UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Although the buy the dip meme has been mocked by many skeptical investors and even some bulls, it has been the best strategy over the past 8 years. It has been foolhardy to question this dogma, but investors with an understanding of history understand that trends never last forever. In the previous cycle, the similar ‘buy and hold’ strategy was prevalent. After the 2008 crash, these investors who lost money with that strategy vowed to never get back into stocks again. Even though smart investing comes down to more in depth analysis of companies, fiscal policy, monetary policy, geopolitics, and macroeconomics, it’s still important to find where this dip buying is coming from. Sometimes investors make investing more complicated than it is because they think it must be hard. It’s not a matter of whether it’s easy or complicated; it’s a matter of getting it right. Don’t be biased against simple explanations.

If you have been following the tape, you may notice that sometimes the factors mentioned earlier affect stocks, but then the next day the market forgets the news and moves on. The market cares deeply about an event and then ignores it 24-hours later. The best example of this is when the market sold off after-hours when Trump won the election. The selloff didn’t materialize in regular trading hours as traders decided either that the election was bullish or that it didn’t matter anymore. There’s a good argument to be had that the market would have also rallied if Hillary was elected.

This endless bid is coming from baby boomers. There have always been investors trying to game which businesses would do well by serving the baby boomers because there’s so many of them and they have a great deal of wealth. One of the trends discussed in a previous article was the growth in public storage. Baby boomers have a greater affinity for ‘stuff’ while millennials care more about experiences they can share on social media. This means baby boomers won’t be able to pass their valuables down to their kids to be used when boomers move to a retirement home. This has led public storage to explode in popularity.

While public storage has worked out successfully, trying to pick a category of businesses which does well with this influx of demand is overthinking the trade. The best trade is to simply buy equities. Baby boomers have the most capital they will ever have in their lives now as they are between 51 and 69. The average person has the most wealth right before they retire, after saving their money throughout their career. The average baby boomer has $136,000 in retirement savings which isn’t enough to retire with. Americans are living longer than ever. This will be a problem once they begin retiring in mass. Until then, they need to take excess risk to meet their goals before retiring. This savings cannot afford to earn low rates on bonds since the opportunity cost is too large.

Low bond yields are pushing everyone into stocks; the fact that baby boomers with $136,000 average savings need excess returns in a short period makes the decision more alluring to allocate more capital to equities in a last bid gamble.

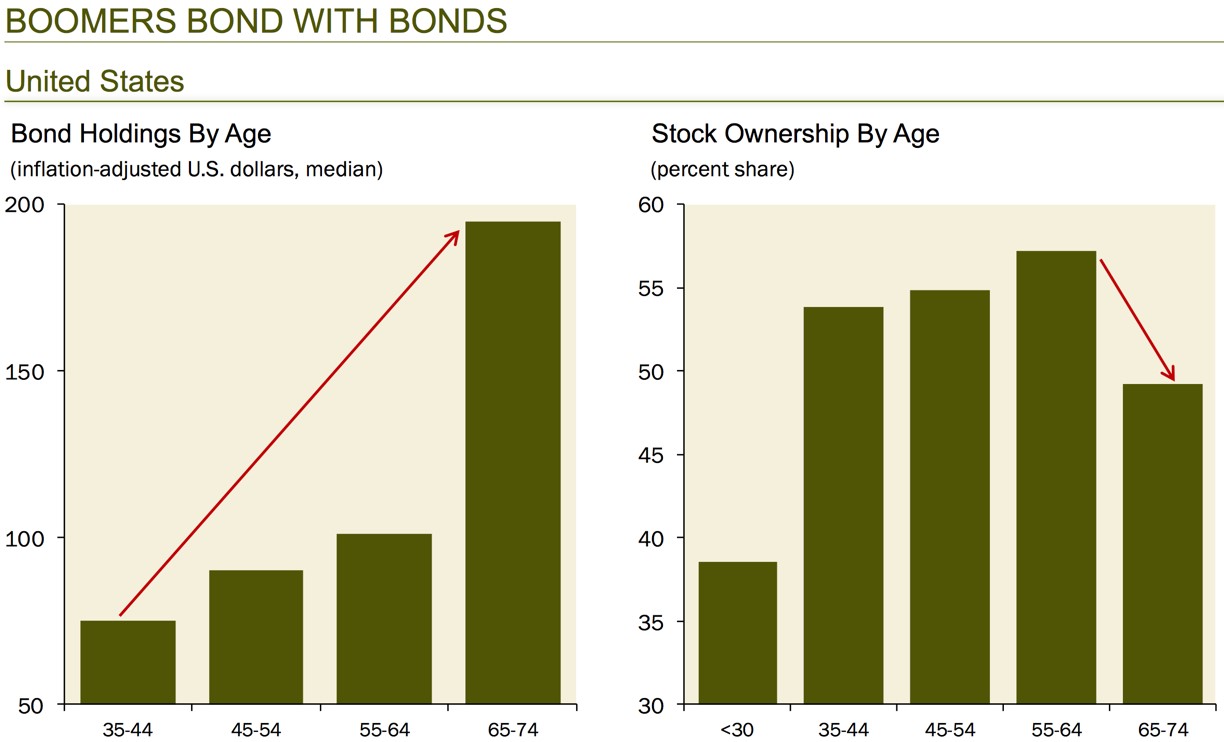

As you can see from the chart on the right, stock ownership for those aged 55 to 64 is above 55%.

