UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

It’s possible the economy bounces back in August and September due to the decline in COVID-19 cases and the fiscal stimulus. We got early positive news from the household pulse survey. As you can see from the chart below, employment increased 1.9 million. If we start seeing better jobless claims reports and the household pulse survey is strong next week, the monthly BLS reading should be ignored for being weak because it will be old news. The stock market might rise on a weak report next Friday which would cause many to scream the market isn’t pricing in the changes to the economy. The market is usually looking at earnings and the economy. You have to think ahead. We say usually because sometimes in extreme euphoric or pessimistic situations, the market doesn’t properly price in anything.

Even though it’s possible that the July labor report might be old news because there might be an underlying trend of improvement since the survey week, you’re probably curious what the report will show. Based on historical seasonal changes to the household pulse survey, we can say there will be about 2.2 to 4.7 million job losses. The unemployment rate is very likely to increase because there will be job losses and the measuring gap will close. While the stock market might ignore this report, it will be politically important. If there isn’t a stimulus passed by then, there will be added pressure since the data will be weak. Timing is very important since the stimulus will likely pass in early August. The most important part being debated is how much added federal unemployment support there will be and for how long.

Weak Dollar Impact

One of the aspects causing the weak dollar is COVID-19’s relatively high impact on America this summer compared to Europe. The dollar has fallen the most in relation to the euro. On Thursday, the euro rose to $1.18 versus the dollar which is the highest since June 2018. The dollar index is down about 4% in the past month. Let’s not get too excited about this movement as there has been virtually no change in the dollar index in the past 3 years. There is much more historic action in gold than the dollar.

As you can see from the chart above, the media & entertainment and software & services industries have the highest correlation with the dollar which means their stocks fall when the dollar falls. On the other hand, materials, real estate, and energy are helped the most by a weak dollar since commodity prices rise when the dollar falls all else being equal. The market will price these industries based on how sustainable it thinks the trend is. As we mentioned in a previous article, when oil prices went negative for a day, energy stocks didn’t react. Because many are predicting rates to stay low forever, they are willing to pay higher multiples.

Expectations Imputed In The 10 Year Yield

On Wednesday, the Fed didn’t hike or cut rates and gave similar guidance to its last meeting. The Fed has more tools in its chest and the market believes it. However, given the current environment, there’s no need to change the messaging and policy. The key lever is additional fiscal stimulus. The Fed is much more worried about deflation than inflation which is fair because inflation hasn’t been a problem for over a decade and we have an 11.1% unemployment rate. The Fed’s fear of deflation is justified.

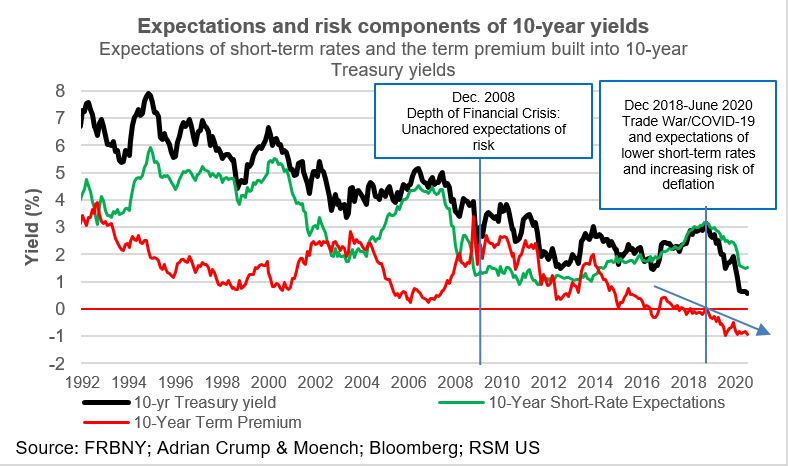

The chart below shows the term premium and short rate expectations imputed by the current 10 year treasury yield. The term premium is driven by investors’ expected level of the risk free rate and their compensation for holding it. The term premium is negative as investors believe rates will say low for years (some even say forever).

You can argue that with all this stimulus and the Fed completely abandoning its concern of inflation that there is risk inflation surprises to the upside. We aren’t saying there will be a spike in inflation like the 1970s, but there could be a cyclical spike in inflation and rates if the economy recovers from this blip of weakness in July. When everyone is leaning in one direction, it doesn’t take much to change prices. This is like how minor weakness in a tech firm’s earnings report can cause its stock to fall because most people are already long it.

What Investors Need To Look For

The chart below shows what investors need to seek and what they need to avoid. The problem with value traps is they are cheap, but the reason they are cheap is sustainable. In other words, investors are pricing in a long term change/disruption to the business. One of the most important tasks investors need to do is to determine which changes are long term and which are short term. COVID-19 is a great example as investors grapple with whether the movement towards technology is sustainable or if it will revert when the virus is gone. Nothing is certain.

Many retail investors are gambling. Rational risk averse investors might get frustrated when gamblers win. Just because it’s unlikely and tough for gamblers to win, doesn’t mean it can’t happen. Sometimes, the person investing determines if it’s a gamble. If a person has expert knowledge on a field, their trade is less of a gamble than it is for most people.

Investors seek optionality and resilience. Optionality means there is more than one way to win. Resilience means the business model has a moat. Resilience means even in unfavorable circumstances, the business will be fine. If a company does well in all economies, you don’t need to predict where the economy is headed to invest in it.

Conclusion

Let’s wait until next week’s household pulse survey before we say the labor market is back to improving. This report goes along with our expectation for an improvement. It’s ahead of schedule. There had barely been a decline in COVID-19 cases by July 21st. Imagine how much the labor market will improve once COVID-19 cases really fall. A weak dollar is bad for software stocks. That could help change their trend which has been overdone to the upside. Investors expect rates to stay low forever. The best investments have optionality and resilience. Avoid gambling and value traps.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.