UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Investors are expecting the Fed to end QT by the end of 2019, but the Fed’s Minutes from the January meeting only mentioned that it would provide guidance soon. Powell’s speech on Tuesday gave us more clarity into the end of the unwind. It was a rare situation where he gave numerical details about the plan. Powell stated, “I would note that we are prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments. In the longer run, the size of the balance sheet will be determined by the demand for Federal Reserve liabilities such as currency and bank reserves.” It’s fair to question when the ‘longer run’ is because there always seems to be some sort of financial disturbance in place. For example, the Fed adjusted its plans after the stock market volatility in Q4 2018.

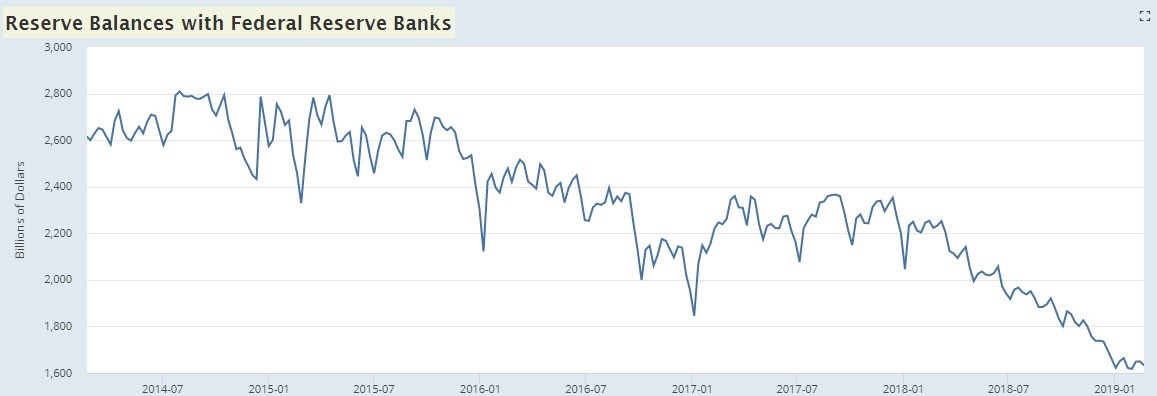

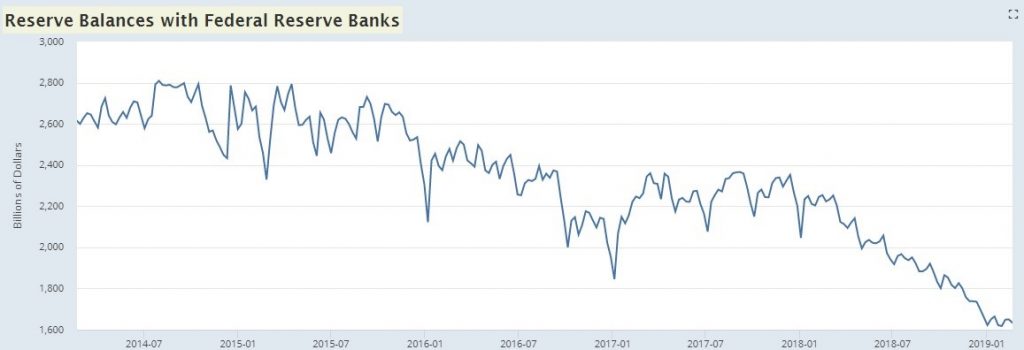

Powell also stated bank reserves will likely end up at about $1 trillion plus a buffer by the time the unwind is over. As you can see from the chart below, bank reserves are now at $1.6 trillion.

This means the unwind will likely end by the end of 2019. That’s because bank reserves are the only category of the balance sheet that is falling. ‘Other Fed liabilities’ have been stagnant and currency in circulation is increasing. We will get the specifics on the timing of the end of QT at the next Fed meeting in March.

