UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

As usual, there are a couple reasons the headline growth rate in new durable goods orders shouldn’t be taken at face value. That’s good because growth dramatically missed even the lowest estimates. Specifically, headline monthly new orders growth was -2% which missed the consensus of 1.5% and the lowest estimate which was 0.9%. Even the headline revision was bad as October’s growth rate was revised down from 0.6% to 0.2%. The October revision was hurt by the extension of the GM strike.

The most obvious impact that doesn’t reflect cyclical changes to the economy was the 72.7% decline in defense aircraft parts orders. Excluding defense goods, orders were up 0.8% monthly. Aircraft orders are usually volatile. Defense orders also aren’t cyclical because they depend on federal government policy.

Defense orders fell 35.6% in November. There has also been some weakness in non-defense aircraft orders as they fell 1.8% following an 8.8% rise. This is partially behind the 1.8% decline in non-defense capital goods orders. There could be an increase in aircraft orders next year if the issues related to Boeing’s 737 Max are resolved.

Excluding transportation, monthly durable goods orders growth was 0% which missed estimates for 0.2% growth. October’s growth was revised down from 0.6% to 0.3%. The chart above shows transportation orders are cyclical. It’s one of the biggest drivers of the cycle. The chart shows weakness continued because it is a 1 year moving average. Core durable goods orders were up 0.1% monthly which beat estimates for 0%. October’s monthly growth was revised lower by 0.1% to 1.1%.

Yearly headline orders growth fell from -1.2% to -3.7%. which was still above the cycle low of -5.8% in September even with the huge crash in aircraft defense orders. Yearly non-defense capital goods orders growth excluding aircrafts improved from -0.8% to 0.5%. That’s the highest growth rate since June. The comp actually got harder as it increased from 4.1% to 6.1%. Therefore, the 2 year growth stack went from 3.3% to 6.6%. That makes this report look good despite the noise.

Weak Capex Intentions

Durable goods orders are important because they help us determine the health of business investment. The weakness in business investment in the past 2 quarters and likely in Q4 has been/probably will be masked by the solid consumer. It’s still worth following business investment because the consumer can have a hiccup.

As you can see from the chart below, the 6 month change in core durable shipments has been weakening.

In the durable goods report we just discussed, headline shipments were up 0.1% monthly, but non-defense ex-aircraft shipments fell 0.3%. The chart above uses the December manufacturing regional Fed capex indexes to project core durable shipments. The capex metric (using the first 4 reports) improved slightly. On the other hand, all 5 regional Fed indexes fell sequentially in December which is why their average is projecting the first under 50 ISM PMI of this mini cycle. Obviously, we already know the ISM PMI has been below 50 for the past 4 months. However, it hasn’t had the full support from Markit and the regional Fed reports. It now has the support of the latter. The one positive, is the projected 49 PMI (using the first 4 reports) is still above November’s reading of 48.1.

Update On ECRI Leading Index & GDP Trackers

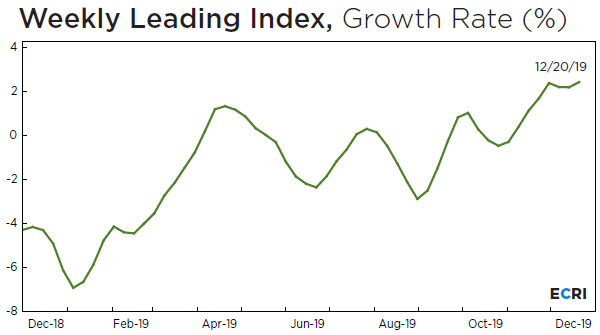

The ECRI weekly leading index increased 0.7 to 147.7 which is still below the record high of 152.7 in early February 2018. The stock market is showing similar levels of euphoria to January 2018, yet the leading index isn’t as high. Yes, the leading index includes the stock market. On the positive side, the chart below shows the yearly growth rate increased 0.2% to 2.4%. On the negative side, the index is about to start facing much tougher comps as it troughed in the last week of December 2018.

There is less reason to fear quarter over quarter seasonally adjusted Q4 GDP growth even though 2H 2019 might be the trough of this slowdown. The median estimate is 1.9%. The Atlanta Fed GDP Nowcast shows growth will be 2.3%. On December 23rd, the estimate for real gross private domestic investment growth rose from -0.9% to -0.1%. The St. Louis Fed Nowcast sees 2.14% growth. It’s not as bullish as it usually is. On the negative side, the Friday update to the NY Fed Nowcast showed its Q4 growth estimate fell 0.13% to 1.19%. The durable goods report hurt growth by 10 basis points. Orders don’t directly impact GDP, but the headline reading impacts the Nowcast because orders help project production; defense and aircraft production count. We exclude defense and aircraft orders to get a better picture of the cyclical economy, but they matter to GDP. Finally, the Q1 GDP Nowcast also fell 13 basis points to 1.51%.

Jobless Claims Fall Again

Jobless claims fell again in the week of December 21st as they are approaching normal levels after the spike related to the timing of Thanksgiving. They fell 13,000 to 222,000. The 4 week average rose 2,250 to 228,000 because a very low reading left the average. The 4 week average will increase again next week and then fall in the following week because of base effects. The chart below shows the disconnect between job creation and jobless claims in recent years which occurred potentially because states made it harder to file for unemployment insurance and lowered benefits.

Conclusion

Headline durable goods orders growth was weak, but much of that weakness was because of defense. The 2 year growth stack in non-defense capital goods orders excluding aircrafts actually doubled. The capex indexes in the regional Fed reports have increased even though the headline indexes have all fallen. The ECRI leading index is showing solid growth, but that might change as comps get tougher. The Nowcasts estimate Q4 GDP growth to be between 1.19% and 2.3%. Jobless claims fell again as the labor market is in fine shape. The spike a few weeks ago was seasonal.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.