UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 6 minutes

There was a time where people joked about Twitter being a frivolous website that did not provide any valuable information nor insight for investors. That’s not the case anymore as financial Twitter (FinTwit) has riveting discussions if you follow the correct people. However, there are often false narratives that pass as financial analysis, whether it be from the consistently bullish or bearish crowd. As the motto of our website goes, the world doesn’t operate on stark contrasts of black and white. The truth generally is in the middle. As we have detailed this issue previously, most often it’s not malicious intent driving the narrative to either extreme, just carelessly confusing correlation with causation and hoping to insight intrigue in terms of number of viewers, which directly influences advertisement revenue. Given that TimeMoney.com is not monetized, our only intent is to seek the truth, because we nor anyone else has all the right answers. Despite following people whom you may revere and who have historically incredible portfolio returns, accepting anyone’s judgement at face value means that you are not placing ideas through a rigorous screener which can significantly alter your perception of reality, thus forcing malinvestment. Critical thinking at every step of the way when it comes to economic research and investment choices is pivotal.

Is Jeffrey Gundlach Wrong?

Jeffrey Gundlach, CEO of DoubleLine, is an incredibly successful bond investor who often offers incredible insight and perspective. Even though he is someone we revere, sometimes his Twitter comments come across as lacking, which may be understandable given the previous 140 and now 280 Twitter character limit. The tweet below is an example of a tweet which in our opinion promotes a false narrative. We can learn from his mistake, which is why it’s worth discussing. As you can see, he says the junk bond ETF JNK is at a 7 month low while the S&P 500 is at an all-time high. He asks the question “which is right?” Technically, he doesn’t show an opinion, but he still promotes a false notion by comparing apples and oranges.

JNK ETF down six days in a row, closing near its seven month low. SPX up five of last six days, closing at an all time high. Which is right?

— Jeffrey Gundlach (@TruthGundlach) November 8, 2017

Besides the false comparison which we will explain later, he makes an implication that stocks will fall because junk bonds are weak. Not surprisingly a bond investor trusts the action in bonds over the action in stocks. That’s not a crazy concept because bonds don’t have as much retail investors as stocks meaning the ‘smart money’ controls the price action. An example where bonds showed their superiority was with Tesla’s bonds selling off while its stock was at elevated levels. Bond investors are less apt to believe in the hype a company has around it and the momentum it has in its stock. A second example is how the long bond had low yields because it correctly expected GDP growth to be slow for the past few years.

