UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 6 minutes

There are many questions about the current monetary policy, but not many answers provided by the central bankers. The situation, which has remained the same since the Federal Reserve started its quantitative easing policy, was perfectly summarized on Monday as Janet Yellen spoke at the University of Michigan. She didn’t give any new responses which will change anyone’s understanding of Fed policy, but the criticisms on Twitter were loud. Critics used the hashtag #fordschoolyellen to voice their displeasure. Yellen may want to rebut some of the critics and stray off message, but given that the Fed’s talking points move markets, this could be a risky proposition. Hence why most events are scripted.

The essence of the disagreement between the critics on Twitter and the Fed members is whether the economy is going according to the way the Fed has planned. Yellen claims the economy is reaching the Fed’s targets. She said:

“We are doing pretty well. The economy is growing at a moderate pace.”

She discussed how the unemployment rate being at 4.5% is below the Fed’s target and how inflation is nearing the 2% target.

The first issue with the way Yellen frames the discussion is that she frames it as if the Fed’s policy decisions are the primary reason why the economy is where it’s at. The economy always moves in cycles based on the amount of credit in the economy. The unemployment rate always rises and falls. The idea that the Fed can target unemployment is ludicrous. It implies that the Fed has eliminated recessions from ever occurring again. An analogy to this would be someone taking credit for the sun coming up in the morning.

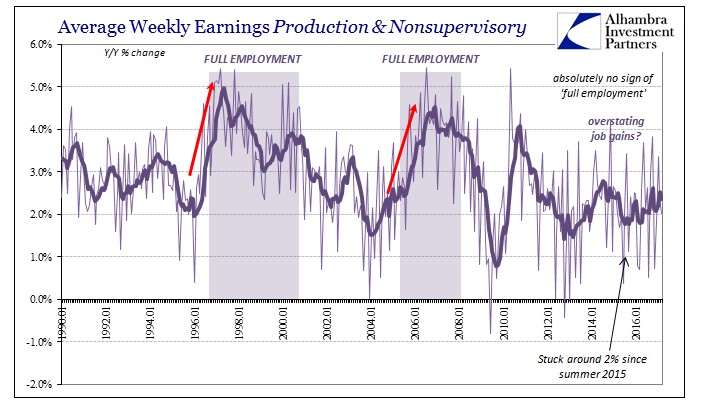

The second issue is whether the economy is at full employment like the Fed claims. As you can see in the chart below, the average weekly earnings of workers in nonsupervisory positions hasn’t increased at the rate seen in the prior two cycles.

On the one hand, not seeing wage inflation allows the Fed to not have to raise interest rates and spur a recession. However, the Fed wishes hourly earnings were increasing quickly so it could normalize rates.

Hourly earnings increase fast when there’s little slack in the labor market, meaning not many people looking for work. Or in other words, participation rate is high. Keep in mind there is a distinct difference between the way the job participation rate is calculated versus the unemployment rate.

The fact that wages haven’t grown quickly after 8 years of this recovery, shows there’s still slack in the labor market even with the unemployment rate at 4.5%. It puts in question this entire recovery as the everyday working person has yet to experience the strong economy even as corporate profit margins are near record highs.

The other issue with Yellen’s statement is about how she says the Fed got price inflation to 2%. As a reminder, the Federal Reserve has maintained a policy of making sure that price inflation is around 2%. Over time this makes it easier for the government to pay off its debts, if the purchasing power of the currency is constantly eroded. Or said in other words, you pay more for everything.

There is a critical difference between the terms “inflation” and “price inflation”:

In the simplest definition, “inflation” is the increase of the supply of currency (debt) in excess of the supply of money (assets). Mostly commonly you may be familiar with the concept of “price inflation”, which is an increase in prices as a factor of the currency’s (dollar’s) decrease in purchasing power. We see price inflation every day. Have you noticed that a candy bar costs more than it did five years ago?

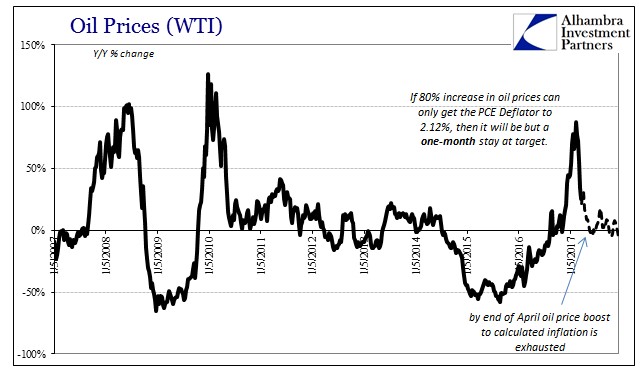

The Fed isn’t the real reason price inflation is up recently. Price inflation is up because of the base effect of oil prices.

The chart below shows the year over year price change in oil. The 80% increase in oil prices got the personal consumption expenditure deflator to 2.12%.

The problem with Yellen’s analysis is that because she’s missing out on the cause of price inflation, her forecast is wrong. The base effect of oil prices won’t boost price inflation in April which means price inflation could in fact be price deflation (good for consumers).

