UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Oxford Economics’ predictions for the June Fed meeting that we showed in a previous article were accurate in most cases. The Fed didn’t cut rates as expected. Many Fed members supported rate cuts this year, but the median stayed the same. The Fed projected a cut in 2020 which lowered its guidance by 50 basis points since it was previously projecting a hike. Finally, it got rid of the word “patient” in its statement because rate cuts are probably coming. We will analyze these decisions in this article. The one sentence takeaway is this was a dovish hold in which the Fed left open many possibilities because it will be reacting to both the cyclical slowdown and how the trade negotiations with China go.

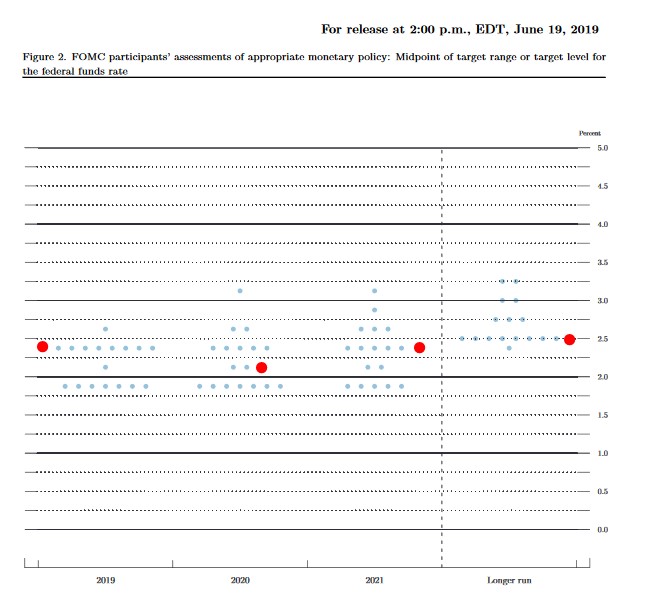

The Barbell Shaped Dot Plot

Many investors expected the Fed to guide for a rate cut this year or at least have some FOMC members support one. That occurred, but not as expected because as the plot below shows 7 members projected 2 hikes and 8 members projected no hikes. Also, one member saw one hike and one member saw no hikes or cuts. This is in the shape of a barbell with many on the dovish side with 2 hikes and many saying the Fed shouldn’t hike. Only one member is in the middle of them.

10 FOMC members voted in June; the decision was 9-1 in favor of keeping rates stable. Only Bullard voted for a 25 basis point cut. Since 8 out of 17 participants supported 2 hikes in 2019 and there was only 1 dissent for a cut in June, likely most of the members calling for cuts weren’t voting members. That lowers the possibility of a cut as most of the doves don’t get to vote this year.

This barbell approach is a good way to look at policy because if Trump adds new tariffs, there might be significant cuts and if there is a trade deal, there might be an economic resurgence which reduces the need for a cut. The best support for the economy would be a trade deal, but the Fed can only set monetary policy; it can’t make trade deals. This reminds us of when the Fed stimulated the economy earlier in the cycle in place of stimulative fiscal policy.

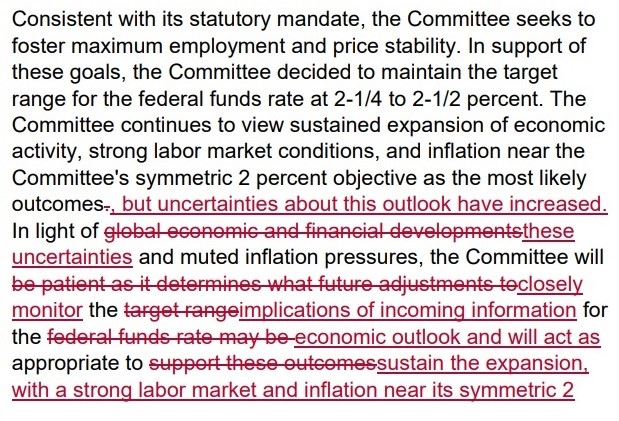

Big Language Shift

The May Fed meeting was defined by the word “patience” because it meant there wasn’t going to be a rate cut or hike soon. The paragraph below shows the original statement crossed out and the new statement underlined.

