UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Weakness in real median income is the backbone of the income inequality debate because if median incomes are increasing people don’t care as much about how well the rich are doing. If people have jobs and are getting raises, they aren’t willing to protest. If they are getting real pay cuts, the rich become a target even if the rich are seeing their wealth decline.

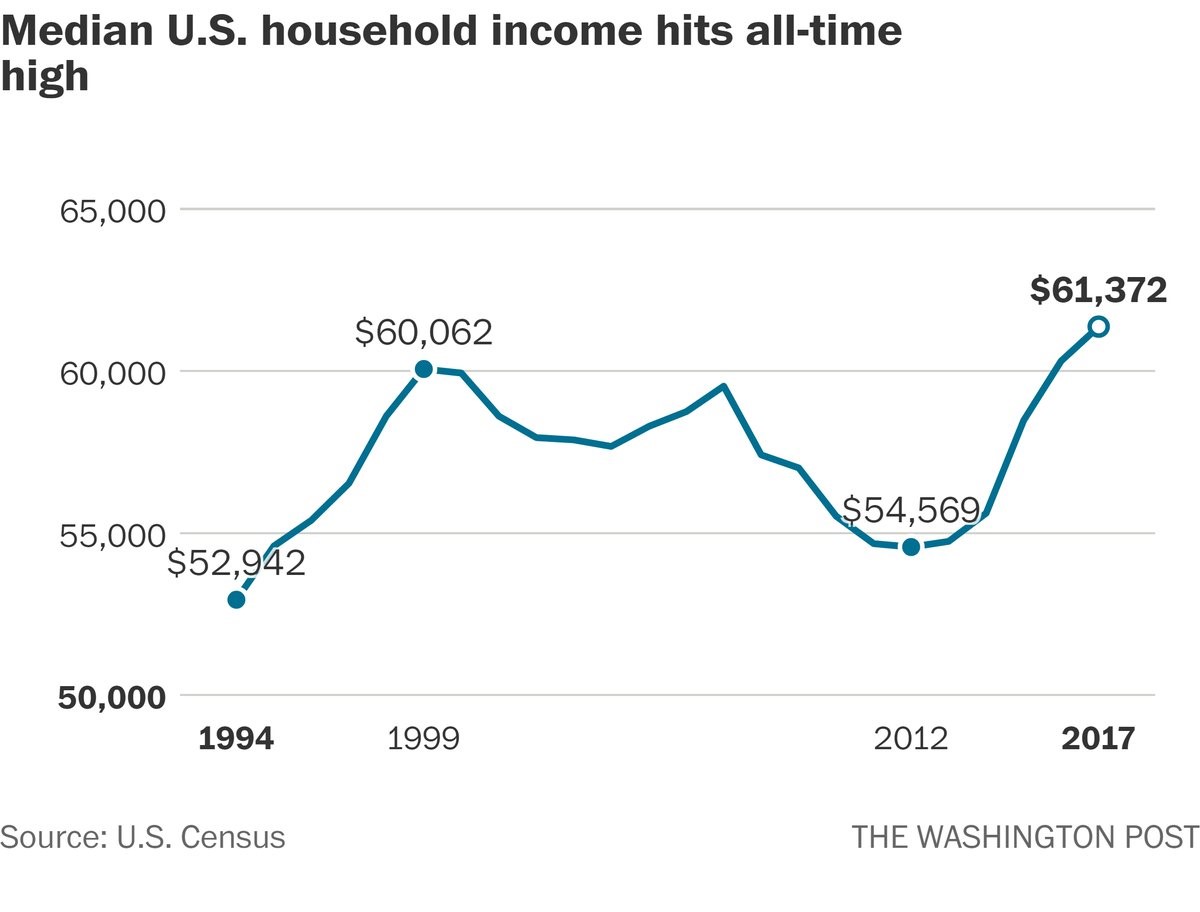

It took this expansion 7 years for real median household incomes to finally reach a new high in 2016 of $60,309, surpassing the peak of $60,062 from 1999. In 2017, the all-time high was surpassed at $61,372. Taking 18 years for an increase of $1,310 per year isn’t a huge victory, but it’s a step in the right direction. As you can see from the chart below, incomes have been increasing since 2012.

Real incomes were up 1.8% in 2017. The bad news is growth has been slowing as it was 3.2% in 2016 and 5.2% in 2015. Since inflation has increased in 2018, growth might slow further.

Poverty Declines, But Inequality Expands

Americans in poverty declined 0.4% to 12.3% which is the lowest level since 2006 as 39.7 million people live in poverty. Since 2014, the poverty rate has fallen from 14.8% to 12.3%. Interestingly, the only education group which saw an increase in poverty was those with a bachelor’s degree as it increased 0.3%. One of the reasons income inequality debate is still alive and well is because the poor still aren’t doing well even though the median has improved. From 2007 to 2017, real household income for those in the 90th percentile increased 7.5% and the real household income for those in the 10th percentile fell 4.5%.

