UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

After the election, the stock market rallied on supposed optimism caused by the anticipation of deregulation and tax cuts. The rally was called the Trump Trade. The question remains why stocks would rally based off rhetoric from a politician. Yes, the stock market likes to discount future events. However, buying the promises a politician makes seems like too much of a leap of faith. It’s especially dubious because the country is already in $20 trillion in debt. The decision to lower revenues at this juncture isn’t plausible. Forgetting about math for a second, it’s not even politically feasible to balloon the deficits by cutting taxes because the House Freedom Caucus opposes increasing the debt and the Democrats aren’t in favor of tax cuts for the wealthy or corporations.

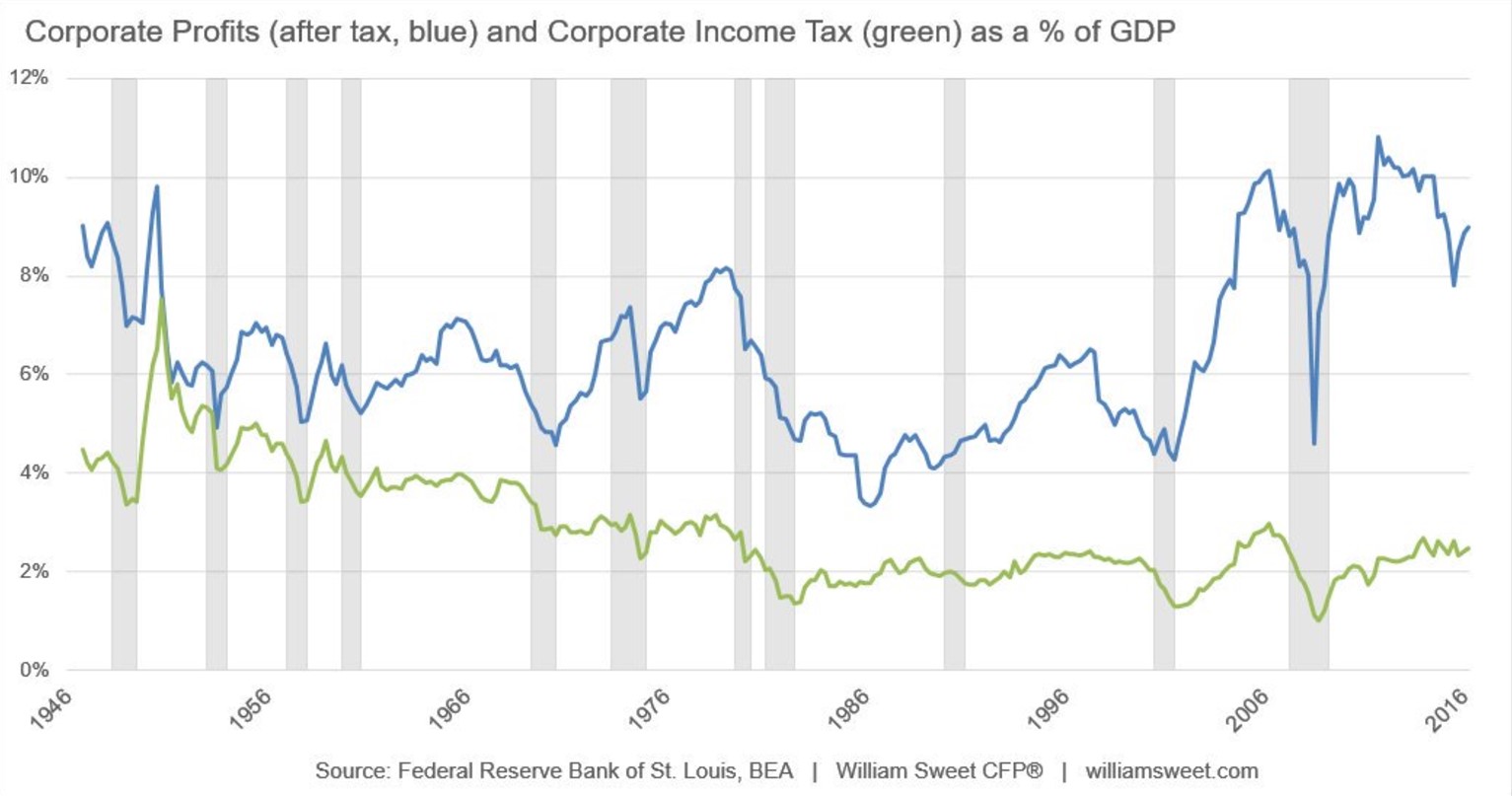

Besides the dubious claim that stock investors suddenly decided to trust a politician when making investments, corporate tax revenue is already low as a percentage of GDP and profits are already high a percentage of GDP, as you can see from the chart below.

