UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 6 minutes

With S&P 500 earnings at record highs, the labor market as measured by the unemployment rate seemingly strong, and inflation as measured by the CPI moderate, it’s not surprising to see the S&P 500 near its all-time high. With solid fundamentals currently in place, one of the issues which can knock the market off its perch is political risk. It’s not being a doom and gloom person to focus on risk; it’s about managing realistic ever-changing expectations and understanding the probabilities of downside risk possible. It’s better to be aware of an event which doesn’t lead to anything than to miss out on a risk which costs you money.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

-Mark Twain

There’s a key point to make about risk analysis. It’s not about hedging your long exposure or selling stocks anytime a risk pops up. There’s always risk in the market and there will always be risk. The issue is about being aware of the risk, but deciding when to act on it. Every investor is confronted with fears, however only the successful investors know which fears are not to be feared. In this article, we’ll review some of the risk. It’s up to you to decide whether or not to position yourself conservatively as these events unfold.

The principal concern for investors focused on politics is the debt ceiling. It was breached months ago, but through extraordinary actions the government can keep functioning until October. The concept of a nominal debt ceiling is illogical because the debt in relation to the GDP is more important than the total debt. And the debt per capita is even more so important. The debt increasing isn’t a big deal if the economy is growing faster than the debt. The other issue is that the debt ceiling deals with currency that’s already spent so the debate is over whether to honor previously made commitments. Even ardent fiscal conservatives don’t want to renege on promises made by the government. This makes the debate futile. The problem is when spending is appropriated, there’s not much concern for the nation’s balance sheet.