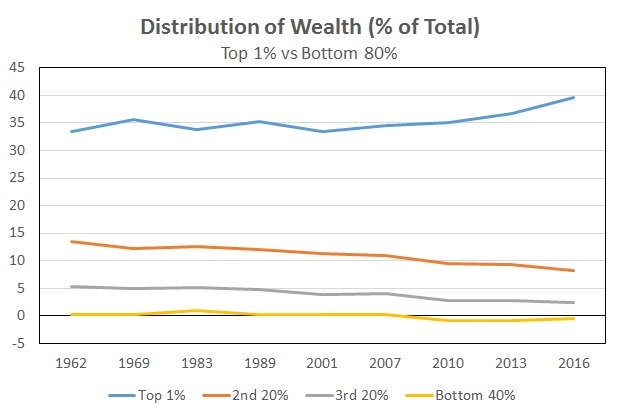

The chart below shows the historical changes in the distribution of wealth.

Those in the top 1% hold about 40% of the wealth and those in the bottom 40% hold a negative percentage of the wealth.

Bezos Tax Act

The most recent example of legislation aiming to end this situation is the Bezos Act sponsored by Bernie Sanders and Ro Khanna. The Stop Bad Employers By Zeroing Out Subsidies bill aims to tax corporations for every dollar their low wage workers receive in government healthcare and food stamps. The obvious logical fallacy this bill makes is that corporations already pay taxes which go to funding healthcare and food stamps. It’s simply a tax increase on firms which employ low skilled workers.

The way capitalism is set up is the drivers of profits get the rewards while those who can be replaced get very little. It could be a better idea to make it easier for people with low skills to gain skills and to found businesses. Even though Amazon is the 2nd biggest company in America, it is a low margin business outside of the cloud division. Amazon wants to replace low skill labor with robots, not pay them more. This means higher skill jobs will be created.

How To Grow Your Wealth

While theoretically its possible for the government help solve the problem of poverty, in reality the best way to do it is for each person to make better decisions. The best example of millions of individual bad decisions was the housing bubble. People willingly chose to buy houses they couldn’t afford. Predatory practices can’t force someone to buy a home. Better financial education could have prevented the housing bubble. It’s human instinct to buy an asset that is increasing in value, but people don’t have to follow their instincts. There’s nothing that stops people from thinking about the risks of their actions.

The best decisions individuals can make which will bring them out of poverty and grow their wealth are to invest in education, but not get into student loan debt, be open to new career opportunities, do tasks that others don’t like doing, and spend money to save time if there is an opportunity to do something more valuable with the time.

When you are young and don’t have much wealth, saving is the most important driver of your returns. For example, let’s review a scenario where you make $40,000 per year and have $10,000 invested. If you make a 10% profit on the $10,000 investment instead of 8%, you made an extra $200. If you decide to save 10% of your money instead of 8%, you saved an additional $800. If you have a decent salary for where you live ($40,000 goes further in the rural south or midwest than cities on the coasts), it is more effective to increase savings early in your career than improve your investment returns. Obviously, if you live paycheck to paycheck you can’t save, but in that situation you probably don’t have investments either.

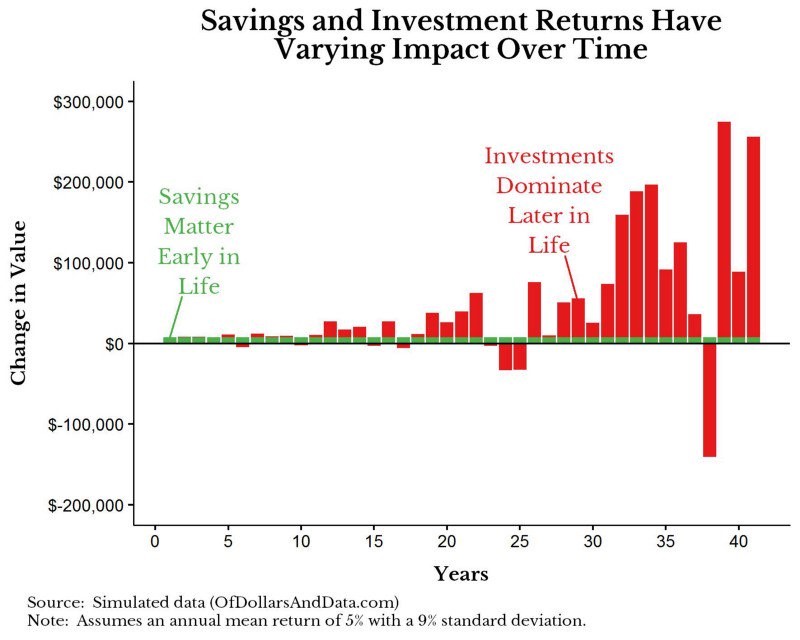

The chart from OfDollarsAndData below shows the variations in investments aren’t as significant as the changes in savings early in life.

