UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Fed didn’t hike or cut rates at its May 1st meeting as expected. Based on the bond market, stock market, and Fed funds futures market it’s safe to say this was a modestly hawkish statement/press conference. The QT plan stayed in place as the Fed will lower its treasury exposure by $15 billion per month and its mortgage backed security exposure by $20 billion per month.

The Fed Lowers IOER By 5 Basis Points

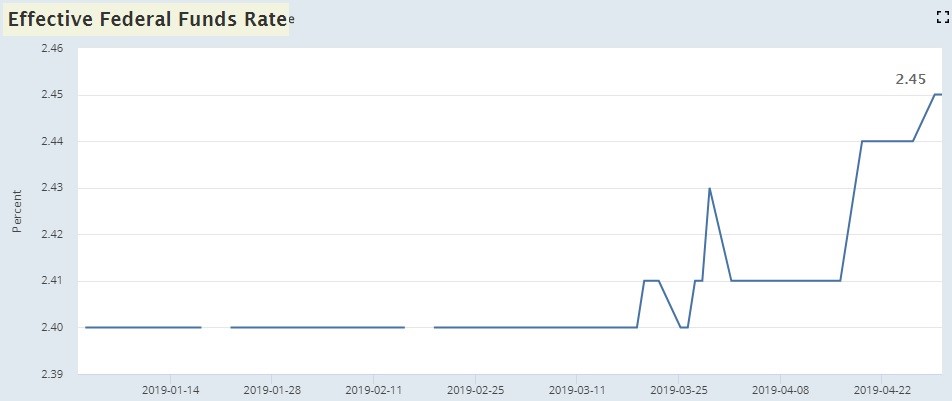

One of the biggest news stories from this meeting is a bit complicated. The Fed lowered the rate paid on required and excess reserves by 5 basis points to 2.35%. It’s below the high end of the Fed funds rate by 15 basis points. The goal is to regain control of the Fed funds rate. The Fed funds rate is at 2.45%. It has recently risen 5 basis points in the past couple months even though the Fed hasn’t changed policy. Another 6 basis points would put it outside of the FOMC’s range of 2.25% to 2.5%.

If the Fed loses control of this rate, commentators are stating that this could lose the market’s trust. A change of a few basis points doesn’t have a huge impact on the economy, but the market wants to know the Fed has control of the rate. The Fed also directed the NY Fed’s Open Market Desk to conduct open market operations such as overnight reverse repurchase operations at an offering rate of 2.25% to maintain control of the FOMC’s target rate.

Biggest Changes To Fed Statement

The paragraph below reviews the changes to the Fed statement. The rest of the statement didn’t have any changes. The biggest news event from Powell’s press conference was on inflation, so let’s review that part of this paragraph.

In March the Fed effectively stated overall inflation and core inflation remained near 2%. Overall inflation was kept lower by energy. That wasn’t the case in the March PCE report, which just came out, as energy prices were up 3.6%. In the May statement, the Fed stated core and headline PCE inflation have declined and are running below 2%. The reality of Fed statements is most of what is said is simply a statement of fact. The market likes to review every detail to measure tone, but we don’t see much of a change here. Inflation is lower and the Fed said it declined. That’s all that sentence says.

Under Powell, the Fed is focusing more on press conferences and less on the statement. The statements have been much shorter with Powell at the helm. The big news event from Powell’s press conference was when he stated low inflation was transitory. He said, “We suspect transitory factors may be at work.” He remarked that inflation should return to the Fed’s target over time, and then be symmetric around its objective. Furthermore, he said, “If we did see inflation running persistently below, that is something the committee would be concerned about and something we would take into account when setting policy.”

Powell Won’t Cut Rates Because Of Low Inflation

The media pressed Powell on how he’d react to lower inflation to see if he’d back rate cuts. In theory, the Fed could cut rates if inflation stays low, but since the Fed doesn’t think it will stay low, this decline in inflation is only serving to allow the Fed to pause its rate hikes. It would have been a big policy shift if Powell supported the idea of rate cuts.

Inflation being below the Fed’s target isn’t news. It has been below the target most of this expansion. Since the Fed started hiking rates, core PCE inflation has been above the Fed’s 2% target only once. Whether it’s Powell or Yellen at the helm, if the Fed hikes rates with inflation below 2%, the Fed will just claim the decline is transitory.

It’s extremely easy to support a thesis on inflation, but it’s difficult to make a correct forecast. Since the Fed has continually stated low inflation has been transitory when it hasn’t been, you can make the case that low inflation will never be a factor causing the Fed to be dovish. It’s not a completely illogical stance to take because the Fed shouldn’t cut rates this year if the economy doesn’t weaken further. Positive economic growth and a low unemployment rate don’t beget a rate cut.

What Caused The Decline In Inflation?

Remember, the Fed can get away with saying inflation is transitory because it bases policy on predicted inflation, not past inflation. The chart below shows the recent shift in inflation expectations. As you can see, in the past 4 months, near term estimates of inflation have fallen. From March 2018 to December 2018, long run inflation estimates fell.

The table below shows the catalysts for the changes in core PCE inflation since July 2018.

In 2017 Yellen blamed inflation weakness on cellular telephone services. Now the blame is on financial services and investment advice. However, core goods and healthcare have also pushed core inflation lower. The Fed is like a sports team that lost decisively, but still blames the referees for the loss. Transitory issues and referees are a factor, but the team would have lost anyway and core PCE would be low without transitory factors anyway.

Fed’s Effect On Markets

The weirdest part of the press conference was when Powell supposedly blamed the decline in core inflation on the stock market’s decline last year. Unless this was misunderstood or a misstatement, that’s an incorrect notion because core inflation was low in March even though stocks rose in January, February, and March. Speaking of the stock market, this slightly hawkish meeting gave the signal that the stock market is on its own because the Fed won’t further support it by cutting rates. That’s not necessarily a disaster for stocks because Q1 earnings season has been good. The S&P 500 only fell 0.75% on Wednesday.

There was a big change in the expectations for cuts this year. The chart below shows economists are looking for 0.7 hikes and the market is looking for 1 cut.

The market lowered its expected odds of a cut after this meeting. As of April 30th, the odds of a cut this year were 66% and now they are only 47.7%. This pushed up the 2 year yield by 4 basis points on Wednesday, as it is now 20 basis points below the 10 year yield which had no change.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.