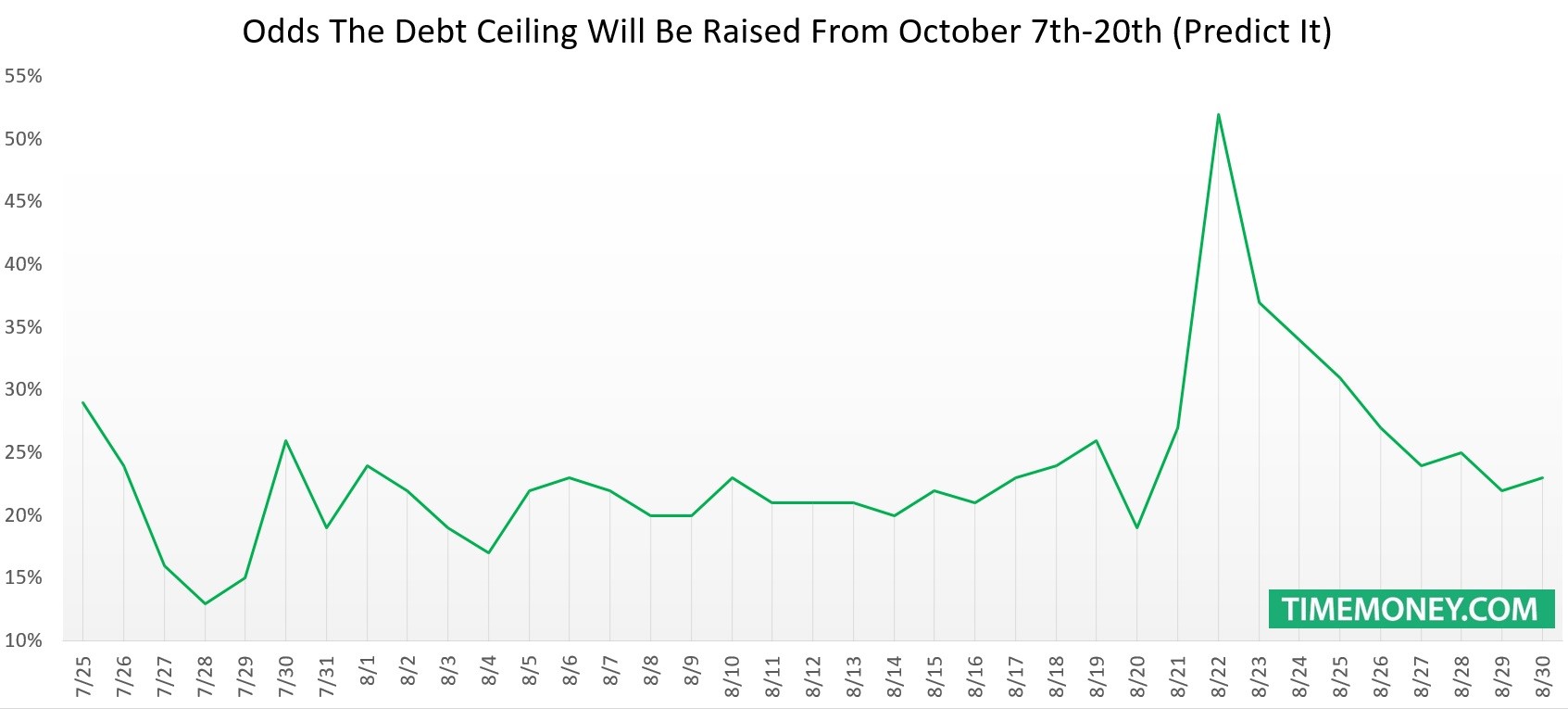

The biggest risk for the stock market is the government’s debt being downgraded like what happened in 2011 when S&P downgraded U.S. debt from AAA to AA. This time the downgrade might come from Fitch or Moody’s which still give America an AAA. Fitch said the prioritization of debt service payments over other government obligations, should the debt ceiling not be raised, “may not be compatible with ‘AAA’ status.” This is a warning to Congress that if there’s a government shutdown and debt payments are prioritized because the debt ceiling isn’t raised by early to mid-October, then Fitch will probably downgrade America’s debt. The result of this will be stocks falling. The last downgrade actually caused U.S. debt to increase in value because it was a flight to safety. That’s a weird trade because speculators are buying American debt because American debt was downgraded. During this time period in 2011, gold was reaching new all-time highs. The confluence of the debt show down set for October, along with precious metals reemerging from what was a 6 year bear market, may become another catalyst for significant upside. Perhaps, in addition, bitcoin may become a sympathy trade if there is a risk of a debt deal not being done. The cryptocurrency certainly doesn’t need an excuse to rally as it’s already near its all-time high. The chart below gives you a picture of where the betting market is pricing in the timing of the debt ceiling increase. It will almost certainly be increased, but the issue is when. Now there’s about a 20% chance it gets raised in mid-October right around the deadline.

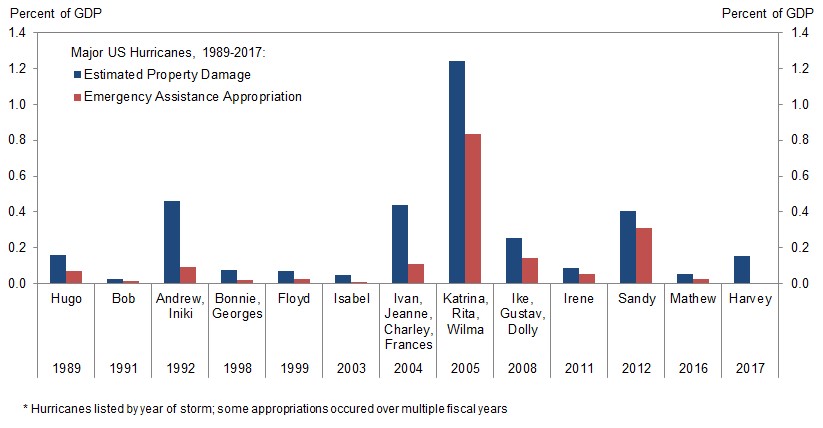

Goldman Sachs thinks the possibility of the debt ceiling being raised without a problem has risen now that the Congress needs to appropriate spending for disaster relief to help the victims of hurricane Harvey which destroyed 40,000 homes in the Houston area. The Goldman chart shows how this storm stacks up against previous ones. Houston is 3% of the U.S. economy, so the damage is quite large. Goldman thinks appropriations for disaster relief will come with the debt ceiling increase, speeding up the process because the funds are desperately needed. As much bickering as there is in Washington, everyone can agree that these victims need help.