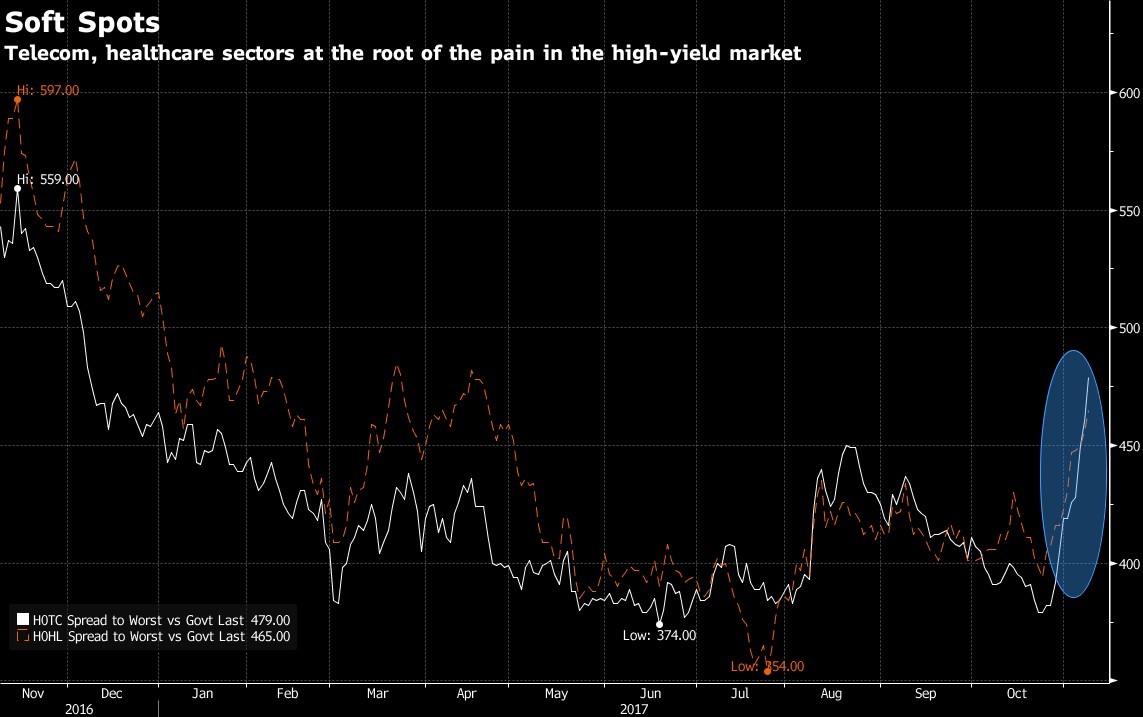

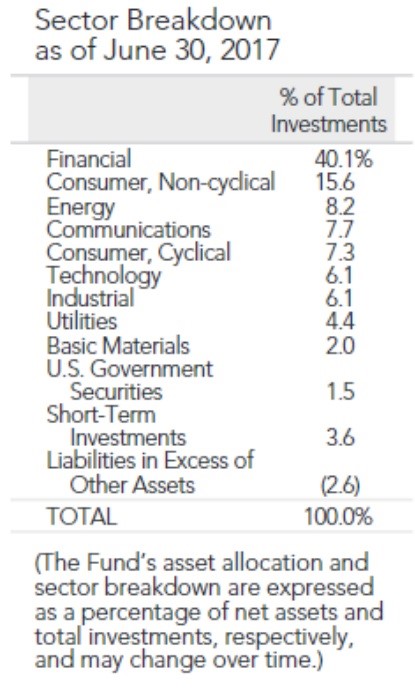

The junk bond comparison to the S&P 500 is incorrect because they don’t have the same sector weightings. This is because the companies who make the most profits don’t tend to be in the same sector as the ones which take out a lot of risky debt. Companies which dominate the S&P 500 like Apple and Exxon Mobile have high debt ratings. The S&P 500 has about a 25% technology weighting. Tech typically doesn’t have a lot of debt so it’s much smaller in the JNK. As of June 30th, tech had a 6.1% weighting in the bond fund. The chart below shows the reasons for the junk bond selloff in November.

The spike in JNK came from the healthcare and telecom sectors. The telecom sector is below 2.5% of the S&P 500’s market cap. Sprint and T-Mobile were trying to merge in the summer of 2017. These firms failing to merge hurt their bonds. Sprint is one of the top 10 holdings in the JNK, so its bonds caused the JNK to weaken. It would be silly to claim this failed merger means the stock market will fall. Neither Sprint nor T-Mobile are in the S&P 500. There are only three telecom stocks in the S&P 500 which are CenturyLink, Verizon, and AT&T.