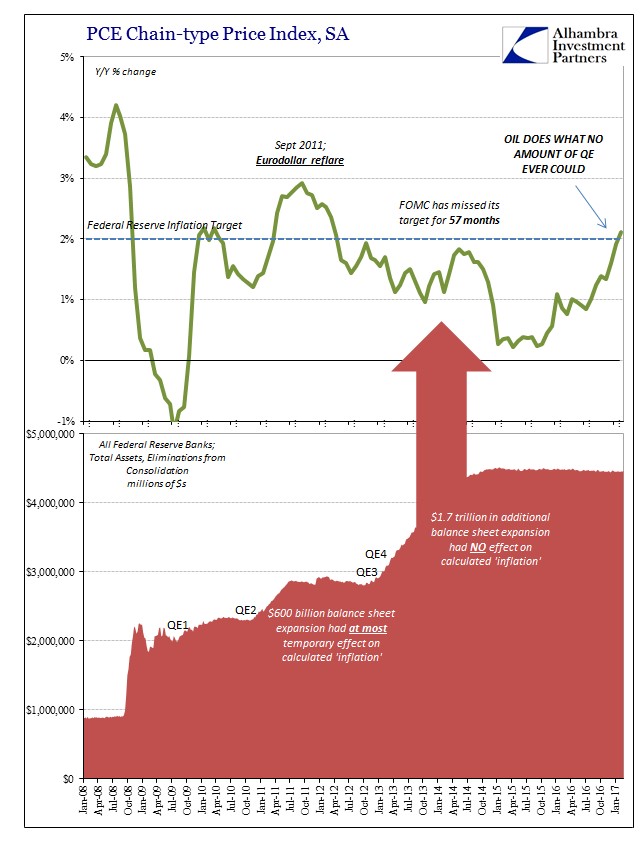

The chart below shows how the Fed’s quantitative easing hasn’t boosted price inflation despite the Fed’s claims.

As the quantitative easing (QE) program was in its beginning stages there were claims by Fed critics that QE would cause price hyperinflation. There has been significant price inflation in terms of asset prices such as bonds, stocks, real estate and costs of running a business or making products. However price inflation in terms of commodity prices increasing has not occurred, yet. The lack of price inflation is in fact a good thing for consumers. It is more beneficial for consumers to witness price deflation, or stated in other words, the purchasing power of your currency increases and you can afford more things. Inflation hurts the consumer and lowers the value of future corporate earnings which are both negative for the economy. Just looking at it in terms of whether the Fed is reaching its goals, the Fed has missed its inflation target of 2% for most of this cycle in the manner that the CPI index measures it at least.

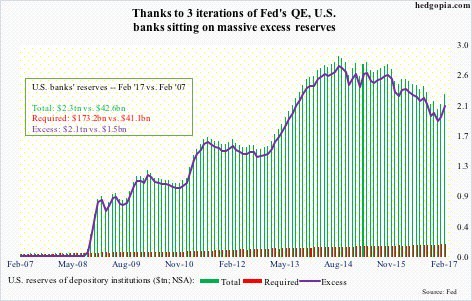

Economists play the game called “find the missing $2 trillion.” The chart below shows where bank reserves are as a result of quantitative easing.

There are $2.1 trillion in excess reserve on the banks’ balance sheets. The banks have already increased credit growth this cycle. With investment grade debt at the highest level ever, it would be wrong to say the banks aren’t lending enough. Who the borrower is, is a different story. As we detailed earlier, corporate debt is at its highest ever.

One restriction on the banks’ ability to lend is the Dodd-Frank regulations which have especially crimped community banks who can’t afford to pay people to help them comply with the new standards. It’s also worth noting that the Federal Reserve can’t force the banks to lend their capital. In fact by raising the Fed funds rate recently, the Federal Reserve is increasing the pay-off for banks to hold capital.

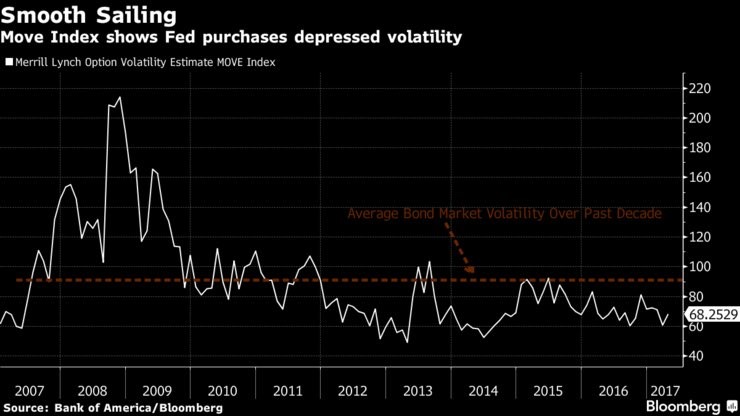

As was mentioned, the main type of price inflation created by quantitative easing is that of financial asset prices. That price inflation can be seen in the chart below as the Fed has been able to depress the volatility in bonds, artificially reduce borrowing costs for the economy and increasing the price of bonds.

The red line shows the ten-year average volatility in bonds. It has been below average for several years. When the Fed takes credit for this achievement, it is correct. Obviously, the Fed buying bonds will lower volatility (measure of risk) in bonds. It’s like how the Swiss Central Bank buying American stocks helps increase stock prices as a function of increased demand.

Conclusion

There were a few explanations in this article which showed inconsistency in the Fed’s arguments, but the central point of the critics of the Fed wasn’t discussed. Their main point is that the Fed’s policy of creating financial asset price inflation will end in a bust which will cause more pain for the economy than the benefits which have been realized in the past few years. As was shown in the chart which showed wage increases, the benefits are scant for the working-class member which implies any negative result of a bust in the economy would not be worth it to them. Considering the Fed’s track record of missing the last two bubbles in the economy, the Fed is likely missing these bubbles as well, even though its actions helped create all three.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.