The Fed currently holds $1.6 trillion in mortgage backed securities. It wants to only hold treasuries. If it lets the MBS mature and reinvests the money into treasuries, it will take over 8 years to reach that goal. The Fed could sell MBS instead of waiting for them to mature. If the Fed uses the money to buy short term treasuries, which is mainly what it holds now, it leaves itself open to do an “Operation Twist” where it sells short-term bonds to buy long-term notes to impact the economy in an uncertain situation. In both scenarios, the Fed is a net buyer of treasuries for the next few years. It’s worth noting that the Fed could easily pause its goal to own no MBS if there are problems in housing market.

Housing Starts Were A Big Bust

The housing starts data from December was absolutely terrible. Starts missed estimates by the largest amount in 12 years. They came in at a seasonally adjusted run rate of 1.078 million as the chart on the left shows. That’s an 11.2% decline to the lowest level since September 2016.

This report missed the consensus for 1.26 million and the low end of the consensus range which was 1.2 million. The November reading was revised down from 1.256 million to 1.214 million. This report caused the Atlanta Fed GDP Nowcast to lower its estimate for Q4 GDP growth from 1.9% to 1.8%. Its estimate for real residential investment growth fell from -4.4% to -5.8%. The housing market was a sore spot for the economy in 2018.

The good news from this report was permits were 1.326 million which beat estimates for 1.29 million and the high end of the consensus range which was 1.305 million. The November report was revised from 1.328 million to 1.322 million.

The big discrepancy between starts and permits was driven by the West which was affected by wildfires. Starts in the West were down 26.3% monthly to 216,000, while permits were up 17.1% to 383,000. That’s not to say the starts report would have been great without the West. Starts were down 13.2% to 125,000 in the Midwest. They were down 6% to 630,000 in the South and they were flat at 107,000 in the Northeast. Single family starts fell 6.7% and multifamily starts fell 20.4%. Permits were up 0.3%. Single family permits fell 2.2% to 829,000, and multifamily permits were up 4.9% to 497,000.

Recession Incoming?

As you can see from the chart below, the residential investment cycle is a great predictor of the economic cycle.

8 of the 10 recessions since 1950 were caused by the household residential investment cycle. The good news about this cycle is consumers have deleveraged. That means declining mortgage rates should be enough to boost demand. Housing price growth probably won’t have a sustainable decline in 2019 unless the labor market worsens. The labor market could be hurt by the weakness in the housing market because so many construction workers have been hired, yet not many houses are being built.

The best explanation as to why the housing market might not cause a recession this cycle is because the housing market wasn’t built up as much as every cycle since 1960. As you can see from the second chart below, permits as a percentage of the population are near previous cycle troughs.

There are a few trends working against the housing market suppressing home building. Millennials are moving out later, so the amount of people per house is increasing, people are staying in their houses longer, the population is aging, and the birth rate is dropping. Even with these factors, we don’t think permits as a percentage of the population has much room to fall this cycle.

Housing Prices

Both the S&P CoreLogic Case-Shiller home price index and the FHFA house price index (both December readings) missed estimates. The CoreLogic 20 city non-seasonally adjusted year over year home price growth rate fell from 4.6% to 4.2%. That’s the lowest growth rate since September 2012. The FHFA home price index was up 5.6% yearly which fell from 5.9% growth. This was a 3 year low.

The chart on the right shows the effect of the SALT deduction cap ($10,000) from the new tax law.

Low tax cities like Denver and Las Vegas have seen much higher price growth in the past 7 months than high tax cities like New York and Los Angeles.

Conclusion

The housing market was terrible in November and December. However, there are some green shoots. A strong labor market with high real wage growth and lower mortgage interest rates should increase demand for housing this spring. It will be interesting to see if this weakness in residential investment still causes a recession even though building was never elevated, and consumers have deleveraged this cycle. It probably makes more sense to be worried about auto and student loans than the housing market.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.