UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

As part of its monetary policy, the Swiss National Bank owns $100 billion in U.S. stocks. A central bank buying stocks is a slippery slope because the unintended consequences are unknown. Having a small bid under U.S. shares doesn’t concern any bulls though. If they were to buy more shares and then suddenly sell them all at once creating a decline, it would cause an uproar. Some say the SNB would never sell their shares. That could be false very soon.

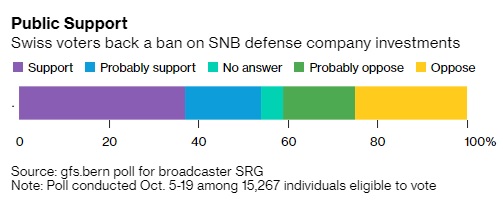

There will be a national vote on November 29th over whether the SNB needs to sell its shares in defense firms. This could cause them to selloff. The proposal to force the SNB to sell shares in firms that derive more than 5% of their sales from arms is supported by 54% of Swiss citizens and opposed by just over 40%. The SNB will need to sell its shares in 300 firms which together are worth 11% of its portfolio of global stocks.

This is another slippery slope because morality might not stop there. It’s possible the voters are asked to decide on an ESG ranking for the central bank’s positions in the future. It’s almost like they are passive shareholders in an index that takes out the stocks which aren’t deemed moral. Normally, many investors would say to try to maximize profits, but in this case, it’s the central bank owning the shares. There doesn’t seem like much downside for voters to support selling defense stocks. We don’t know when the sales will occur, but we do know when the vote happens, it should impact prices immediately. It will be a widely covered story.

Capital Gains Taxes To Increase

As you can see from the chart below, the top income bracket could have a long term capital gains tax rate of 39.6% if Biden wins; it is 23.8% now. To be clear, if Biden wins the presidency and the Dems narrowly win the Senate, it’s not a lock the rate will increase that much or at all. The first few months of his presidency will focus on the COVID-19 crisis. Besides timing, the other aspect is the potential for a compromise. The rate could rise to a lower number (depending on the Senate election). If the Dems barely win the Senate, they will have little room when trying to make broad sweeping changes.

There has been a mixed bag for stock returns before and after capital gains rate hikes because each event happened with other scenarios in play. Having only a few data points means we don’t know how this will affect stocks. However, there will surely be an issue for stocks if the corporate tax rate is increased along with capital gains taxes. The market seems to have one thing on its mind right now: the potential for a $2 trillion or greater fiscal stimulus. That’s fair because the stimulus will come first. There has been analysis on how stocks do depending on the tax rate they pay, but a lot of returns can be chalked up to interest rates. Growth stocks like lower rates (low real economic growth) and value stocks like higher rates (real economic growth).

Cyclical Upturn

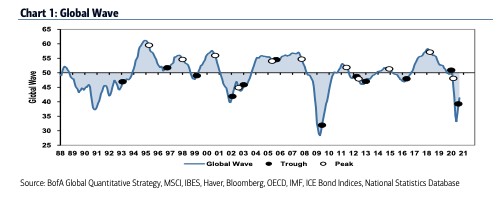

Bank of America is signaling that we could be in the early stages of a cyclical upturn that lasts years. The chart below shows the cycles dating back to 1988. This is on the global economy, so the U.S. stimulus only plays a medium sized role. Supporting this thesis, we got a 20 month high in the U.S. October flash Markit PMI. According to Bank of America, after troughs, the all country world equity index rises 30% in the next 3 years with about an 80% win rate. Returns average 15% in the next year; 9 of 10 occurrences had at least 10% gains. This global wave reading is based on industrial confidence, consumer confidence, capacity to utilization, unemployment, producer prices, credit spreads, and the earnings revision ratio. All of these global components have risen, so the index is unabashedly bullish.

High Frequency Data

We just looked at broad global intermediate term trending data. Now let’s look at U.S. high frequency results which are impacted by the rise in COVID-19 cases to a new record in October. As you can see, the Apple driving mobility index has fallen from September, but it’s still higher than June. It’s lower than July which was the peak of the 2nd wave. Small business confidence is up just like the NFIB survey showed. Hotel occupancy is up, but it’s still only at half which is a disaster. The truck load index is very strong.

Retail gas demand growth weakened throughout October. The spike in COVID-19 cases has been in rural areas where people drive more. If those people stop driving, it will hurt demand. It appears they have. Airport traveler volume is improving as we mentioned in a previous article. Restaurant dining growth appears to have stopped improving which is no surprise because the colder weather makes it tougher to dine outside. The spike in COVID-19 cases means fewer places will have indoor dining. Some will have partial capacity.

Retail Sales Growth By Category

Bank of America card spending growth shows the cities with higher growth in COVID-19 cases haven’t seen worse spending growth. In fact, Detroit had the highest growth (9%). That’s a Midwestern city in the thick of the outbreak.

The data below which shows card spending growth by category should be a surprise to no one. Airlines, lodging, and entertainment are struggling, while online electronics, home improvement, online retail, and furniture are on fire. One has to wonder how much people can spend on durable goods for the home. Surely, when someone buys an item like a refrigerator, they don’t buy another one in a few months even in a pandemic.

Conclusion

The SNB is likely going to sell its defense stocks which could move those stocks after the vote in the end of November. The capital gains tax could be going up for upper income people. We think the hike in corporate taxes will impact stocks more than that. The global economy is in a cyclical upswing in spite of the spike in COVID-19 cases. The high frequency economic data isn’t as bad as you’d expect. There actually is high retail card spending growth in a few midwestern cities even though they are dealing with the worst of the virus. The usual suspects are seeing spending growth and declines. It seems unlikely that durable goods spending on the home will be strong after the economy reopens. Even if it doesn’t reopen, who needs to buy another refrigerator a few months after getting a new one?

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.