The chart on the left shows this capital moves away from stocks and into bonds once people hit 65. This represents a cliff the stock market might fall off as the money flowing into stocks dries up. When this causes stocks to fall, it may cause an avalanche of selling from those who lose faith in the ‘buy the dip’ strategy. People who are within 5 years of retirement can’t afford to take losses. They might panic and sell out of stocks. All this baby boomer wealth can be gone in an instant.

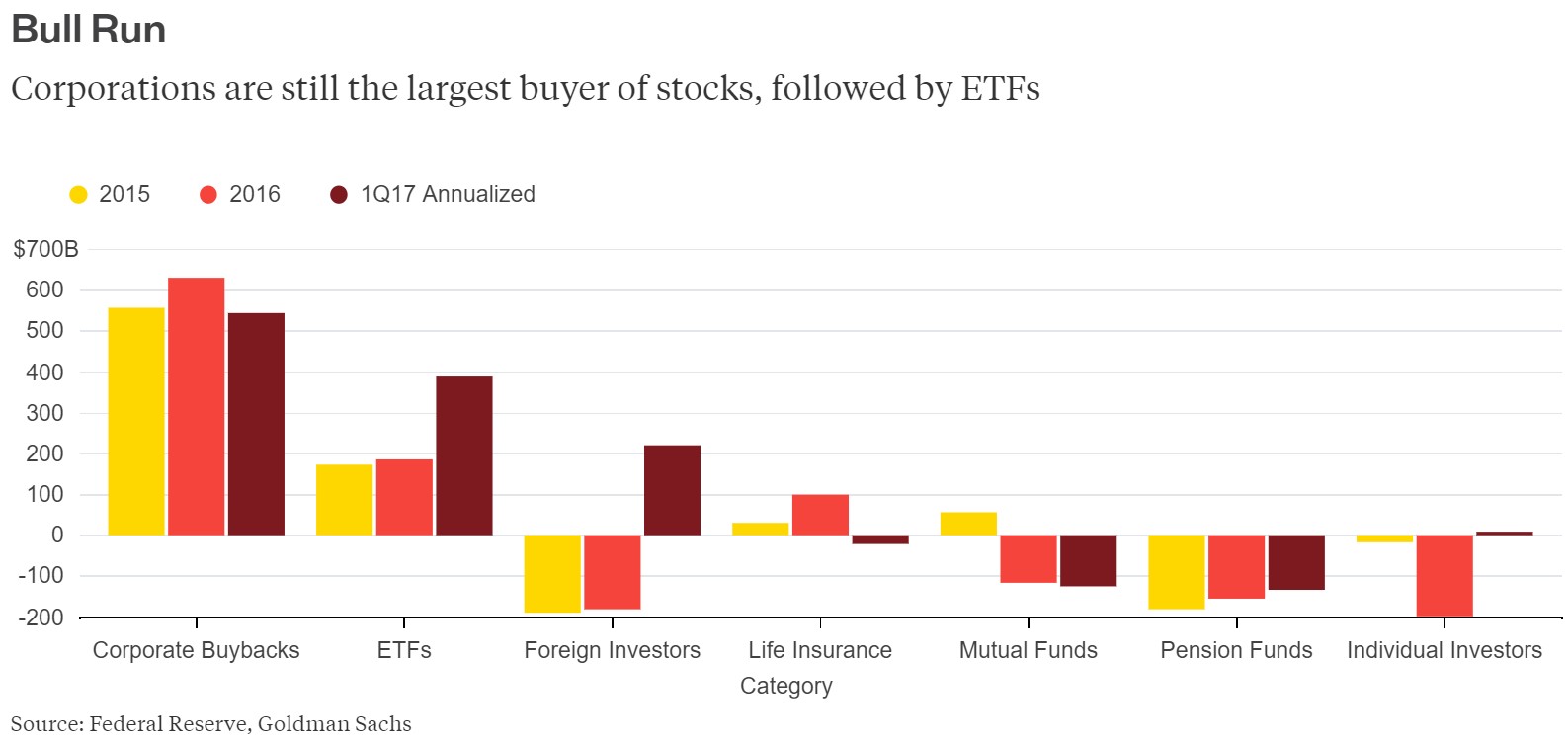

The chart below dissects the money flow into the market.

While fundamental analysis should determine how you value stocks, how the stocks perform will depend on the flows from the contributors above. If you have a time horizon of 10 years or more, you may not care about near term action. If you have a less than 5-year time horizon, these flows need to be studied. As you can see, corporate buybacks are on pace to have a 13% year over year decline. This weakness has been more than made up by the buying from foreign investors and ETFs.