The Fed is now “closely monitoring” the situation like Oxford Economics predicted. This means it is open to cuts. It’s also critical that the Fed is closely monitoring “the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.” The incoming information is the news on trade talks. The Fed is using how the trade talks affect the economic outlook to judge how it should make policy. The main goal is to continue the expansion.

Insurance Cuts

The Fed’s openness to cutting rates to keep the expansion going explains why the stock market rallied on Wednesday. While it wasn’t a big rally, the stock market was close to its record high and it had been down on 9 of the previous 10 FOMC decision days. Specifically, Powell stated, “An ounce of prevention is worth a pound of cure.” That implies the Fed is going with insurance cuts like it did during 1995 in which it successfully prevented a recession.

The chart below shows the market implied probability of insurance cuts versus a recessionary cuts in the next year. The dark blue part that shows recessionary cuts is consistent with 4 or more cuts. The light blue part that shows insurance cuts is consistent with up to 3 cuts.

Even if the cyclical slowdown continues, rate cuts combined with a trade deal could help stave off a recession. A trade deal will bring back economic clarity to businesses which have been delaying making big investments until they are certain about the law.

The Market Is Sure Of Cuts

The market is now more certain than ever that there will be a cut in July and that there will be multiple cuts this year. There is now a 100% chance the Fed cuts rates at the July 31st meeting. Whenever the odds are above 70% that decision usually happens. There will be a cut unless the economy improves, Trump makes a trade deal, or the Fed comes out against cuts. Not only is there expected to be a cut, the market sees a 38.5% chance of a 50 basis point cut which is how cuts started in 4 of the past 5 cycles. Furthermore, the Fed funds futures market is pricing in a 71.2% chance of at least 3 cuts this year. The chart below shows how far the Fed is from the market. The Fed moved dovishly, but the market is expecting even more cuts, so they didn’t get closer.

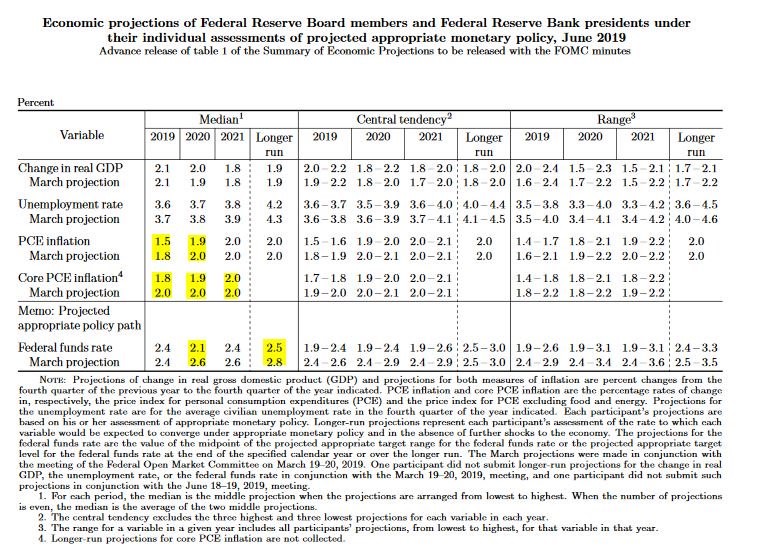

Fed Expects Lower Inflation

One of the reasons the Fed guided for a cut in 2020 and 7 members stated they support 2 cuts this year is because of weak inflation. That’s why it’s no surprise that the Fed’s Economic Projections show lower inflation predictions. The Fed lowered its 2019 and 2020 predictions for PCE inflation from 1.8% and 2% to 1.5% and 1.9%. Oil prices have been weighing on headline inflation. Core PCE inflation estimates were lowered from 2% for both to 1.8% and 1.9%. The Fed is finally recognizing that the decline in inflation isn’t transitory. Keep in mind, the previous projections were from March. Since then we have seen weak inflation data.

Finally, it’s notable that the Fed changed its longer run estimate of the Fed funds rate from 2.8% to 2.5%. That makes current rate policy look more hawkish and implies the Fed is trying to stimulate the economy if it cuts rates in the future.

Conclusion

This was a dovish hold. 7 Fed members supporting 2 cuts this year sent stocks higher, bond yields lower, and gold higher. The next big catalyst for the market will be the G-20 summit where President Trump will meet with President Xi to make progress on a trade deal. Keep in mind, a deal that helps the economy because it gives businesses clarity could lower the number of rate cuts this year.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.