UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The long term trend has been towards online shopping, but brick and mortar stores are still prevalent for many types of goods and services. It might be a great time to invest in brick and mortar stores because competition has fallen. Plus, multiples are lower because the business isn’t sexy. Before the internet, general stores had monopolies on local goods and services. Now stores need to bring people in with some sort of entertainment, unique products, or low prices. The experience is much better for consumers. Online retail is very tough because people can easily switch to a new website. Amazon’s secret weapons are having a two sided marketplace and Prime subscriptions.

Last year was a disaster for all physical stores except groceries. Some wondered if internet sales would take permanent share from brick and mortar. Some wrote off brick and mortar stores too soon when the pandemic wasn’t over yet. Now that it is nearly over in America, the data tells us what the post-pandemic economy will look like.

As you can see from the chart above, in the past few weeks, not only does brick and mortar retail spending out of the home have a much higher share than in 2020, it has a slightly higher share than in 2019. Consumers are rushing back to their favorite stores now that they don’t need to wear masks. The winners in this space can be highly profitable for years to come.

Inflation Peak

Inflation may have peaked, but don’t expect companies to downplay it in their Q2 quarterly conference calls. Firms love nothing more than to give excuses for anything they can. Negative macro headwinds are blamed for weakness, while the strength of the business gets the credit when results are strong. Obviously, higher input prices are a problem for margins, but that will be mitigated in the 2nd half of 2021. The 2nd half can be good because price increases might stick while input costs fall.

As you can see from the chart above, 84% consumer staples firms have mentioned inflation on their Q1 calls so far. They spend money on energy and food which have been experiencing inflation. 41% of energy firms mentioned inflation. They have higher input costs, but higher inflation is a net benefit since it usually means higher oil prices. It’s ironic that only 18% of tech firms mentioned it because these stocks usually do the worst with higher inflation. Despite them not being capital intensive, their stocks fall because the discount rate used to value stocks rises. If you think rates are headed lower, it’s a good idea to buy growth tech stocks.

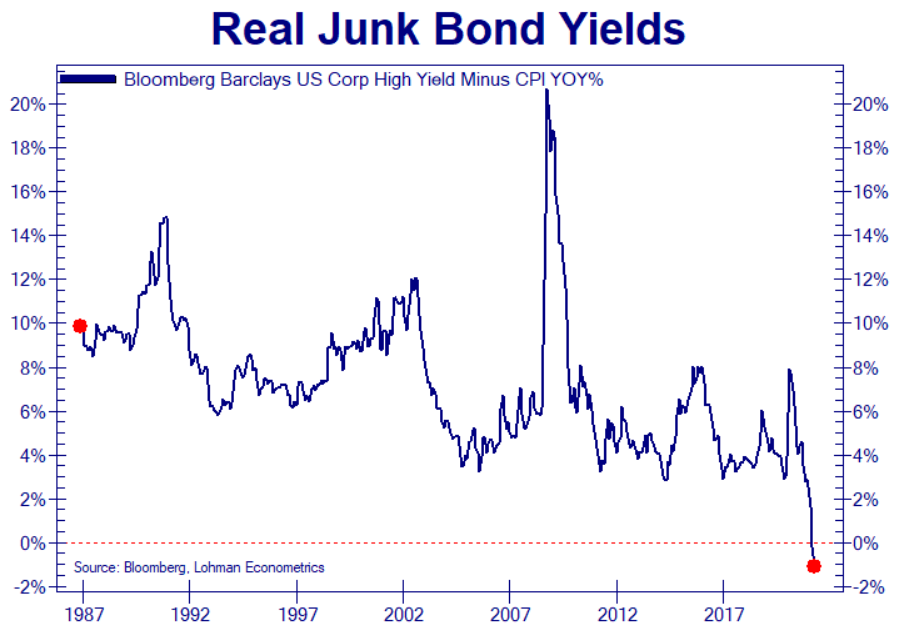

Why Is Real Junk Negative?

As you can see from the chart below, real high yield debt is negative for the first time ever. Many new investors must be wondering what is going on. It’s not that exciting. In fact, it’s boring. There was a temporary spike in CPI due to base effects and the economic reopening. This situation was combined with near record low rates and very tight spreads. Rates are low because of low population growth. Spreads are tight because of the easy Fed policy and the lack of expected risks in the economy.

The Fed quickly limited the damage in March 2020 when spreads expanded due to the heightened risk environment. When the financial conditions index indicates stress, spreads widen because it’s tougher for highly indebted firms to raise capital. Now, corporations are in fine shape because they were allowed to raise a lot of debt and equity last year. In fact, many now have extra cash. This is leading to higher dividends, share buybacks, and capex. With rates so low and spreads so tight, high leverage is encouraged by investors. However, higher leverage means higher risk. You don’t want to ignore leverage risk because financial conditions can worsen before you realize you must sell.

Is Everything Backwards?

As you can see from the table below, in every decade from the 1950s to 1980s plus the 2000s, the cheapest 30% of stocks outperformed the most expensive 30% of stocks. Only in the 1990s and the 2010s have the most expensive stocks outperformed. Including all data, the cheapest ones have outperformed by 5.2%.

Keep in mind that the highest multiple doesn’t mean a stock is necessarily expensive. It just means a lot of growth is priced in. However, if high growth materializes, then that stock with a high multiple can do well. Lately, the low multiple stocks are banks and energy, while the high multiple stocks are in healthcare and technology. If you want to bet on valuations, you should adjust for sector weighting.

Be careful to avoid quick explanations that rely heavily on recent data. Some claim you shouldn’t be able to make money just by buying low multiple stocks. Conversely, value investors will say that you shouldn’t just be able to make money buying firms with high sales growth. Both criticisms are accurate. You can’t just make money by looking at the pe ratio or the sales growth rate. It takes more due diligence.

Great value stocks can do well when growth is winning. Great growth stocks can do well when value is winning. If you own the best stocks, then you can do well in either regime. Regimes are overhyped because they have a large near term impact. However, both individual company research and macro outlooks must be combined to have a successful process.

Conclusion

Brick and mortar retail actually took share in May. Inflation is peaking, but don’t underestimate companies’ ability to highlight this negative as an excuse for weak margins. Real junk yields are negative. This is temporary because CPI will fall. However, spreads might stay tight and rates should stay low. Lately, the most expensive stocks have been doing well. A good portfolio incorporates growth and value stocks. Your weighting towards each style factor and sector depends on your circle of competence and what opportunities are available. It’s great when you are bullish on a certain factor and there are a lot of opportunities in the space (relatively cheap stocks).

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.