Charles Schwab witnessed a 44% year over year increase in account openings, the most in 17 years in Q1 of 2017. Clearly the money didn’t flow to the individual investors category which shows those who are picking individual stocks. The money went straight into ETFs which continued to take market share from mutual funds. For fundamental investors who are deep thinkers, focusing on the lows fees ETFs charge is missing the forest for the trees. What you are buying matters more than the fees. Millennial investors are hyper focused on getting trades for free, but they don’t care about the valuations of the asset they’re purchasing. This lack of understanding of the basic concept that what you pay for an investment is the determining factor of whether it is a good deal hasn’t dawned on some people. They will pay dearly for this miscalculation.

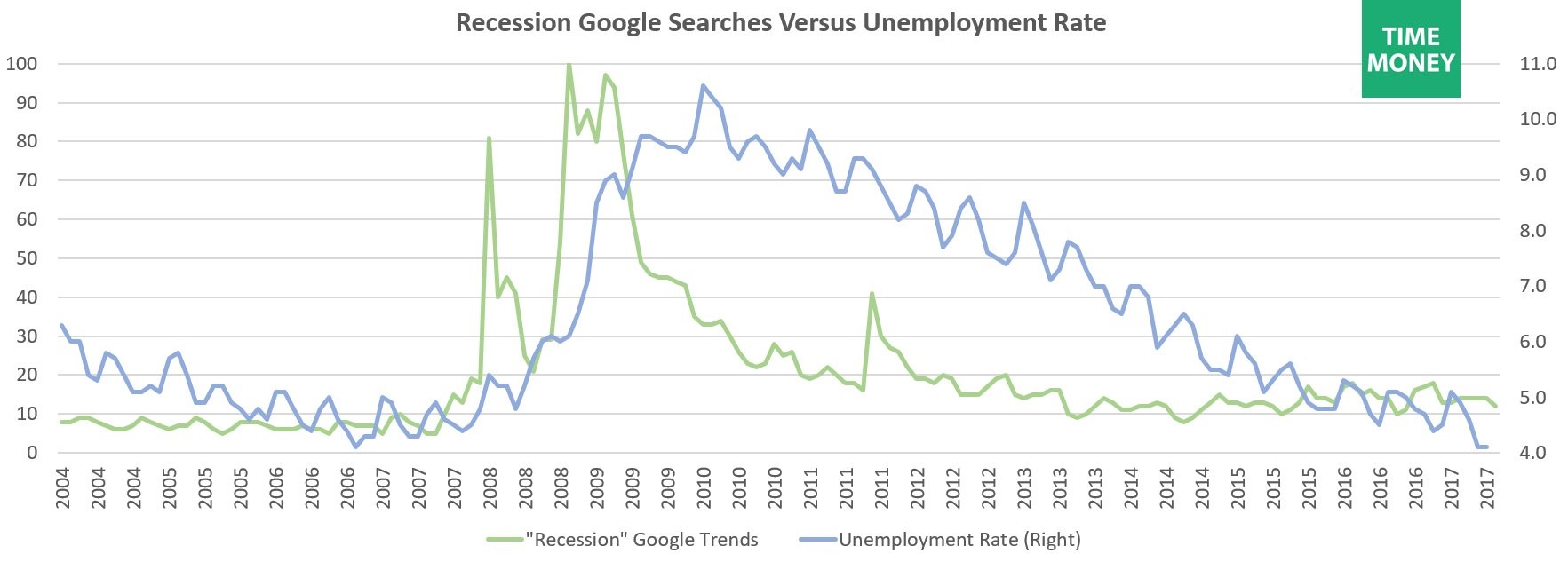

One potential leading indicator to when investors will pull out of stocks because of economic weakness is the Google search prevalence of the term “recession.” As you can see, it rose in early 2008 before the market crash and before the unemployment had its biggest increase. The search prevalence also fell before the unemployment rate fell. This is the only cycle we have information on, so it’s not as tried and true as other indicators. However, it’s worth paying attention to because of how searches can predict action taking.

Conclusion

Baby boomers are funneling money into ETFs as they need to earn as much returns as possible to live a comfortable retirement. $136,000 is only enough to have $9,000 per year in retirement. That’s not enough. If you are a 60-year-old who has $136,000 to retire, you realize that you can’t afford retirement. You look at the stock market hitting record highs consistently and the bond market offering low yields, so you decide to throw money in ETFs, chasing returns. When these baby boomers retire, it could cause a mass exodus out of stocks. As you can see from the chart above, that doesn’t necessarily mean stocks will crash tomorrow as the search prevalence for “recession” is still low, but it may very well be a contrarian indicator suggesting that it’s time to reexamine your equity investments, rather than chase the positive performance of the last 8 years. As a reminder, investors are often conflicted by extrapolating indefinitely their experiences from the most recent past. However, with monetary policy changing to a tightening standpoint despite all of the poor economic data, the results of the past 8 years have created an environment where investing in equities is more risky (and overvalued) today than it was in 2009. Now may be the best time to take risk off the table, especially for those retiring soon. Buy low, sell high.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.