UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Housing price growth has been high in the past few quarters which makes some think it’s a bubble. When surveys show buying conditions are bad, this confirms people’s priors about an impending crash. However, sentiment is weak because supply is so low that inventory doesn’t stay on the market long enough to get people comfortable when they buy. Once supply comes down and prices increase at a lower rate, buying conditions will be better. There is zero catalyst for a crash. We have another metric that differentiates this market from the 2000s.

As you can see from the chart above, the percentage who think housing is a good investment and that prices won’t come down is low. This means they think prices will come down unlike in 2006. Of course, they were exactly wrong in 2006. Housing was a terrible investment and prices did come down in the crisis. Waiting to buy a house (to live in) probably isn’t a great idea unless you’re just waiting for housing supply to return to normal, giving you time to make a decision. Housing obviously isn’t as great of an investment as it was last year, but it’s not a bad one either. As usual, it comes down to location and the price you pay.

More Container Ships Are Coming

The supply chain issues are temporary. They will be gone by the end of the year. This is about basic economics. If shipping rates are high for an elongated period, more ships will be bought. That’s what’s happening. As you can see from the chart below, there have been 208 new orders for container ships this year which is almost as high as 2018 (the highest reading in 6 years). Of course, 2021 is only half way over which means this will be a historic year. It wouldn’t be a surprise if this leads to a glut once pent up demand goes away and normal spending habits return.

Inflation Isn’t That Exciting

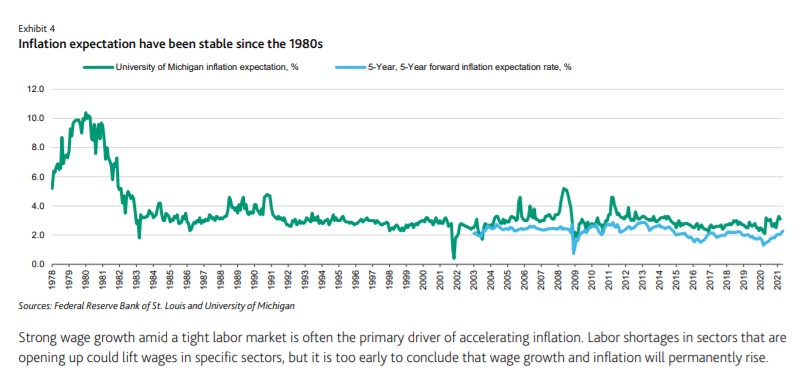

The Fed isn’t suppressing the 10 year yield by buying bonds. The last few times QE programs ended, the 10 year yield fell. This round of QE won’t be done for another 18 months. It will be interesting to see if that sends the 10 year yield lower again. The 10 year yield is low because the long term trend in population growth is downward. We have stable inflation expectations as the chart below shows. That means equity valuations will stay high. The recent inflation readings are blip on the long term charts. No one will care about or remember the May 2021 CPI report in 2022. Quite frankly, the market didn’t even care on the day it came out.

There Isn’t Euphoria

Some investors turn negative when they see record highs. There certainly have been a lot of them. This has been the 8th straight month with a record high in the S&P 500. However, record highs aren’t bearish. They don’t mean much. The signals we look at are mixed. There is obviously a bubble in about 10-15 popular retail names, but they don’t matter when you are studying the overall market.

The NAAIM fund manager positioning index is at 79.65 which is elevated, but not crazy. The index has been above 100 7 times since late October. The AAII investor sentiment survey shows there are a lot of neutral investors which isn’t too scary. In the week of June 9th, 39.1% of individual investors were neutral which is above the long term average of 31.5%. That’s the highest since January 2020. Stocks crashed 2 months later, but that was because of the pandemic, not enthusiastic sentiment.

There are 2.2% more bulls than average and 9.8% fewer bears. That’s modestly bad for stocks because the number of bearish investors is typically a more reliable indicator. The CNN fear and greed index is at 54 out of 100 which is neutral. As you can see from the chart above, the 10 day average of the put to call ratio is at the lowest reading since at least 2007. This is the most bearish sentiment reading.

Retail Mania Will End In Tears

The scariest part of this retail mania is the propensity for them to gamble on weekly options. When these retail stocks explode, they often rise to the highest option strike price. We have never in history seen this many retail investors. We also have never in history seen derivatives trading being this popular.

After this mania ends, there will be new options restrictions for retail investors. Too bad regulations don’t get ahead of issues. Unfortunately, these regulations might be too harsh. Legislators will get emotional when they hear about retail investors losing their entire life savings gambling on derivatives. We have a double negative of intense losses and more restrictions coming for individual investors.

Bigger Sweet Spot?

Investors love the chart below because it shows there potentially is a bigger sweet spot for massive outperformance. Critics of stock picking who favor passive investing say it’s impossible to pick the few mega winners which provide compound annual returns of over 25%. This chart shows there is an increasing number of companies with an elevated return on invested capital. This might be due to the rise of software firms.

Critics of this chart say it doesn’t adjust for intangibles. Either way, it’s impossible to calculate the odds of a stock providing great future returns because we don’t know how all stocks will do. The best bet is to firstly, understand the macro environment, and do deep research on companies with reasonable valuations for that macro environment that have the potential to grow sales and increase operating leverage. It’s not an easy task!

Conclusion

The housing market is heated. Price growth will cool without a crash. There has been a spike in ship orders which will end the supply chain issues within a few months. Inflation will stay low and won’t be volatile following the post-pandemic spike. There isn’t evidence of euphoria in stocks other than a few retail favorites. This doesn’t mean stocks are immune from a correction. There is always the risk of a correction. That’s why investors get paid a return above CDs. There may have been a bigger sweet spot of stocks that delivered a high return on invested capital, but there are no guarantees that this will continue.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.