As you can see from the green line, most of the time corporate tax collection was lower than now the economy was in a recession. Corporate profits hit the highest rate as a percentage of GDP ever in the middle of this current cycle. Certainly, it is still possible to cut corporate taxes to boost profits as the average effective tax rate was 29% last year. However, it seems like a questionable proposition given how low tax collection is and how high the deficits are now.

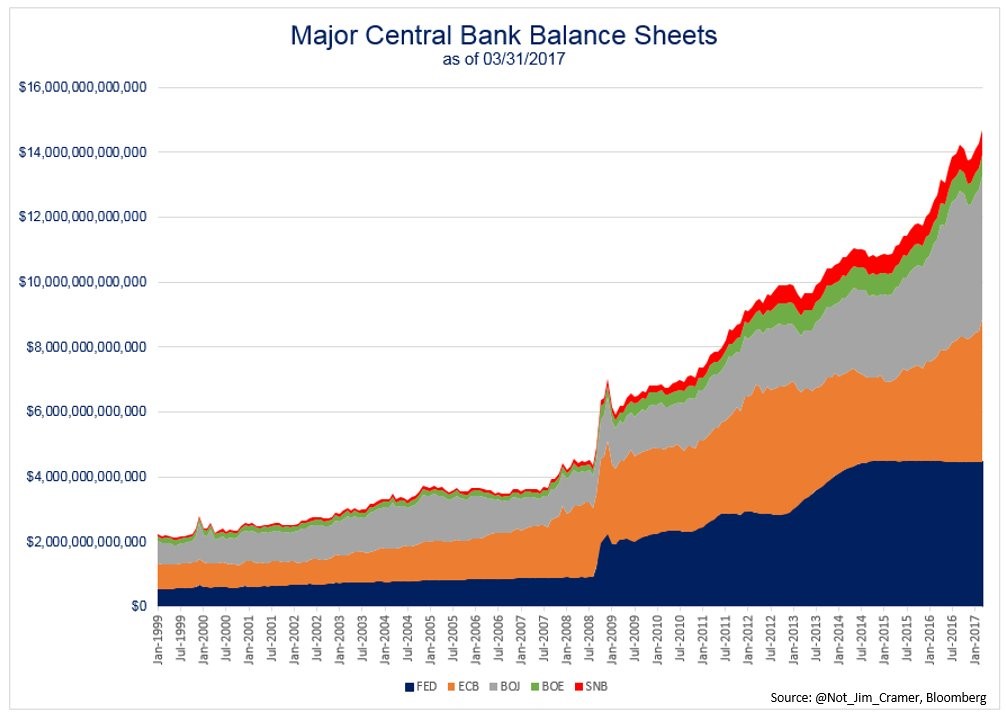

President Trump has only been able to put out a one page document supporting tax cuts, yet stocks haven’t fallen in response. The financials have fallen about 6.5% because disappointment about deregulation, but the stock market is near its all-time high. Stocks have been rallying this entire bull market without improvements to the fundamentals. Trump has only been president for a small part of this rally. What has been consistent throughout this rally has been central bank asset purchases, as you can see from the chart below.

There was a large boost in central banks’ balance sheets in late 2008 just before the bull market started. The expansion hasn’t stopped since then as the collective balance sheet total assets tripled from $4 trillion to $14 trillion.

