UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Fed didn’t hike rates at its June meeting nor did it change its planned asset purchases. This was expected, yet the stock market fell modestly and treasury yields rose decently (and then reversed on Thursday). Some commentators used those reactions to claim the Fed changed its policy even though there was no hike or end to QE announced. Since hikes will occur after QE ends, the first hike will probably be in 2023 at the earliest. The shift in the dot plot caused the modest chaos in markets. 7 FOMC members are calling for a hike in 2022 which is up from 4. 13 members are calling for a hike in 2023 which is up from 7.

The chart above shows the median expected Fed funds rate at year end through 2023. Of course, many of these members won’t be around to hikes rates in 2023. Powell is more dovish than this. Therefore, during his presser, he tried to discount the prospects of hikes. This is something he will need to work on in 1-2 years when we reach the point when members want a hike. The good news is he will have the data on his side next year. Inflation will be lower than this year. On the other hand, the unemployment rate will also be lower.

Increase In Uncertainty

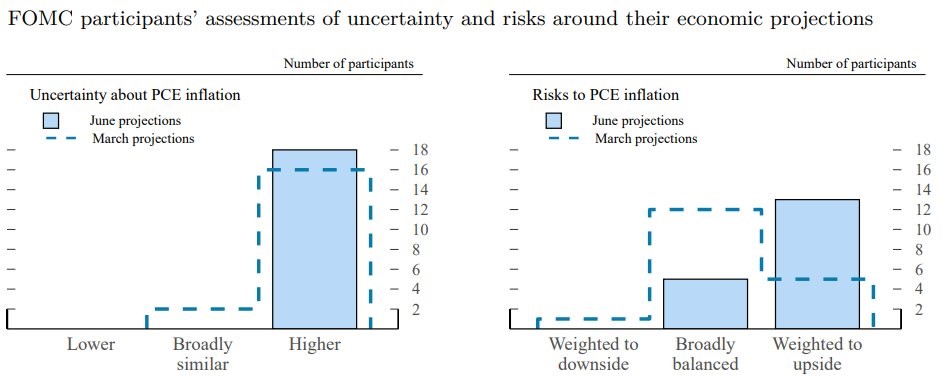

The chart on the left shows the inflation uncertainty dispersion among FOMC members increased in June compared to March. This is odd because the pandemic is more under control now than it was in March. The economy should be more predictable now. Inflation has spiked, but that should have been expected.

A few FOMC members might be overreacting to near term data. There is some outside pressure to hike rates even though this inflation is transitory. The Fed didn’t hike rates, but the dot plot forecasted more hikes which is reactionary. Remember, guidance is policy. Official Fed guidance didn’t change, but members have altered their views. As you can see, two more members said PCE inflation was more uncertain. It shouldn’t be more uncertain since the current spike in inflation was highly predictable.

The chart on the right shows the risks to PCE inflation shifted to the upside according to many FOMC members. They are following the data instead of making projections. Typically, the Fed is said to be data dependent, but in the last cycle we saw a couple examples of the Fed calling bouts of inflation transitory. This bout is larger, but it’s also even more obviously temporary. There have been very easy comps and the reopening can only happen once (in America). This is a modest overreaction, but it’s not as if the Fed changed its guidance or actually made a policy change. We’re still a decent way off from potential hikes. By then, inflation will be lower.

Talking About Talking About

Guidance is the first derivative of policy. Apparently, that’s not enough for the Fed. They decided to dig deeper. Now discussing guidance changes counts as policy. That’s the 2nd derivative of policy. The Fed is painting itself into a corner by getting so fine. It should probably back away from being this specific about guidance.

At his presser, Powell said, “But you can think of this meeting that we had as the talking about talking about meeting, if you like. And I now suggest that we retire that term, which has served its purpose well, I think.” The Fed discussed when it would change guidance on QE. We have known for weeks that the Fed would probably give tapering guidance at its Jackson Hole event late this summer. It will guide for tapering to start sometime in the first half of 2022. QE will end by the end of the year.

It’s a little weird that the most discussed topic was the dots because the Fed didn’t change QE guidance and tapering comes first. Thank goodness there are no dot plots on QE. Maybe we will see that in a few years. The Fed has been trending towards transparency in the past decade.

The New Forecasts

The Fed got more optimistic about growth this year. It changed its 2021 real GDP growth forecast from 6.5% to 7%. 2023 GDP growth estimates rose 2 tenths to 2.4% for an unknown reason. What happened in the past 3 months that impacted 2023? We don’t know. The unemployment rate projections almost didn’t change at all.

The expectation for 2021 PCE inflation jumped up 1 point to 3.4%. Other estimates barely changed which suggests some FOMC members changed their 2022 and 2023 rate projections based on inflation changes in 2021. That doesn’t make sense. Core PCE inflation estimates for 2021 jumped 8 tenths to 3%. Once again, other years barely budged which makes it odd that some members called for more hikes in 2022 and 2023.

As we mentioned earlier in the article, the Fed’s median estimate for 2023 rates rose to 0.6%. That’s still very low, but it matters because it’s the start of a hike cycle. There will undoubtedly be more hikes afterwards. If the previous trend continues, the Fed funds rate peak will be lower in the next cycle than the past one. It’s possible the Fed only hikes a few times. That makes each hike even more important. Maybe the Fed will start hiking by eighths in the future.

Conclusion

The Fed’s guidance didn’t change, but the market reacted to the dot plot on Wednesday (bonds reversed on Thursday). This dot plot might be a misnomer because many FOMC members reacted to near term inflation expectations. Once 2021 is over, inflation will normalize. It will look very silly to hike rates in 2023 because inflation was high in mid-2021. FOMC members might become more dovish once this inflation spike ends. It’s not a great idea to lean hawkishly at all because growth and inflation are peaking. FOMC members like to react to the data, but sometimes predictions are needed. Supply chain issues will go away. The supply for commodities that saw huge price spikes will increase which will lower their prices.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.