UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The investing landscape has changed in the past 10 years as index funds have burst onto the scene taking market share from active management. This trend in fund flows is important because it changes the characteristics of the market. You need to know your fellow investors. Before ETFs became prevalent, the market was driven by the decisions made by fund managers. The change towards passive investing means there’s more opportunities to be had because buyers aren’t doing the required research on individual names before investing. Therefore, in the past it made sense to find the companies fund managers liked and ride them. Now you can look for diamonds in the rough. Some stocks might be obviously undervalued. A stock can get that way if many investors have given up looking at the fundamentals. If you do the correct research, your odds of making a profit will increase. The key time when investors will realize that your stock is undervalued is earnings season. This makes betting on earnings season easier.

In a previous articles we’ve discussed the merits of passive investing versus active investing. Passive investing changes the market dynamics, so the more popular it gets, the less it makes sense to be a passive investor. There are a few reasons why passive investing has gained prevalence. The first obvious point is that the first ETF didn’t start trading until 1993, so it wasn’t an option before then. Secondly, there are less stocks in the market, meaning it’s tougher to find undiscovered gems. Thirdly, money managers can’t talk to management during quite periods before earnings, so they can’t get an advantage that’s worth their fees, hence why active management has under performed considerably during the past decade. Fourth, there has been much less volatility lately. Managers do better in volatile times because they have experience; they don’t panic. They properly allocate funds to avoid losses. Since the market hasn’t been volatile, it makes active management seem less useful.

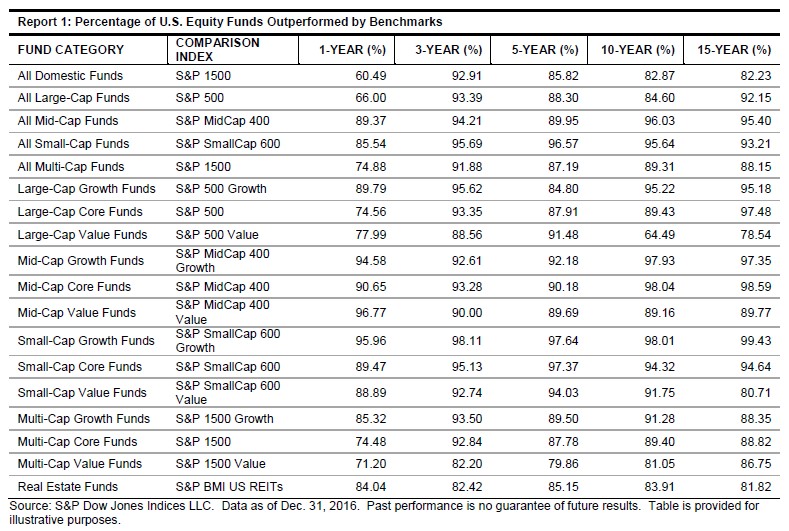

The elephant in the room which we didn’t mention yet is seen in the table below.

It has been reported by the media that active funds usually miss their benchmark. Anyone who looks at this table will immediately want to take their money out of an active fund and put it in an index. It seems like a no-brainer because a 15.43% success rate isn’t something you want to bank on. However, these statistics aren’t accurate. It’s actually tough to compare index funds to active funds. As we have said in previous articles, often lazy analysis rules the day. This table is clear cut which is great for sharing on social media. However, reality isn’t clear cut and nothing simple when it comes to finance. If you aren’t in finance you may not realize this, but it’s a critical lesson. You need to dig deep into the numbers to get a good picture of the world. We know that’s not what people want to hear especially among the crowd of investors who want to put their money in an index fund which requires no research at all. Unfortunately, there’s no free lunch.

There’s two reasons why comparisons between active funds and their indexes aren’t accurate. The first is that many of these funds close. It’s not helpful to look at the average performance of funds compared to their index if a majority of them closed in the time period reviewed. That would make it impossible to be in a situation where you held many of these active funds and lost out on potential gains. In a free market consistently underperforming funds wouldn’t be able to survive, hence the reality is they don’t survive, further increasing the allure of passive investing and creating a positive feedback loop.