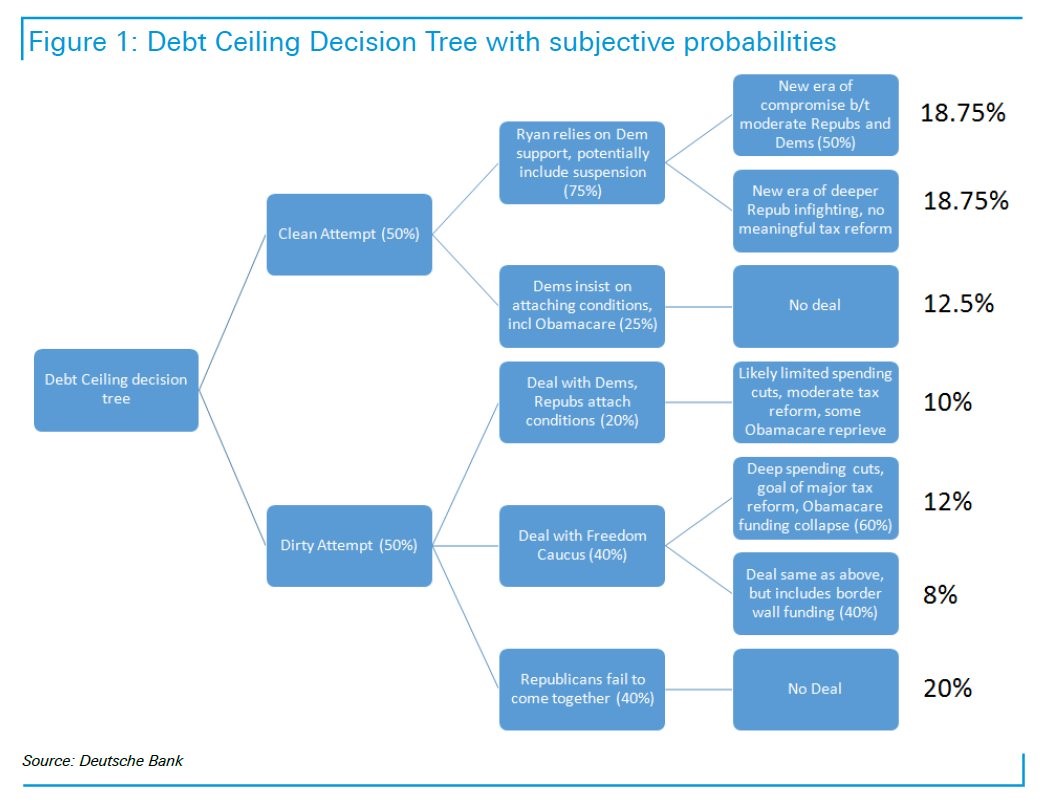

The possibilities on how the debt ceiling issue will be resolved are endless because there’s many ways the Congress can get a deal done. The decision tree summarizes the outcomes and their likelihood. A dirty attempt is one with attached spending changes like tax reform. A clean bill has nothing added to it. Usually a clean bill has an easier time getting through because there’s always a faction that doesn’t like the change added to the bill. The one exception to this rule would be disaster relief funding which would help the debt ceiling be raised quicker. How could anyone vote against relief funding? We’re seeing Ted Cruz get attacked because he voted against the Sandy relief bill because he said there was too much pork (spending on unrelated projects). If you add up the odds at the end, there’s a 32.5% chance no deal gets done. That would be a self-inflicted disaster for the country. It makes the government look dysfunctional to lenders (which it is for the most part). The U.S. legislative process is built so it’s tough to get reforms passed, but not paying the government’s bills would be a new low, even for Congress.

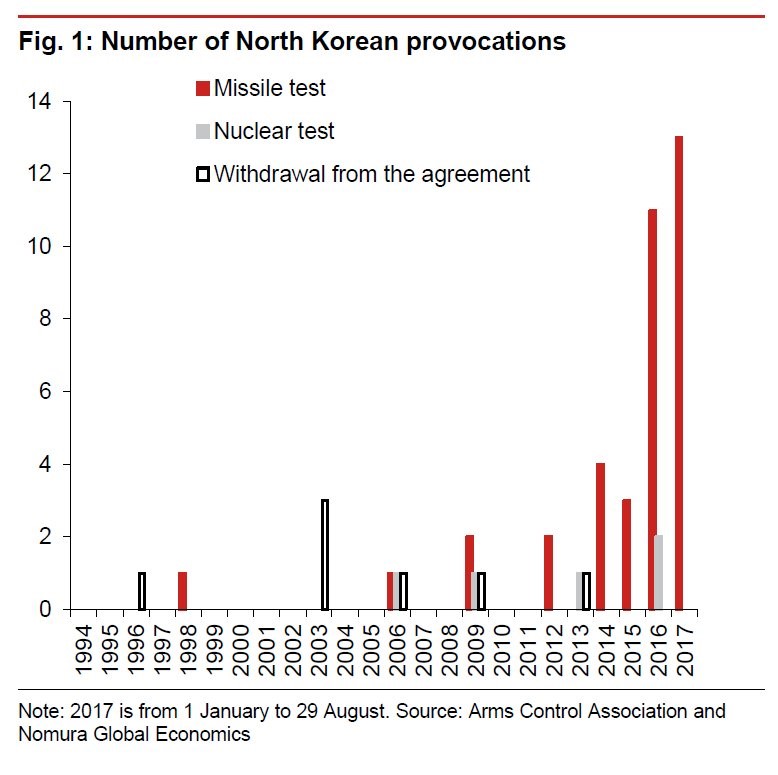

The other major political risk is nuclear war with North Korea. As you can see from the chart, the Google searches for North Korea have been increasing in the past month. The latest threat was North Korea shooting a missile over Japan which broke into 3 pieces and landed in the ocean. The U.N. is sanctioning North Korea, but this hasn’t stopped its missile tests this year. The biggest threat facing the world is if North Korea launches a test and it accidentally kills people in Japan because of a mistake. Game theory says North Korea would never attack another country because America would destroy it. An accident occurring is the only logical way North Korea would end up bombing another country. The US wouldn’t care if it was a mistake and would ruthlessly attack North Korea, starting a war. That would cause stocks to crash.

There’s no way of knowing the chances of North Korea mistakenly killing innocent people with a missile launch, but the odds increase with the number of launches. As you can see from the Arms Control Association and Nomura Global Economics data, the number of provocations have increased. This increases the chances of a military escalation between North Korea and America.

Conclusion

The stock market might not have to deal with any of these risks or they could cause the market to fall. That’s the issue you must rectify in your own portfolio by deciding whether to hedge. Debt ceiling issues are more likely to crop up, but will do less damage to stocks than a war with North Korea, even in this inverted world of bad news is good news.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.