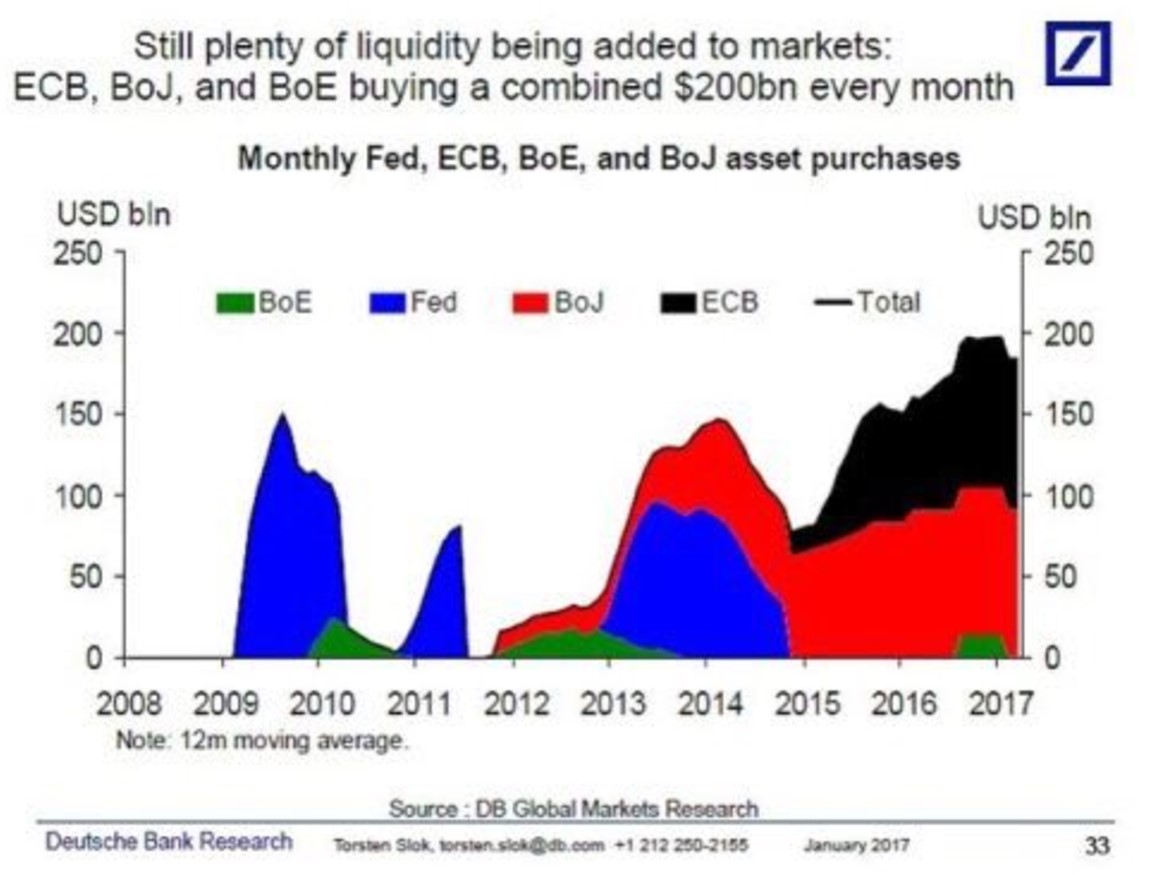

The influx in liquidity boosts stock prices at the behest of real economic growth. The chart below shows the recent influx in purchases made by the central banks on a per month basis.

Total purchases were almost $200 billion per month in the time since Trump was elected. The election was an excuse to justify the bullish narrative, but the real reason is this excess liquidity sloshing around markets searching for returns. At today’s valuations, not much returns will be had by buying stocks, but investors are betting on the ‘greater fool’ theory which is that someone else will purchase their expensive shares in the future at a higher price.

