UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Monday March 9th was the anniversary of the start of the 11 year bull market (length of bull run is up for debate). In a true twist of fate, the S&P 500 fell 7.6% and the Russell 2000 fell 9.37%. This put the S&P 500 down about 18.9% from its record high which caused many to say the bull market is over regardless of when it started. In our Twitter poll, 72.1% of 190 voters said the stock market is in a bear market. The 7.6% decline was the 7th largest daily fall since WWII. It appears, despite the relatively stable economy, we are seeing quicker declines. The talks of a possible recession heated up as undoubtedly the economic data will be very bad in March. Goldman Sachs lowered its Q1 GDP growth tracking estimate by 0.2% to just 0.7%.

One issue in this bear run is stocks have blown through their normal stop signs because the solution requires a fiscal response and the government to act appropriately to quell the coronavirus’ spread. The CNN fear and greed index fell to 3/100 which is extreme fear. As you can see from the chart below, the expected Fed funds rate is only 31 basis points. That means when the Fed cuts rates, it will do little to help markets. The cuts are already priced in. The Fed can act quicker than Congress.

The good news is the market can price in a fiscal stimulus weeks/days before it gets passed. The current discussions are about a payroll tax cut, aid to hourly workers who don’t get paid sick leave, and a bailout of industries such as the airlines and the cruise ship firms. New York City is providing no interest loans and grants to small firms who have been hurt by the virus. That being done on a national scale would help. The entire country of Italy is in lockdown as it needed to follow in the footsteps of China. We wondered which approach would work. It appears governments are willing to issue travel bans when nothing else is working.

Some might ask the question, “what would the market be doing if the Fed didn’t cut rates?” We don’t think markets could be acting much worse, but there would be a crisis of confidence as traders would feel the Fed is asleep at the wheel. That shows how much the market relies on the Fed. Now that it is relying on fiscal policy, it has been hung out to dry longer than the Fed ever would allow. As you can see from the chart below, the financial stress index hit the highest level since 2011 in spite of rates expected to be near zero soon. The Fed can’t save the market from a pandemic and a slow to act government.

PE Multiple Is More Reasonable

We pointed out the market’s high PE multiple in articles in February. As you can see from the chart below, it peaked at 19.1. That type of exuberance in valuations justifies a correction on its own.

As we are seeing how serious the coronavirus has become, it’s no surprise stocks have fallen more than the usual 13% correction. As you can see, the PE ratio has fallen to 15.8 which is still 2.2 higher than the December 2018 trough. The market’s PE is lifted by the decline in the energy sector though. Energy firms have low PEs. Therefore, when they have a low share of the market, the overall multiple rises. The market is also helped by the fact that the economy was just exiting a slowdown. That’s why the multiple had gotten so high earlier in the year. We think there needs to be a U.S. fiscal response and a peak in new cases in Italy to avoid the market revisiting the Q4 2018 valuation trough.

One of the most important questions investors are asking is “are stocks cheap or are bonds just expensive?” That’s because the chart below shows the S&P 500’s dividend yield is 1.6% higher than the 10 year yield which is the highest gap since March 2009.

Since the 1970s the 10 year yield has almost always been higher than the S&P 500’s dividend yield. However, before the chart starts, it was more common to see the dividend yield above the 10 year yield. Are yields too low or are stocks cheap? While the long bond is extremely overbought in the near term, recognize that its long term rally is because of demographics and slower growth.

Watch Italy Closely

The coronavirus has come in waves. The first wave was China. The 2nd wave was Italy, South Korea, and Iran. The third wave is America, Germany, France, and Spain (among other European nations). China’s experience is good news for the 2nd wave as you can see from the chart below. Those countries are about to hit a plateau in the number of cases if they follow China’s experience. The shutdown in Italy should help.

The bad news is the 3rd wave of countries is just about to feel the brunt of the crisis. America’s biggest problem is getting enough tests done. South Korea did 189,236 tests as of March 8th. America has only done 1,707 tests. That’s a massive dislocation. The market would rather have some bad news than no news because that creates uncertainty.

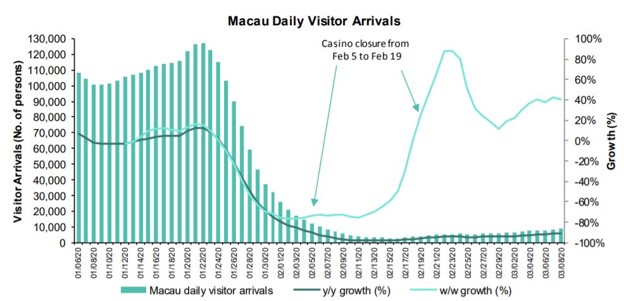

We have mentioned that China is recovering which is why its stock market is improving. However, it’s not close to back to normal. This could be a preview of what Iran, South Korea, and Italy face in April. As you can see from the chart below, the number of Macau (gambling) daily visitor arrivals is about 10% of where it was in January.

If China’s recovery is delayed, it could signal America’s recession risk is greater than many think. America might be dealing with this for a few months and have economic ramifications for almost a year.

Conclusion

The stock market cratered 7.6% in one day which will surely lower consumer confidence. Even though rates and gas prices are down, consumers won’t be eager to spend because of fear. China’s economy still hasn’t recovered even though the number of daily new cases has been falling for a few weeks. The Fed can’t save the economy. It needs a fiscal response. The only good news is stocks are getting cheaper. Even if a fiscal response doesn’t come and a recession awaits, markets will still function and re-price. There will be a place where it makes sense to buy stocks no matter what happens, but that doesn’t mean that place is here.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.