UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Two topics that took center stage this past week have been the Federal Reserve’s supposed change (perceived tightening) in its monetary policy and the monthly Bureau of Labor Statistics (BLS) report. The Fed clarified its forward guidance this week in a speech by Bill Dudley, president of the Federal Reserve Bank of New York. The Fed considers its public rhetoric to be a part of its policy decisions. This is not like a politician, for instance Trump, who sometimes speaks in a stream of consciousness manner. Every phrase is carefully constructed to have whatever effect on the market the Fed wants. That’s not to say that the Fed doesn’t make errors with its open mouth policy. The Fed discussed multiple rate hikes in the past two years, while only delivering one each year. Besides monetary policy, we will review the labor report which was weaker than expected. One perceived mainstream reason for this weakness was the winter storm which hit the northeast, interestingly that is always an excuse for a much more serious issue.

The Fed’s Minutes on Wednesday was unclear on how the balance sheet would be unwound. This caused the stock market to sell off. It’s possible it didn’t sell off further because traders may have known an explanation was coming which would ease concerns. To clarify, the Fed was mixed on whether it would unwind the balance sheet quickly or slowly. The decision was either to stop buying maturing bonds all at once, or gradually. The market had been expecting the latter to occur. Being mixed on the opinion made it confusing because most investors didn’t think stopping all at once was even a possibility.

This set up the latest points made by NY Fed President Bill Dudley in a Q&A. He made two clarifications to the forward guidance on the balance sheet. The first one was that the Fed will be doing the unwind gradually. This makes more sense because of the gradual speed at which interest rates have been raised in this tightening cycle. The second point was a new one. He said the Fed would be pausing its rate hikes temporarily while it unwinds the balance sheet.

Here is Bill Dudley’s attempt at clarifying what he said:

“Some people misconstrued what I said last week. I said a little pause. A pause is pretty short already, and I think a little pause is even shorter than that. Presumably at the time that you make the decision on the balance sheet you might want to forgo the decision on short-term rates just to make sure that the balance-sheet decision doesn’t turn out to be a bigger decision than you thought you were making. So, I would emphasize the words ’little pause.’”

As a reminder, only a week ago Dudley stated the following:

“A couple more hikes this year seems reasonable. If the economy is a little bit stronger than we expect, we could do a little more, and if it’s weaker than we expect, we could do a little less,” Dudley said in an interview with Bloomberg TV.

A pause is somewhat of an ambiguous term because that could mean one month or one year. That’s why it was used because the Fed wants flexibility in its policy decisions.

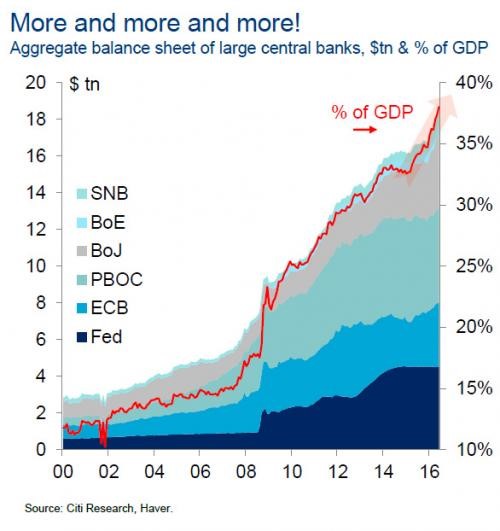

Some are skeptical of this entire ordeal. Skeptics of the Federal Reserve balance sheet unwind have the chart below to back up their claims.

As you can see, starting after the financial crisis the central banks’ balance sheet as a percentage of GDP has been a one-way path higher. If this reverses, asset prices will fall which is something the central banks don’t want.

March BLS Jobs Report

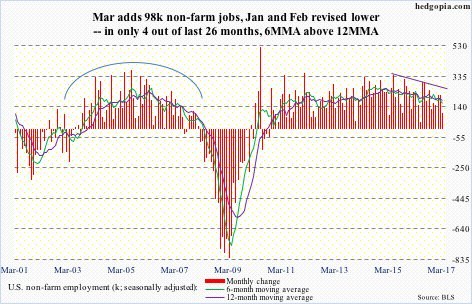

The March jobs report was a big miss as 180,000 jobs were expected to be added, but the report showed only 98,000 were created. This miss was fueled by retail bankruptcies. Retail hemorrhaged about 30,000 jobs in the month. The most disconcerting part of the report was that the prior two months had a negative revision of a combined 38,000 jobs.

The chart below shows the trend in jobs growth.

With the negative revision and weak March report, the six and twelve moth moving averages are falling. The April and May reports will give us clear insight into whether the labor market is signaling a recession.

The chart below illustrates the long-term trend in retailers hiring less department store employees.

This is because of the shift toward spending money online. The trend had been shown to accelerate in recessions, but the fall in 2012 proved that the shift away from department stores can even accelerate without a recession. Just because the latest retail bankruptcies in Q1 2017 are being caused by a secular decline, doesn’t mean they should be ignored. Retail spending has been weak as the Atlanta Fed GDP Now downgraded its expectation for real consumer spending growth in Q1 from 1.2% to 0.6% in its latest update.

As promised, there are three charts below which show the debt/stock market bubble in its glory.

The first chart shows the net debt and net buybacks of non-financial corporations. At the peak of this cycle, both were higher than the peak in 2008. These three bubbles show a trend of financialization where everything gets leveraged to get as much return as possible. Part of the reason for this is because the GDP growth rate has been in a secular stagnation as productivity has decreased.

The second chart shows the leverage ratio for investment grade firms. Low sales growth combined with low interest rates is a perfect combination for leverage to increase. The first chart showed total debt and buybacks, meaning it’s not adjusted for the growth in the economy. The leverage ratio is adjusted for the growth in the economy since it includes total equity. It’s a more disconcerting chart as the leverage ratio reached a new record high this cycle.

The third chart shows the use of equity financing to fund M&A activity. It’s interesting to see that even with the elevated use of equity financing, the leverage ratio is still at its all-time high. It shows that corporations are using any means necessary to improve their performance. It is like attempting to ‘squeeze water from stone.’ Real growth from productivity is needed to grow the economy because leverage always reverts to the mean. Or stated in other words, you can’t borrow indefinitely.

Conclusion

The central banks don’t tend to unwind their balance sheets, but the Fed’s rhetoric suggests they may be preparing to do so later this year. Proving the skeptics wrong will be the least of its worries as unwinding the balance sheet could trigger problems related to the over indebtedness of the economy. The increased supply of treasury and mortgage bonds could cause interest rates to increase which would increase defaults, causing the credit cycle to move into a stressed state, thereby bringing an unwind to the financialization of the economy, something that will negatively impact not only bond and stock valuations, but a loss in jobs.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.