UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

As we learned from Mandelbrot, markets are volatile. If returns were normally distributed, we’d never see corrections like what just occurred in the past week. The stock market has outdone itself as this correction from a record high has been the quickest since 1928. This was the worst weekly decline since 2008. Since 1915, the rolling 5 day returns of the Dow Jones are the 47th worst out of 22,504 periods. You can’t say this is one of the normal 13.4% selloffs that occur about every year. This has been anything but normal.

Because this hasn’t been normal, we caution you when we provide the next stats. The McClellan Oscillator was the 4th most oversold going back to 1998. Of the prior top 10 oversold readings, the S&P 500 gained an average gain of 5.1% in the next month. It rose in every instance except one. Similarly, only 7% of S&P 500 stocks are above their 50 day moving average (only 4 stocks are up this week). That’s in the 2nd percentile using data since December 2001. The table below shows the average gains after this reading is hit. As you can see, in the next year the average gain is 23.7% which is above the average gain of 9.9% in all other data points.

So Much For The Earnings Recovery

2020 was supposed to be a year where earnings recovered and non-GAAP EPS growth accelerated. We had a solid Q4 earnings season as EPS growth was 6.68% for the first 453 firms to report earnings. The situation changed because of the coronavirus. We have previously discussed that Q1 EPS estimates have fallen so sharply that growth will very likely be below that of Q4. As of the 26th, Q1 EPS growth was expected to be -0.14%. As more firms issue updates to their guidance reflecting the coronavirus, we will see an accelerated decline in estimates. Q1 growth might not even be positive.

The stock market rally in 2019 was based on 2020 being a turnaround year for EPS growth and the economy. It looked like that was about to happen, but the situation has changed dramatically. For example, the Bloomberg economic surprise index is at a 2 year high. That’s based on economic data mostly from January which was mostly before the virus was impacting the Chinese economy. The Atlanta Fed Nowcast shows Q1 GDP growth will be 2.7%. That’s only based on data that has come out. The data that is being collected now will likely be much worse.

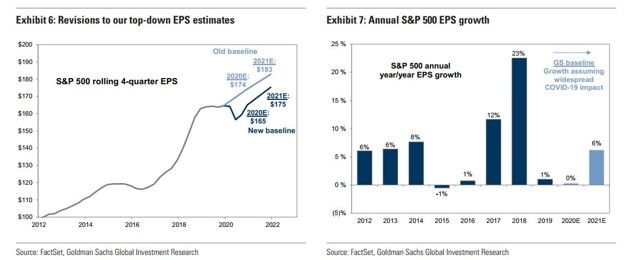

The coronavirus’ impact is reflected in the updated baseline created by Goldman Sachs which is shown in the charts above. Baseline 2020 S&P 500 EPS fell from $174 to $165 because of the coronavirus. 2020 EPS growth is now expected to be 0% which is down from 1% last year. The gains aren’t expected to be made up in 2021 as EPS estimates have fallen $8. That’s only $1 less than the 2020 decline. The important point here is that stocks started the year expensive, but could have rallied very modestly while becoming cheaper if EPS growth was in the high single digits. If the EPS growth that was expected doesn’t occur, stocks need to re-adjust. The 2019 rally needs to be rescinded at least partially.

Even though the coronavirus is transitory, S&P 500 earnings growth is being delayed a year. The market can’t sustain its PE multiple without strong earnings growth. In order for multiples to contract, stocks need to fall because there is no EPS growth to cover it. Therefore, stocks aren’t necessarily getting cheaper if they are selling off on news that lowers their earnings. That being said, that doesn’t mean you shouldn’t buy some stocks on the dip. Many firms won’t be impacted by this virus and a few will be helped by it. If you find firms that won’t have their earnings hit by much, yet have seen their stock down double digits, it might be a good opportunity. The problem, however, is that when volatility clusters, as Mandelbrot said, things might get worse first before they get better.

New 2020 GDP Growth Forecasts

According to Moody’s Analytics, the odds of a global pandemic have risen to 40% from 20%. On February 27th, there were 4,289 new cases outside of China. Just as Chinese activity is starting to show signs of life, the rest of the world is being hit with new cases. Keep in mind, that by the time the economic data fully reflects this new situation, stocks will have already discounted it. Don’t fear a weak GDP growth reading in a couple months. The issue is the current catalyst. With that being said, the table below shows Bank of America’s new 2020 growth forecasts.

Global GDP growth is expected to be 2.8% which would be the worst since 2009. Growth doesn’t need to be negative for there to be a recession. Chinese GDP growth was readjusted by 0.4% to 5.2%. U.S. growth was adjusted down 0.1% to 1.6%. That might be too optimistic.

Hedging Steals Your Gains

Hedging your portfolio sounds good until you realize that even a 10% out of the money hedge in which your portfolio is 95% in the S&P 500 and 5% in the hedge takes away almost all your gains and didn’t even prevent most of the losses in 2008-2009. If you think your exposure is too risky, just sell something. Hedging should be done opportunistically at most.

Conclusion

The stock market’s decline has been record breaking because of how quick it has been. Corrections happen every year, but they almost never happen in 6 days after hitting a record high. Stocks are very oversold, but this isn’t necessarily a great buying opportunity if earnings are impacted. The earnings that we thought we were paying for have partially vanished. It only makes sense to buy stocks that have fallen that won’t be impacted by the virus such as consumer staples, even then you still have downside risk because of the effects of volatility. Estimates for 2020 GDP growth have come down, but they still may have more room to fall. Interestingly, hedging continually is a bad strategy. There is no such thing as a free lunch. You can’t get portfolio insurance and make money, perhaps unless you own treasuries. However, you can just sell some stocks if you think they are risky.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.