UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

In a previous article, we discussed the top two candidates which could be selected by Trump in February 2018 as the Federal Reserve chair. The weird thing about those two was they don’t seem to want the job. Yellen’s speech at Jackson Hole was in direct defiance of the President’s goals as she staunchly defended financial regulations which the President opposes. Gary Cohn nearly resigned from the Trump administration after his Charlottesville statement. He also doesn’t have monetary policy experience.

The fact that neither candidate is vying for the job by trying to get in Trump’s good graces means neither have a great chance of being picked as Trump values loyalty. It’s also worth keeping in mind that the Fed pick must be confirmed by the Senate. Trump has had a tough time getting his cabinet approved, so he needs to make sure he picks someone who is supremely qualified and appeals to conservatives. Democrats will be angry about whoever he picks, but they will have a strong argument in Cohn not having experience. Conservatives wouldn’t be happy with getting Yellen reappointed as there is movement led by Rand Paul to limit the Fed’s power; Yellen is a supporter of quantitative easing which expands the Fed’s power.

In this article, we’ll look at dark horse candidate Kevin Warsh which Predict It shows having a 29% chance of being the next Fed chair. Kevin Warsh seems to want the job and has monetary policy experience, making him a strong contender. He’s also a Republican which helps has cause further. Warsh was a Fed Governor from 2006-2011, has experience at Morgan Stanley, is a fellow at the Hoover Institute, and has a close relationship with hedge fund manager Stanley Druckenmiller. The reason we mention that he’s gunning for the job are his statements. Kevin Warsh has criticized the insularity of the Fed. He thinks the Fed has independence on monetary policy, but not on regulations.

Warsh thinks the Fed should answer to the people, which in this case means Congress. This led him to say:

“But the idea somehow that if the Congress says ‘We think you guys should consider X, or you should reform yourself in this way,’ well my view is we shouldn’t fall into a defensive crouch and say ‘How dare you challenge our independence!’ We are subject to the people’s will.”

That’s a populist statement in the vain of Trumpism. Warsh is a rare figure in the institution who calls for reforms. He probably sees Trump as someone who would support his reforms, so he is channeling his tone in a way which appeals to him. The criticism he makes is valid because Fed officials view PhDs in economics as a gateway. Since most in Congress don’t have them, Fed officials look down upon them. They can’t consider the possibility that someone who didn’t get the education they got can make a logical point. They are very reliant on their models. It’s like a religious cult where being blessed with a certain degree makes your opinion matter and the models are a god-like aspect that they have blind faith in. The truth is that models are as flawed as the individuals who create them.

The second quote which shows Warsh is reaching for the job as Fed chair is when he moderately compliments the Trump administration. In January 2017, Warsh wrote in the Wall Street Journal,

“A new Fed strategy would have the central bank acting as a responsible, forward-looking grown-up. Markedly better tax and regulatory policy is likely with the new administration.”

So far, we haven’t seen the improved tax policy. The point here is Warsh agrees with the deregulatory path Trump is on and is willing to support the administration’s goals on tax reform. The Fed chair doesn’t control fiscal policy, but it always helps to have another person in the government which is on Trump’s side.

Kevin Warsh has interesting opinions on monetary policy. His main criticism of the Fed is on how it cares about stock prices more than real economic growth. The Fed claims to alter policy based on changing data because it’s motto is to be ‘data dependent.’ However, this often becomes an excuse to make changes based on where the stock market is going. The term data dependent is vague, so if the market is down, the Fed can find a weak data point and use it justify dovish policy which supports the stock market. In an article in January 2017, Warsh evidences a time where the Fed seemed to act based on what the stock market wanted.

He said,

“A year ago around this time, the U.S. stock market fell about 10%. The Fed reacted precipitously, reversing its announced plan for 2016 of four quarter-point rate increases. But when prices rallied near the end of the year, the Fed decided it wouldn’t look good to let the moment pass without raising rates. It raised its key interest rate by a quarter point in December.”

The final point we’ll discuss in this article is Warsh’s viewpoint on the Fed’s 2% inflation target. He doesn’t think this is a good policy which is why he said,

“The Fed should establish an inflation objective of around 1% to 2%, with a band of acceptable outcomes. The current 2.0% inflation target offers false precision. According to the Fed’s preferred measure, inflation is running at 1.7%, only a few tenths below target. The difference to the right of the decimal point is too thin a reed alone to justify the current policy stance. It also undermines credibility to claim more knowledge than the data support.”

For the record, the whole concept of targeting inflation is ridiculous. Why target 2% when we can target 10%? If the concept fails to be applied to extremes that means there is hypocrisy in it, making it a flawed idea.

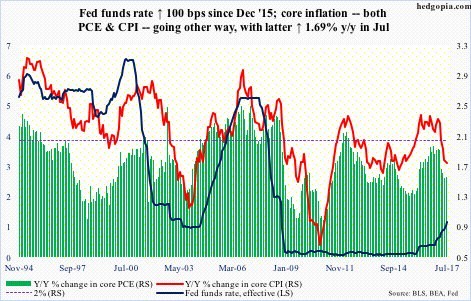

Inflation is rarely exactly 2.0% which is seen is the chart of core CPI and core PCE.

It’s notable that Warsh likes a 1%-2% inflation rate over a 2%-3% inflation rate. This makes him a hawk. With this logic, he would be raising rates because he would be ignoring the fact that the current inflation rate is below the 2% as it is in between 1% and 2%. Being a hawk could cost him the job as Fed chair because Trump prefers low rates.

Conclusion

Warsh has a good shot at being the next Fed chair because he has monetary policy experience, complimented Trump’s policies implicitly, and has a populist reformer flair to him. The only thing that can hurt him is that he leans hawkish. The stock market would selloff if he was picked since he criticizes the Fed for caring too much about the stock market. This could end up helping the real economy (in the long-term), but investors in stocks won’t be happy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.