UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The biggest change in investing strategies in this cycle is that investors have moved to index funds in droves. With the power of the internet and the free flow of information, people realized they were getting fleeced by mutual funds who usually missed their benchmark. Investing used to be unfair in the sense that large fund managers would get access to a firm’s top management which would give them an edge when it comes to investing. In the past decade, most fund managers, not having any special privileges, weren’t able to beat the market. This has led to a large change as investors take money out of active management and put it in passive management. Passive management is where investors buy an index without worrying about what stocks they are getting.

Unsurprisingly, investors who are putting money into passive funds aren’t thinking about the consequences of them doing so. They aren’t thinking about the fact that they aren’t performing due diligence on their investments. This matters because index investing has effects, namely that companies don’t have to deal with as much pushback from shareholders when they make errors because shareholders don’t follow the company. This is a moral hazard as it’s less important for firms to execute on their business plan. The next 10 years will not be like the prior 10 years because the makeup of investing has changed. If you decided on your own to switch to passive investing, it would be fine, but when everyone does this, it affects how assets are priced.

The idea that everyone investing in something is a bad idea, is an abstract concept. When you are in the period where everyone is buying that asset, the asset looks like it does well historically. For example, housing had always appreciated when you looked at it 11 years ago. Past returns looked especially great at the top in 2006. Besides looking at valuations, the other way to tell an asset isn’t a great buy is when everyone is doing the same thing. The trend works until the crowd reverses course. The current bull thesis on stocks is they are the only game in town which suggests that stocks are a buy because they are up recently. That’s an incorrect approach. The higher the valuation, the greater investment risk it carries. The lower the valuation, the greater potential return.

As we discussed before, buying index funds is the same thing as everyone buying into the top few stocks. The top 5 holdings of the Nasdaq 100, which is a popular index, are listed below:

The Nasdaq 100 is the highest market cap firms in the Nasdaq out of 3,000 firms. As you can see, Apple has a large weighting, along with the other tech names. It’s a complex valuation process to determine if Apple is a good buy. You must make projections that are difficult such as deciding what technology will look like in 5 years. We might not even buy smartphones by then. This is a very tough call to make. What we know for certain is that investors piling into these companies without doing any of this analysis is a bad idea.

The weighting of the top firms in the S&P 500 isn’t greatly above average. What’s different this time is that investors are putting money into indexes indiscriminately, same as occurred with technology firms in the late 1990s and the nifty fifty in the 1970s. Stock pickers have had a rough time in the past decade, but doing research is better than doing nothing. There have been tests that show that randomly picking stocks can outperform the market, such as when the UK Observer showed a cat beat the S&P 500. A cat can beat the market, but if cats ran the financial system, it would go awry. This is an example of the difference between an experiment and behavioral changes. An analogy to this situation would be if someone came up with a winning investing strategy and shared it with everyone. The strategy wouldn’t work as it would become a self fullfilling prophecy with investors pushing stock valuation in the direction that the strategy advocated.

As was mentioned, valuation is important to pricing stocks. There will be much said about how mistaken index valuations were after this cycle is over, but that won’t help much. To avoid following the crowd off the cliff it’s better to do your research before you reach the edge. Indexes don’t include companies that lose money which distorts the P/E ratios that are reported in most articles. It can be valuable to remove losses because losses can distort the picture. For example, the energy losses in 2016 made earnings look worse. Then energy firms made earnings growth look better in 2017. The best way to value stocks is to look at the index with and without losses to get a good picture of the situation. You must recognize the inherent bias from people who make money by telling you stocks are cheap. Besides bias, indexes remove firms that lose money because their negative P/E, caused by negative earnings, effectively lowers the average if you add it in and divide by the number of firms. Therefore, stocks may be more expensive than they appear.

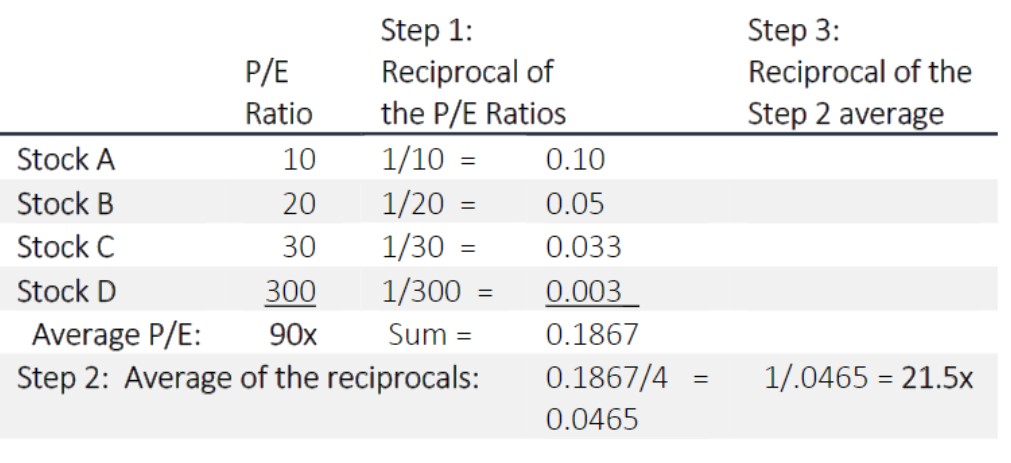

The second issue with indexes is they use a weighted harmonic mean when finding the P/E. This is the reciprocal of the arithmetic mean of the reciprocal of the set of observations. You can see the math of an example situation below. To be clear, a reciprocal is flipping a fraction. 2/5 is the reciprocal of 5/2. 1/10 is the reciprocal of 10 or 10/1. The chart shows the average of the reciprocals, dividing that by the number of firms which gets the average, then finding the reciprocal of that. This may look like hocus pocus, but it does have value when dealing with extreme metrics. The best strategy is to look at both averages, recognizing that the harmonic mean lowers the weight of a firm like Amazon which has a high P/E. It makes sense to lower the weighting of Amazon because one stock shouldn’t have an outsized effect on the index, but it also shouldn’t be ignored. A better approach may be to use standard deviations to change weights, but that formula isn’t utilized.

Conclusion

The goal of this article was to demonstrate that past is not prologue. Trends of the past, namely index investing that is so popular today, will be shunned in the future, making active investing provide greater reward. The goal is to realize this and prepare your portfolio accordingly. Additionally, changes indexes use to normalize valuation metrics are imperfect and do not tell the truth about the economy, therefore believing that economic growth will occur because national index’s are increasing is flawed thinking. You are looking at imperfect information if you look at P/E multiples. While any strategy can work in the short-run, in the long-term the only strategy that works is performing due diligence on all your investments.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.