UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

In looking at who Trump will pick as Federal Reserve chair we often hear that he is against regulations and likes low interest rates. It’s important to acknowledge that having a low interest rate policy is a terrible idea. Not even the most stringent dove at the Fed would claim that interest rates should always remain low. In true capitalism, the free market would set interest rates which would change depending on the credit cycle. However, we live in a world where central banks have credibility (so far) and the ability to print currency to influence and set interest rates.

As we have noted on previous occasions:

Unless economic growth is sponsored voluntarily and naturally by people’s ability to use their savings to fund consumption, that the sustainability of such artificial government action creates economic booms that are quickly followed by economic busts, thereby destroying the illusion of created wealth.

In the current Federal Reserve dominated environment, whereby it acts as a monopolist, when price inflation is high, rates should be raised to limit the demand chasing the goods which are seeing large price increases. While economic growth is good, if inflation is faster than nominal growth, the real change is negative, meaning the economy is weakening. When economic growth is weak and inflation is low, the Fed should cut rates to encourage banks to give out loans, supporting the credit market.

The most prominent critics of the Federal Reserve claim it kept interest rates too low for too long in the 2000s which inflated the real estate bubble, an accurate claim if we may add. President Trump has made comments supporting low rates when he was President, showing an addiction to financial bubbles and a lack of understanding of economics. In full transparency, not many understand economics in Washington D.C., so this is not a criticism of any one individual.

That analysis is taking what he has said literally, but that might be the wrong interpretation. Our clue to that is when Trump said he liked Yellen, he called her a ‘low interest rate person.’ Yellen probably thought that description was ridiculous as no Fed member would depict themselves in this way, since Federal Reserve members consider themselves objective stewards of the economy, accurately understanding and accordingly adjusting monetary policy, both easing and tapering, depending on the economic activity. This leads us to two possibilities. The first is that Trump is mistakenly saying he likes low interest rate people, those that prefer low rates regardless of economic activity, when he really means that he prefers doves. The difference between the two is that a dove is in favor of low rates relative to the median consensus and can switch between being a dove and hawk. That’s because their reasoning isn’t based on always wanting low rates; it’s based on them looking at different economic metrics than the consensus. The second possibility is Trump legitimately doesn’t understand that rates are historically low because the U.S. has relatively low real GDP growth and inflation. Even if Yellen were hawkish and raised rates to above the Taylor Rule to about 2.75%, rates would be historically low, as we have detailed previously – Fed Funds Rate to Taylor Rule Ratio Most Dovish Since 1970. In this scenario, President Trump would mistakenly call a hawk a low interest rate person.

The point of that discussion wasn’t to criticize President Trump. The fact that he criticized the Fed for creating a bubble economy during the presidential campaign is more than any major party candidate has ever done. The point of that discussion is to rectify the proper use of monetary policy terms to understand the potential candidates for Fed chair. It’s possible that a candidate which isn’t considered to be a viable option in the fall of 2017 becomes a serious candidate in 2018. In that case you won’t be able to fall back on our candidate specific analysis, but you can remember what the various terms mean which can be tough when the President misuses them.

