It’s not surprising those without a degree barely have any wealth. The younger the loan applicant is the worse the financial situation gets.

For all loan applicants, those who are under 25 have a median net worth of -$7,849. The net worth becomes positive once the borrower’s age gets to 28. While borrowers who are older have a higher net worth, they have fewer years to work after graduation. They also have fewer years to build up a nest egg to retire. 6.8 million student loan borrowers are in their 40s. They have $229.6 billion in debt, meaning the average person with such loans has a balance of $33,765. This is one of the reasons why 28% of people over age 55 have no retirement savings at all.

The higher net worth of the older loan applicants is likely impacted by those seeking a master’s degree. The graphic shows that the median MBA loan applicant is in the best shape as they have a median net worth of $30,445. The worst case is those seeking a loan to be a Doctor of Osteopathic Medicine as their over $100,000 in student loans gives them a net worth of -$58,703.

Less Student Loan Demand

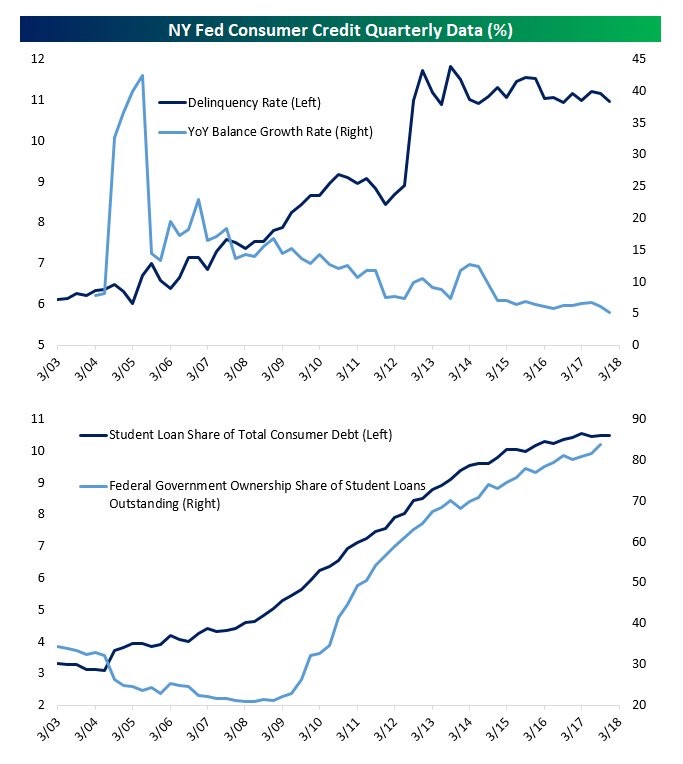

The millennial generation appears to be the most affected by student loans because it looks like by the time the next generation gets to college, the costs will be so prohibitive that some will avoid loans. As you can see from the top chart below, the delinquency rate is inversely related to the year over year growth in student loans taken out.

The delinquency rate on loans is a trailing indicator of how unaffordable college has gotten along with the lack of job opportunities for graduates. College costs will need to come down if the loan growth demand falls to negative. If the system isn’t fixed, there will be a replacement for educating people cheaper, such as trade schools or online learning. Adding to this point, the second chart shows the student loan share of consumer debt has stabilized because student loan growth is no longer faster than the overall growth in the consumer credit market.

We think the decline in student loan growth is a cultural issue more than a numbers one. What we mean by that is many teenagers and 20 somethings aren’t doing the math on the cost and benefits of paying for an expensive education. If this age group was interested in financial forecasting, the masses wouldn’t have borrowed tens of thousands for college. Rather than finding a new love for math, the next generation sees the pain the previous generation went through which makes them less likely to repeat the same mistakes. This is like how millennials are wary of buying homes because of the mortgage crisis. Besides being weary, it’s tough to make a down payment on a house when you have excess student loans, thus bringing us full circle to the original problem.

Conclusion

Student loans are devastating for millennials as they are graduating with excessive debt, yet getting paid similar amounts to baby boomers when they were young. Baby boomers were able to enter their 20s with little debt which helped them buy a house and start a family at a young age. Baby boomers used compound interest in their favor while millennials have been buried by it. As you saw in our example, this could be a $140,000 swing. Many millennials will never catch up with baby boomers. The hope is that the next generation considers the millennials’ hardships and doesn’t take out massive loans.

More articles on this topic:

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.