You’d need to improve returns by over 8% in that first example to make it more important than a 2% change in savings. The roles switch as you get later in life. Gains and losses are magnified. Your salary should increase, but the compounding effect of investments will make them more important than your income. Each basis point of returns matters when you have $300,000 invested.

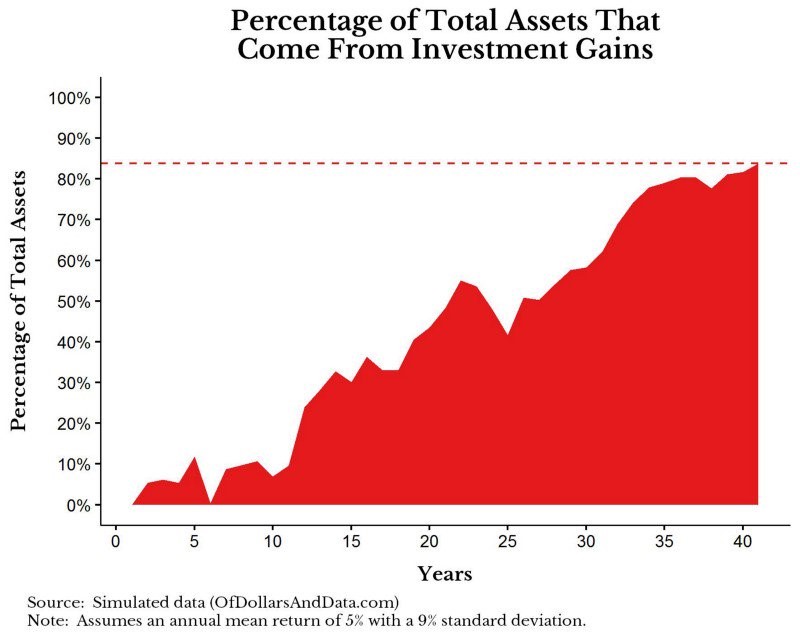

The chart from OfDollarsAndData below shows the information seen above in terms of how much of your gains come from investments.

Not much of your gains come from investments when you get started, but investing is almost everything later in life.

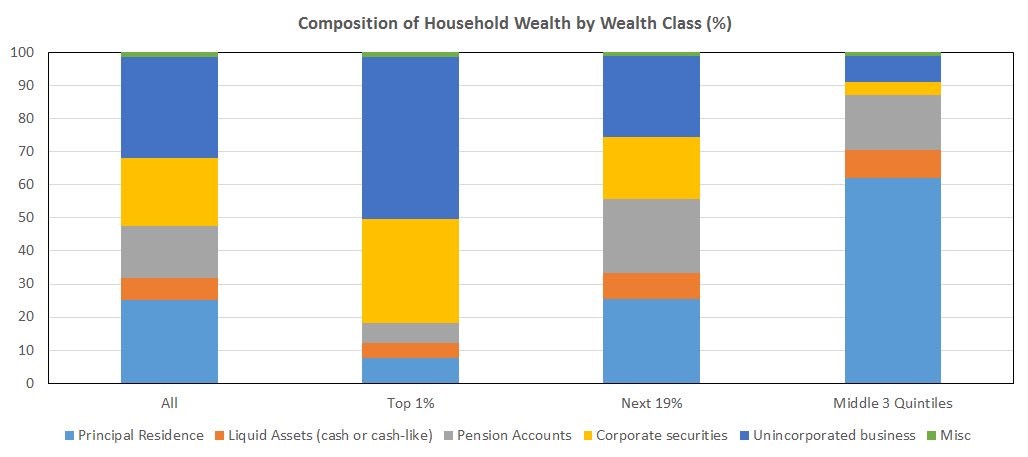

The chart below is an interesting tidbit which shows how wealth is composed by various income groups.

The top 1% have a lot in businesses and stocks, and only have about 6% in their primary residence. Those in the middle 3 quintiles have about 62% of their wealth tied up in their primary residence.

Conclusion

We can’t solve wealth inequality in an article, but we can give you the tools to help you grow your wealth. It’s important to save as much as you can in your 20s and 30s, while your investment returns are more important in your 50s and 60s. It can be more difficult to save when you are young because that’s when households are formed. The good news is compounding will take care of you if you start early.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.