The Pursuit Of Truth

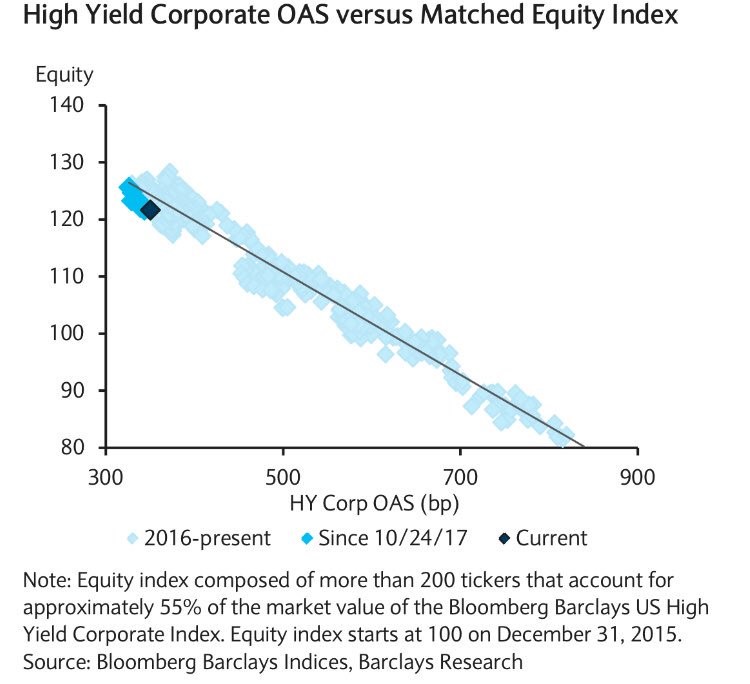

If you’re curious about how an apples to apples comparison would work, the chart below provides you with an answer. The chart compares an equity index of over 200 firms which make up about 55% of the Bloomberg High Yield Corporate Index with that high yield index.

The matched equity index and the high yield corporate options adjusted spread have a direct relationship. When equities fall, the junk bond yields rise and vice versa. Therefore, the JNK fell because it has different companies in it than the S&P 500. It can still be future indicator for the stock market, but it doesn’t necessarily mean a correction is coming after it falls. In 2015, the JNK crashed because the oil frackers were getting squeezed by low oil prices. An analysis of the bond market made it appear as though a recession was assured, but that didn’t happen, likely because central banks prevented it, which is something we have discussed in-depth previously.

If you are wondering about the weighting of the S&P 500 with tech dominating and telecom only having 3 firms in the index, the chart below has an answer. It looks at the historical weighting of the S&P 500.

The balance between the sectors isn’t as equal as it was in the 1990s. That being said, the top five companies by market cap in the index, which are all tech, don’t make up a disproportional percentage of the S&P 500 historically. This quells the worries that the stock market is getting too top heavy.

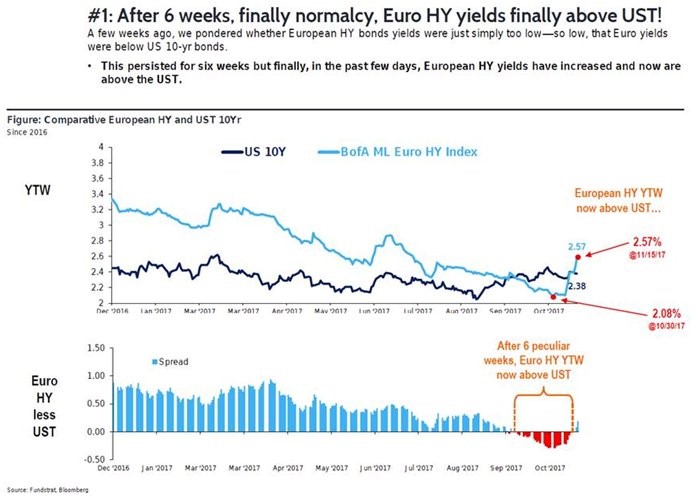

Normalcy Returns

With the ECB buying 60 billion euros worth of bonds per month, over the past years the high yield bonds became very low yielding bonds, lower than US treasuries. U.S. treasuries are often considered risk free while European junk bonds are debt for companies which have a high default rate. That’s the world we live in with central bank interventions. The impossible has become possible as the risk has been temporarily ‘eliminated’ by the ECB. However, normalcy is slowing creeping back into markets. The selloff in European junk bonds following the ECB announcement that it will end its bond purchase program in 2018 occurred along with a US junk bond selloff, pushing their yields above the U.S. 10 year treasury yield.

Conclusion

Despite whom you may revere when it comes to financial commentary and analysis, it is critical to judge the idea, not the individual or organization. This ensures that you are always placing priority on the concept above the individuals. No one has a perfect track record for predicting the future, because no one knows the future, therefore everyone is prone to make errors. Whether you are bullish or bearish, you should always approach all ideas, regardless of where and how they originate, with the same level of objectivity, rigorously analyzing them to determine if they are accurate.

In the instance of the tweet from the esteemed bond investor Jeffrey Gundlach, further review suggests that its a false narrative that may have been placed as a result of falling prey to personal biases, something we are all prone to. While he may be accurate in historical context in betting against economic growth and the stock market, using the selloff in the JNK to forecast negativity in the S&P 500 is a false premise. Look at the makeup of an index before using it as a forecasting metric. The chart below shows its makeup as of June 30th, 2017.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.