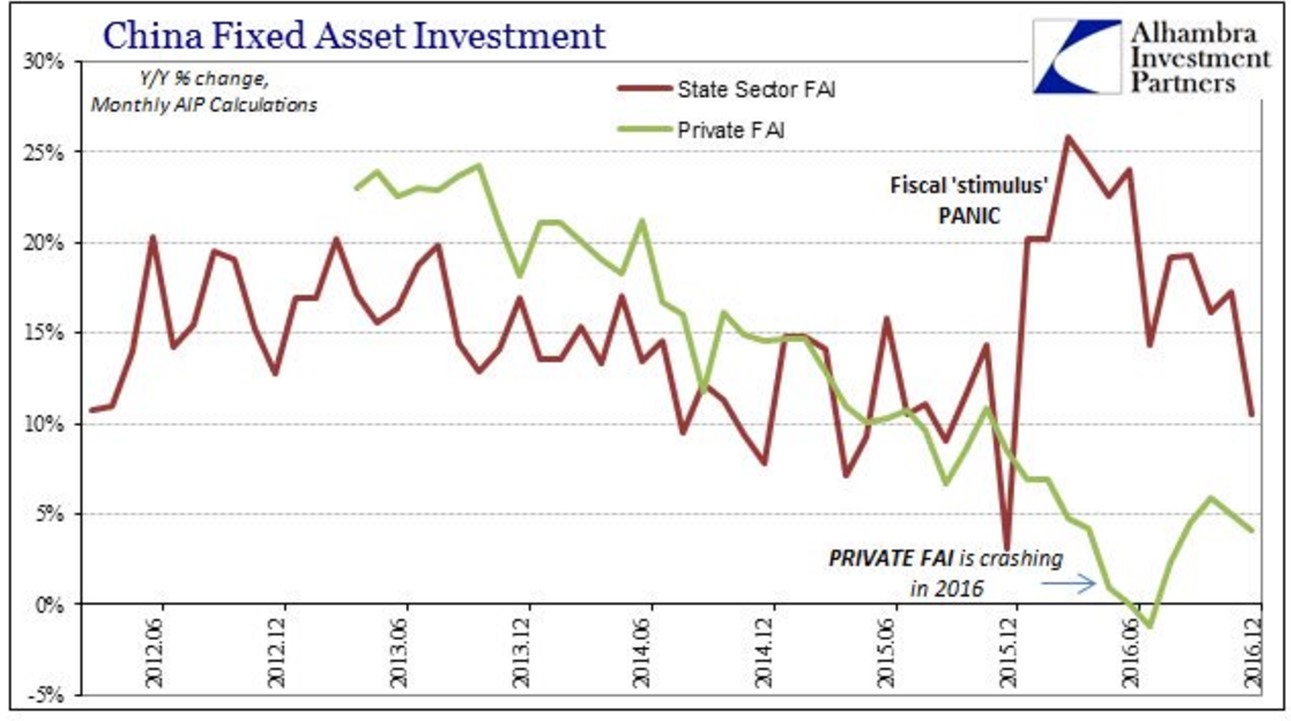

There have been over 200 rate cuts in the past 18 months which has boosted stocks. Also, the Chinese fixed asset investment by the state pushed the economy upward temporarily, but, as you can see from the chart below, private fixed asset investment has been decelerating.

The real economy is floundering, while the temporary fiscal stimulus fails in its attempt to reverse the trend. State spending is always temporary because the state cannot spend at such a high rate while the real economy is weak since that’s where the state gets its money. Deficit spending simply pulls forward future growth. While John Maynard Kaynes wrote “in the future we are all dead”, the excess spending creates bubbles which burst more quickly than governments would like to admit.

It doesn’t take much research to realize that while stocks are rallying, the underlying economy is weak. As you may have read, GDP growth was only 0.7% in Q1. This was caused by 0.3% growth in personal consumption expenditures. Part of the reason personal consumption was weak was because of the 2.5% decline in durable goods expenditures which was driven by decreased spending on motor vehicles. The auto bubble bursting wouldn’t be good for this economy as any catalyst can push it over the edge towards a recession.

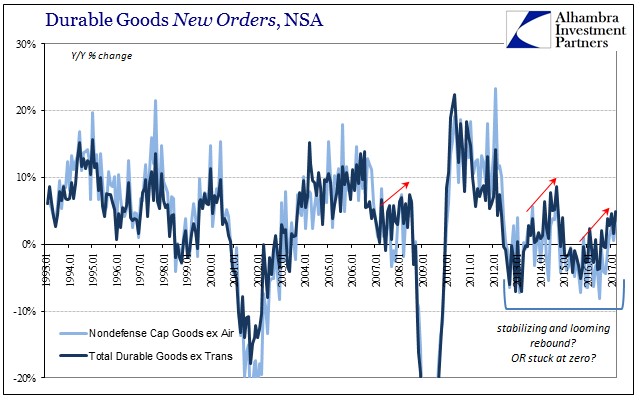

The chart below gives detail about the historical growth rate of new orders for durable goods. These metrics are on a non-seasonally adjusted basis. That means they are the raw reported numbers before economists adjust them to consider seasonality. Seasonally adjusted data aims to smooth the data. It makes it easier to see trends which aren’t caused by normal changes in weather or holidays. The problem with it is that these adjustments are an inexact science, so they may cover up an emerging trend. That’s why it makes sense to look at both seasonally and non-seasonally adjusted reports.

As you can see, non-defense capital goods orders excluding airlines and total durable goods spending excluding transportation have been struggling to grow at the rate seen in previous growth cycles. The current cycle was only able to see quick growth in the early 2010s. That was mainly due to lapping the easy comparisons in 2009 when the effects of the recession were still strong.

Conclusion

Tax cuts and deregulation can boost stocks, but the real reason stocks rallied since the election is the same reason they’ve been rallying for years, namely central bank asset purchases. While some investors bought the narrative that Trump’s election would bring about accelerated growth, we’ve instead witnessed decelerating growth. Stocks hardly missed a beat when the Republicans attempt at healthcare reform called the American Health Care Act failed to even get a vote in the House of Representatives. That’s because stocks are being boosted by central bank liquidity, not potential fiscal policy changes. This article contends that if Hillary Clinton was elected, there would have been a similar rally in stocks. Stocks have rallied after Brexit and Trump which were populist victories. Stocks also rallied when Macron did well in the first round of the French election; that was a victory for the establishment. Central banks have temporarily outlawed political risk.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.