UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Heading into the Q1 earnings season, we mentioned that the bar was raised very high. Usually, the estimates fall a few weeks before the reports come out. This time they were raised because of the tax cuts. Based on the average beat rate, the implied expectations for year over year earnings growth were 20.1%. Many investors look towards sales growth to determine the health of businesses because accounting gimmicks can push up profits. In this case, it was the tax cuts boosting earnings growth. If you are doing work on an individual firm, cash flows can be measured and you can look at each business line to determine if there are any red flags.

For the overall bottom up S&P 500, earnings growth and revenue growth are the most widely cited data points as granularity isn’t available for such a wide swath of firms. The reason we’re discussing this is because sales growth has been boosted by the decline in the dollar on a year over year basis. Therefore, the bottom line and top line are being augmented. The currency effect is a one time event. Some say the dollar is simply returning to its average price since the 10 year monthly median is $90.61. While that’s true, the year over year effects are still transitory. The key is to understand that these earnings can be sustainable without the growth rate being sustainable. The tax cut is more stable as it doesn’t change every day like currencies, but the spike in earnings growth caused by it is also temporary.

Companies Ignore The Bad, Focus On The Good

Firms love to point out to stockholders why performance missed estimates when it does. The better the excuses, the more likely shareholders will overlook disappointing results. To be clear, most of the time this isn’t the case – investors don’t get tricked easily. The common excuse which holds little merit is bad weather. Businesses shouldn’t blame the weather because it’s expected to change. Only extreme events justify that excuse such as last years hurricanes.

On the other hand, when firms have earnings boosted by one time events, they’re more likely to put the earnings and revenue growth in the title of the press release, while quietly mentioning that these are temporary boosts. This is in the firm’s best interest. Investors call these earnings beats with weakness in the details quarters ‘with hair.’ Earnings growth generated by tax cuts and revenues boosted by currency changes mean most reports have hair. This explains why stocks are falling with such great bottom and top line numbers coming out. Understanding this is critical because knowing the reason for the weakness helps you figure out where stocks will go in the future. There is a general fear of rising interest rates, but that’s not the only factor affecting stocks.

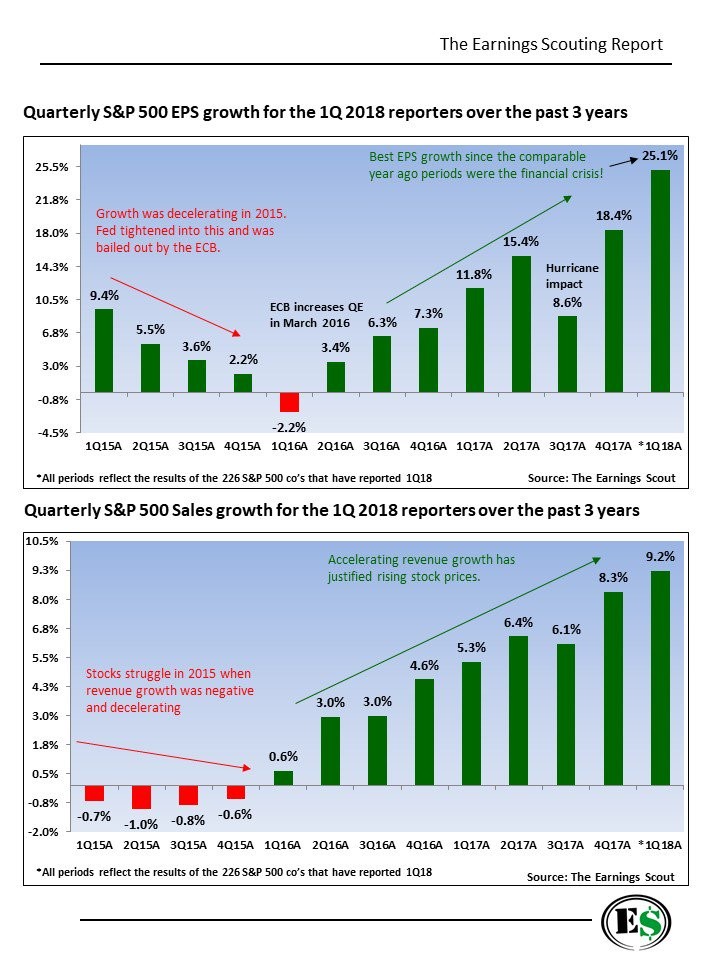

Earnings Growth Has Accelerated

Let’s look at the specifics of the earnings season with over half of the reports in. Keep in mind, the points we make in this article will be valid after all the results are in. There’s no stopping analysis because the results aren’t fully out. The quicker we formulate the analysis, the better it is for the readers. With 266 of the firms in the S&P 500 reporting earnings, the earnings growth rate is 26% and the sales growth rate is 10.35%. The charts below show the data a few days prior when less reports were in. It still gets the job done in terms of showing the accelerating revenue and sales growth rates.

