UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Even though there was a 2nd spike in COVID-19 cases in July, retail sales growth was strong. The one major weak point was autos and auto parts. Without that, it was great. Real retail sales are now 0.6% above the pre-recession peak. Retail sales bounced back in 5 months which is a record quick recovery. It took over 6 years for real retail sales to recover from the financial crisis decline and it took almost 4 years to recover after the 1990 recession. The enormous fiscal stimulus did it’s job. We also have high retail participation in a rising stock market which helps consumer confidence. In 2009 there were media stories about how retail investors weren’t participating in the rally. People wanted nothing to do with the stock market. This is the opposite. The market is exhibiting late cycle characteristics right after a recession ended (which is unusual).

Monthly headline retail sales grow was 1.2% which missed estimates for 2%. That sounds mediocre, but consider the comp was revised up from 7.5% to 8.4%. It’s impressive monthly growth even was positive. Yearly growth was 2.7%. Autos and parts had weak monthly growth, but strong yearly growth as they were -1.2% and 6.7% respectively. The used car market is on fire as people are driving instead of flying for vacations; they are using personal vehicles instead of public transportation. Lightweight vehicle sales were up from 13.1 to 14.5 million in July which makes the weak retail sales reading perplexing. Maybe it will be revised higher next month.

Without autos, monthly sales growth was 1.9% which beat estimates for 1.5%. The most impressive part was control group sales. Monthly growth went from 6% to 1.5% which beat estimates for 1%. As you can see from the chart above, control group yearly sales growth was 7.9% which was the highest rate since 2000. You don’t usually see growth explode in recessions. This indicates the recession is likely over.

Details Of Retail Sales Report

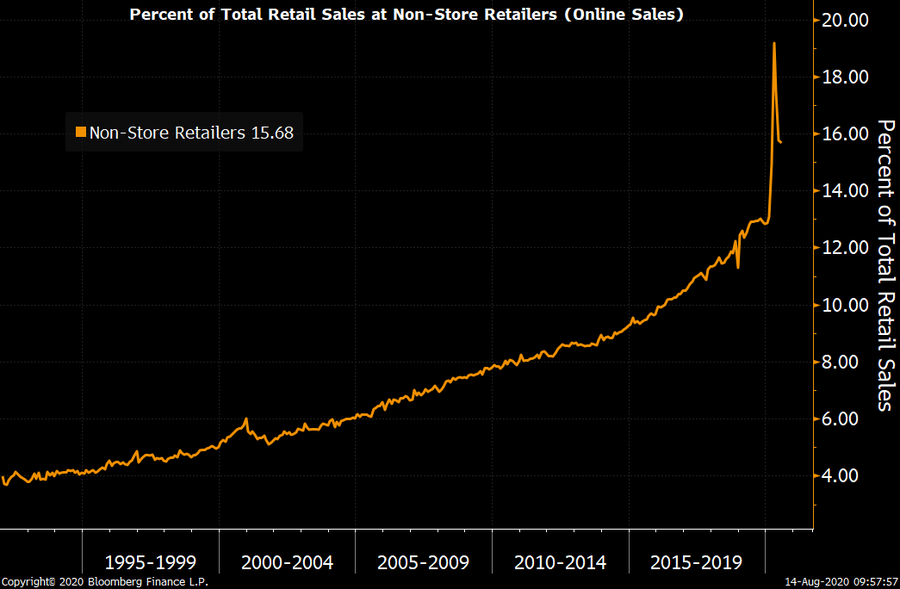

Retail sales are just 1/3rd of personal consumption as this report just measures goods. Essentially, it’s measuring the best part of the economy (outside of housing which is also doing really well). Even though retail sales are 1.7% above the pre-recession peak, the makeup of the sales is dramatically different. The biggest shift has been towards online sales.

As you can see from the chart above, non-store sales were 21.9% above where they were in February. Monthly growth was only 0.7% following -1.4% growth. That’s likely because stores reopened causing some people to go back to shopping how they used to. Even still, yearly growth was 24.7%. As of June, Morgan Stanley projected e-commerce to be 24.5% of retail sales in 2020 and 25.6% in 2021. However, there have been share losses recently as the economy has reopened. Non-store sales as a percent of overall retail sales peaked at about 19.5% in May and has since fallen back to 15.7% as the chart below shows.

Many of the categories that underperformed during the lockdown have reversed course. Clothing sales are still down 19.9% from before the recession, but they are improving. Department store sales are down over 40%, while many discount stores such as Ross Stores, Home Goods, and TJ Maxx are back to normal. Clothing had 5.7% monthly growth following 110% growth in June. Yearly growth improved from -24.6% to -20.9%. On the opposite side, sporting goods and home improvement (building materials and garden) are 17.6% and 8.7% above the pre-recession level, but have fallen back as their monthly declines were 5% and 2.9%.

Secular Or Cyclical Trends?

One of the biggest potential shifts in the market will be determined by how the economy looks once COVID-19 goes away. Of course, there’s always the possibility that we live in a world that isn’t fully back to normal for longer than a few more quarters. For example, if COVID-19 lasts for a few more quarters will we continue to see less people working in offices, limited concerts, and no sporting event attendance? Those betting on the COVID-19 growth areas of the economy like cloud computing and online shopping therefore have two layers to being right. Either COVID-19 has an elongated impact on the economy or when it goes away because of better treatment or a vaccine people won’t fully go back to the way things were before.

For example, if a worker moves to the suburbs because they can now work from home, they aren’t going to want to go back to the office five days per week even if COVID-19 goes away. Similarly, people may have gotten used to the convenience of shopping online for more items. There will likely be puts and takes. Concerts and airplane flights will always exist. The people who like working from home might do so more often. Work depends on efficiency. Once employers have a choice, they will look at the efficiency of each option. For sure, the concept of demanding workers be at the office even if they aren’t efficient or needed will go away.

Clear Euphoria

This is the perfect setup for a euphoric market. For 10 years, investors were told that buying the dip wouldn’t work in a recession. However, the March bear market rewarded the dip buyers. Now there is no fear. People believe if stocks fall, they will rebound quickly. The S&P 500 just had its best 100 day rally ever (50.8%). The Nasdaq had its 3rd best rally ever (59% gain) ; the top 2 rallies ended in January 1999 and March 2000. The problem for the bulls predicting a bubble is we already had a great move. It shows how bad the risk reward is when the bulls’ main argument is to predict a bubble (at least in the momentum tech stocks).

As you can see from the chart above, the 10 day moving average of the put to call ratio is the lowest since 2000. The NAAIM index shows fund managers are leveraged long on average. Retail investors also are all in.

Conclusion

Retail sales had a V shaped recovery because of the fiscal stimulus. Let’s see how retail sales react to the decline in unemployment benefits ($600 per week to $300 per week). The good news is the labor market is rebounding solidly in August. Some of the trends in retail sales have reversed as the economy has reopened. What will the new economy look like? There is clear euphoria in the stock market because it vanquished the March decline so easily. With the economy rebounding and the Fed easy, investors think nothing can stop the momentum tech names.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.