According to one 15 year analysis of large cap growth funds, 9% beat their index, 27% lagged, and 64% went belly up. That would mean 25% of the funds that survived, beat their index. As you can see, the data is messy. This would be like if the ETFs tracking the major indexes included the failed companies which were cut from the index for failing to meet the requirements. The great thing about indexes is that stocks are always replaced quickly so there’s usually close to 500 names, getting rid of the losers when their businesses start to deteriorate, thus explaining how indexes are always able to increase over time.

The second reason why the comparison in the table above isn’t great is because many funds have fee structures that doesn’t let them be properly compared to the index. Obviously, you want to include the management fee to see if the fund is worth keeping, but some classes of funds also include compensation advisors receive for their services. To be clear, a financial advisor is separate from a fund manager. Buying a C class fund will include a 1% annual fee which goes to the advisor, therefore making the fund performance look even worse.

Managers are already getting squeezed as the 2 and 20 (2% of assets & 20% of the profits) hedge fund model is dwindling. It makes sense that advisor fees will soon follow. The other possibility would be to include fees paid in fee based advising when index funds are purchased. As you can tell, it’s easy to just look at the index to get returns, but making the extra leap to include the advisor fee gives a more accurate depiction of the situation.

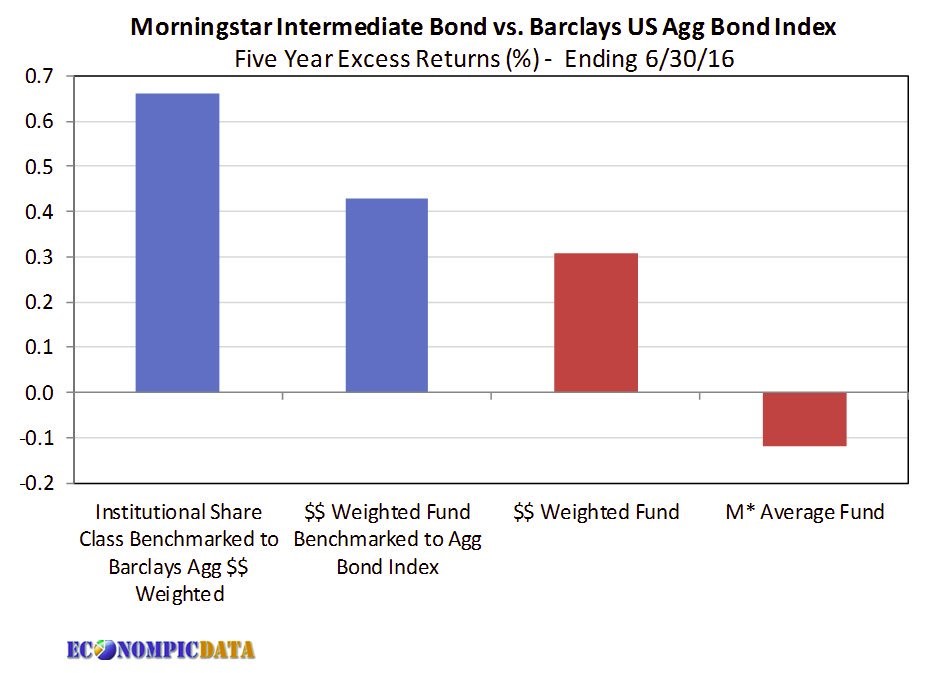

As fees come down, active management may be a great place to put your money, especially when you consider the fact that they don’t underperform as much as the stats indicate. Institutional bond funds, which are actively managed, have good performance relative to the index as evidenced in the chart below. The excess returns over 5 years are above 0.6%.

Conclusion

The goal of this article is to show you that there’s more than meets the eye when it comes to deciding between active and passive investing. This article doesn’t discuss in detail which one to pick, as that is a personal decision and varies depending on which part of the economic cycle we are in. Our previous article titled Perils of Index Investing discusses the cyclical nature of being a passive versus active investor and discusses the likelihood of returns in the upcoming years. Nothing lasts forever. The current cycle’s under performance of active investment will be replaced by an increased likelihood of over performance in the decade to come. However, the key takeaway is to ignore simplistic comparisons of active and index funds, the situation is more nuanced. Index funds aren’t the only investment option out there. Past returns do not dictate future returns.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.