Source: EarningsScout

Stocks Have Been Volatile Because Of Peak Earnings Growth Fear

Even though these are two positive charts, there are two bearish takeaways. The first point is cyclical phase changes matter more than they are given credit for. Some people, especially in politics, think the economy is stationary and only moves as a result of public policy. We’ve seen that thought process proven completely wrong this year as economic growth has slowed down despite the tax cuts. There’s no question tax cuts boost growth, but cyclical changes can override them.

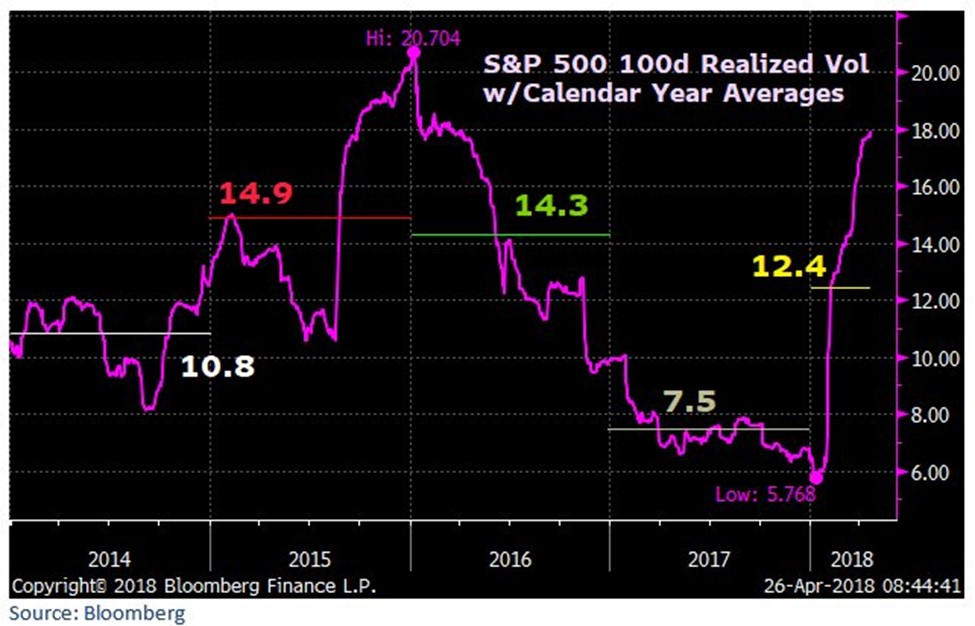

The other bearish element presented is that investors are worried that earnings growth is near its peak. Clearly, 26% earnings growth is unsustainable. Even though these great numbers are pushing up estimates for next year, that doesn’t mean the growth rate will be matched. Stocks rallied in 2017 because results went from okay to good. The fear is results will be shifting from great to good again. At best, there will be a deceleration. At the worst a recession will be the result of this slowdown. The chart below shows the 100 day realized volatility has increased in the past few weeks as investors have scoffed at earnings reports beating on the top and bottom line. The realized volatility was only 7.5 in 2017 as investors loved the improvement in earnings growth and the economy.

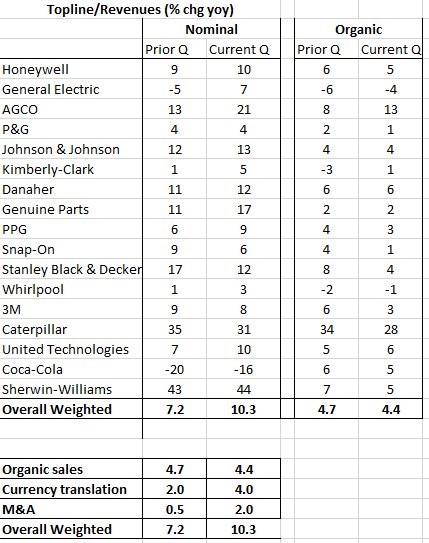

Examples Of Declining Organic Revenue Growth

We are focusing on the small negatives in these earnings reports because greatness was expected after the great risk adjusted returns in 2017. Trading in 2017 was all about the positives and 2018 is more about the negatives. The table below shows the effects M&A and currency translation have had on revenue growth in a few big cap firms. Organic growth actually declined from 4.7% to 4.4% even as nominal growth was up from 7.2% to 10.3%. This gives support to the peak growth narrative even though headline earnings and revenue growth are expected to strengthen next quarter.

Source: @takis2910 Twitter

Earnings reports have largely been great if you only look at the top and the bottom line. However, there has been organic growth weakness which is following the economy lower. This is resulting in price to earnings multiple compression. While the general takeaway from this article can be thought of as a bearish view of the economy, the goal was to demonstrate that even with great earnings, there are positive catalysts that could be transitory. It’s encouraging to understand that company fundamentals still matter to investors. It’s not surprising to see some underlying earnings weakness when the global economy slowed in Q1, especially in Europe. Now you know what to look for next earnings season to determine how the results are coming in.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.