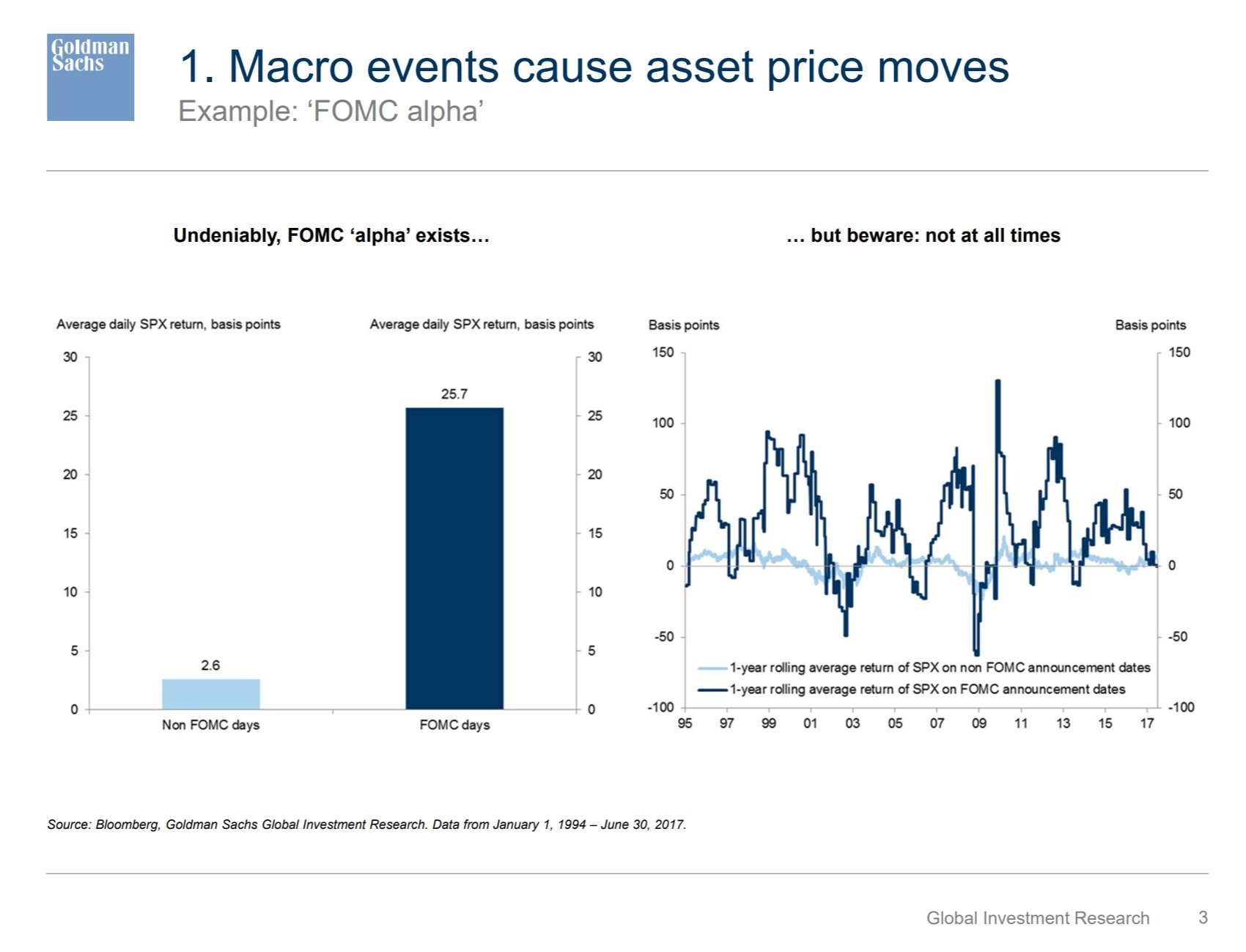

If you think the decision on who the next Federal Reserve chairperson is doesn’t matter much, you are mistaken. The Goldman Sachs slide shows the stock market’s performance on FOMC decision days compared to every other day. The FOMC day is when the Fed decides what to do with rate hikes; it’s when the Fed affects the stock market the most. The average daily S&P 500 return on FOMC days is almost 10 times that of every other day. The chart on the right shows the returns aren’t consistent on FOMC days, meaning the Fed increases the standard deviation of returns as uncertainty spikes. FOMC days have information asymmetry. At the moment the decision and the statement are released, the market immediately adjusts, sending asset prices down/up sharply. While the rate change is usually priced in, the statement is analyzed by algorithms for keywords which alters asset prices. The Fed changes its tone very often, so the market needs to adjust a lot.

This brings us to one of the points Kevin Walsh makes in his criticism of the Federal Reserve. He says the Fed should stop being ‘data dependent’ and instead become ‘trend dependent.’ This led him to say:

“Central bankers who vow allegiance to ‘data dependence’ find themselves lurching to and fro according to undistilled, short-term noise. Instead, the Fed should adhere to a concept I would term ‘trend dependence.’ When the broader trends begin to turn—for example, in labor markets or output—the Fed should take account of the new prevailing signal.”

Fed officials would argue they are dependent on the trends as they don’t change policy based on one off data points. This year the Fed was so ambivalent to the disinflation trend, it refused to acknowledge it until months after it started. The Fed’s appearance of changing rhetoric very often has more to do with Walsh’s other point about the Fed being too dependent on the stock market, than it does being overly obsessive about each data point. For the most part, Walsh’s criticism is insignificant, one which wouldn’t affect guidance or policy. In this case, his criticism was overzealous.

Conclusion

When looking at Trump’s statements on monetary policy to determine who he will pick as Fed chair, we need to go back to the basics. Trump says he likes low interest rates, but rates are determined by economic factors. You can be in favor of relatively low rates compared to what the economy can take, but being in favor of low rates on an absolute basis is wrong. This 2018 Federal Reserve chairperson pick is important because, as we saw, the stock market reacts strongly on FOMC days, not to mention the future of monetary policy and the economy will be in that person’s hands.

How does that quote go?

“With great power comes great responsibility.”

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.