UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

We don’t make predictions on this website. After listening to both sides of the debate, we present the best argument from an unbiased perspective. There is a lot of information to examine, and while some data might make you come to one conclusion, new data the next day could lead you to a completely different answer. Markets are dynamic and changing your opinion, as the information changes, is the only way to be successful long-term. With that understood, let’s preview the Wednesday June 19th Fed meeting which we think is the most important Fed meeting since last December.

Heading into the Fed meeting stocks are high, bond yields are low, and the near term part of the yield curve has a kink which has created an inversion for some parts of it. That’s in place because the Fed is expected to cut rates potentially 3 times in 2019. That would be a massive change because the Fed has previously guided for no cuts in 2019 and a hike in 2020. As of the last Fed meeting in May, the Fed didn’t think the hike cycle was over; the market thinks it is long gone.

As you can see from the chart below, the market’s 2 year estimates of the Fed funds rate haven’t been accurate.

However, near term projections are accurate because the Fed can influence the market to properly price in what it will deliver so there are no surprises. Keep in mind, that the Fed’s guidance influences markets so it’s somewhat incorrect to take the Fed’s projections at face value. The Fed can make a projection to impact markets and the economy. The Fed would rather make the right policy and meet its 2 mandates than worry about if its prior guidance ended up being accurate.

Fed Preview: No June Hike

When the market projects at least a 70% chance of a specific action/inaction on rates, it is almost always correct. As of Tuesday, the market sees a 77.5% chance rates stay the same in June which means they will be left unchanged. The table below lists Oxford Economics’ expectations for the June FOMC meeting.

As you can see, it has the Fed changing from “patient” to “closely monitoring” recent developments. To someone who doesn’t follow the Fed, it probably sounds unnecessary and pointless for the Fed to say it is closely monitoring developments because that’s the Fed’s job. When isn’t the Fed monitoring the economy? The language, however, is important because “patient” means no rate cuts and “closely monitoring” means rate cuts are on the table. The next step after being on the table is to change guidance.

Small Or Big Rate Cut?

Oxford Economics expects the Fed to not guide for a rate cut this year even though the market is pricing in a 98.3% chance of a rate cut this year. Stocks might fall if the Fed doesn’t comply with the market. The only change here is the Fed getting rid of its guidance for a cut in 2020. That’s like the Fed being 5 feet from the market and moving 2 inches closer. It’s not what the market is looking for. The market wants a preemptive cut to help end this slowdown.

As you can see from the table below, the first rate cut of the cycle has been 50 basis points in 4 of the past 5 cycles.

That doesn’t mean there will be a cut of that size now because the economy looks to be in a slowdown rather than a recession just like in 1995-1996 when the Fed cut rates 25 basis points. Plus, the Fed doesn’t have as much room to cut rates since the effective Fed funds rate is only at 2.39%. If the Fed was to cut rates by 50 basis points on July 31st, it could scare the market because that would be a strong action for such a modest slowdown.

40 Year Low In Inflation Expectations

The preliminary June University of Michigan consumer sentiment index fell from 100 to 97.9 which missed estimates for 98.4. That’s a modest decline that is being impacted by the trade war with China. Negative mentions of tariffs were spontaneously made by 40% of consumers which was up from 21% in May and surpassed the July 2018 peak which was 35%. 19% of consumers made unaided references to buying products in advance of tariffs. That’s up from 12% in May and below the peak of 21% in March 2018. Even with such negativity on tariffs the sentiment index was above where it was in April. April retail sales growth was just revised much higher to a solid result.

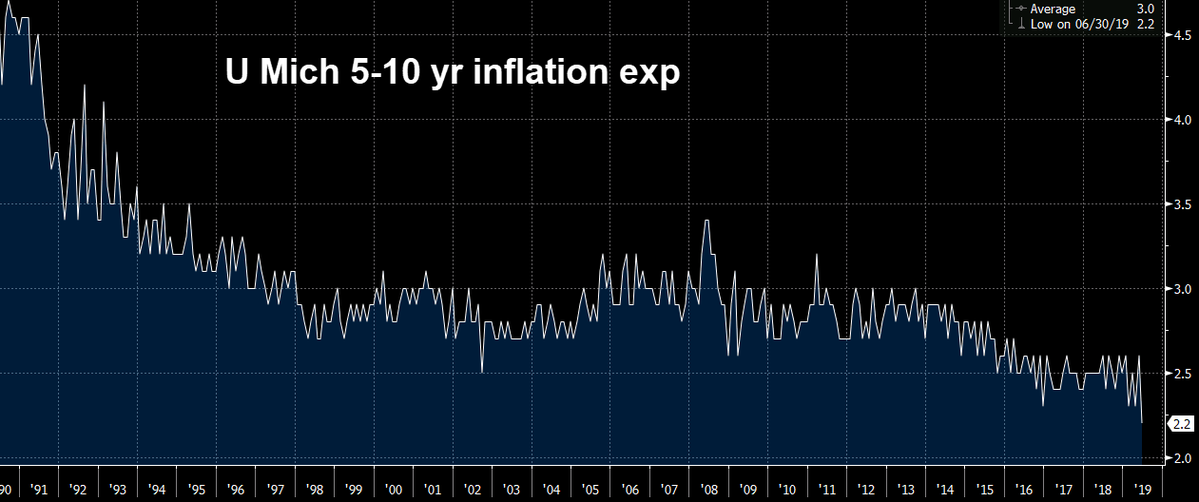

Specifically, the expectations index fell almost 5 points to 88.6 and the current conditions index rose 2.5 points to 112.5. Consumers aren’t in bad shape now, but the trade war makes them less optimistic about the future. The most notable part of this report was the change in inflation expectations. Inflation expectations for the next year fell 0.3% to 2.6%. As you can see from the chart below, 5-10 year inflation expectations fell 0.4% to 2.2% which is the lowest point in the 40 year history of the survey.

Oxford Economics may have been right to suggest tariffs wouldn’t have a net positive effect on inflation because of their negative impact on the economy.

Horrendous Empire Fed Reading

The Empire Fed report was unimaginably bad, but it’s a volatile report. It is only one regional Fed manufacturing reading. If you average all the regional Fed readings, you get an estimate for the ISM manufacturing PMI. One reading doesn’t tell you much. The general business conditions index fell from 17.8 to -8.6. It missed estimates for 11, making this the biggest miss since June 2011. The new orders index fell 21.7 points to -12.

As you can see from the chart below, this was the biggest monthly decline in the new orders index since November 2010.

The only bigger declines in the past 18 years were November 2010, after Lehman Brothers failed in 2008, and after September 11, 2001. Other notable numbers in this report are that the unfilled orders index fell 17.9 points to -15.8 and the future expectations for capex index fell 15.7 points to 10.5 which was the worst reading since mid-2016.

Conclusion

The Fed isn’t expected to cut rates in June, but there’s a chance it will guide for a cut this year to appease the market. Guidance for a rate cut goes along with the record low inflation expectations. The Fed probably won’t cut rates 50 basis points because this is a slowdown and the Fed funds rate is starting this rate cut cycle close to the zero bound. The Empire Fed reading was terrible, but that weakness needs to be confirmed by other regional Fed reports before we start expecting a manufacturing recession.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.