UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Fed’s Beige Book said the economy grew at a “slight to modest” pace. That’s ironic because expectations are for very high GDP growth in Q3, but that’s only because of an easy comp. The Atlanta Fed Nowcast predicts 35.3% Q3 growth. The Fed is likely cautious in its assessment of the economy because any positive comments can be viewed as hawkish. The last thing the Fed wants is for markets to think it is taking its foot off the gas pedal. The Fed is going full speed ahead with zero rates. It doesn’t plan on hiking rates in the next few years. However, we really have no idea what 2021 holds.

Generally, downside surprises like COVID-19 are more likely to cause cuts than upside surprises are to cause hikes. That being said, we never had the economy going from partially shut down to fully opened. Yields would spike and demand for services would increase substantially assuming there is an all clear sign. Of course, it’s possible the re-opening is gradual because some people are still nervous or that it takes time to get people vaccinated.

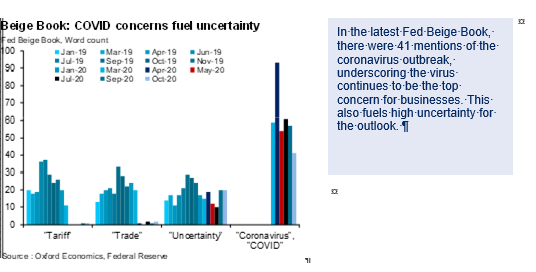

The October Beige Book activity index created by Oxford Economics rose from 0.89 to 1.11 after hitting a record low of -2 in March. The index isn’t back to where it was before the pandemic, but it’s close. That sounds more optimistic than how the economy is actually doing. As you can see from the chart above, the virus was mentioned much fewer times in October than in September even though cases are increasing in the Midwest. This doesn’t imply that the Fed is taking COVID-19 lightly, it just shows how word counts aren’t everything.

The Fed doesn’t mention tariffs anymore because that’s not the focus. Stimulus talks are acting like a carrot and stick bait for the stock market just like trade talks were. In 2018, we would see talks boosting stocks without a grand deal ever happening. However, in this case we will get a stimulus. It just isn’t happening before the election. There is a political calculus being made where either one or both sides think it’s better for their election chances if nothing gets done.

Restaurants Are Being Killed

Obviously, the biggest tragedy is a loss of life, not a loss of a business, but we focus on economics here, so we look at the impact of the crisis from that lens. This is about to be a very tough period of time for the restaurant industry as economic restrictions are increasing and there are no vaccines or treatments that will reopen the country in time to prevent the losses businesses face.

As you can see from the chart below, 15,770 restaurants have been shuttered since March 1st. There are 10,390 temporary closures. The longer this crisis lasts, the more likely these will become permanent. The weather has gotten colder and indoor dining is getting tougher. That’s a recipe for disaster. Millions will be spent on heating people eating outside, but it’s a tough sell. It’s not comfortable to eat in 40 to 50 degree weather.

Everything Rests On Yields

You can put your head in the sand by reading about individual companies, but in the intermediate term macro guides the market. Fighting macro is like swimming against the tide. If rates stay low and you stay long value and short growth, you will be crushed. Conversely, growth investors will be crushed and value investors will win if rates rise. Money losing companies can’t survive in a world where you actually get interest on bonds and there is real economic growth. The chart below shows the duration trade in action.

It’s recency bias to think that rates will stay low forever just because they have been low and the Fed promises to keep the Fed funds rate near zero for the next few years. That’s a major mistake because the long bond can still selloff. The Fed doesn’t control the long bond yet. Some traders think the Fed will do yield curve control. However, imagine a scenario where the economy reopens and rates rise. The Fed might not want to control the curve then as the economy would be improving. Just like the macro picture changed quickly in March, it can change again next year. Don’t rest your thinking based on narratives. Consider all possibilities and keep in mind that narratives can often have linear thinking as the underpinning thesis, whereas the economy functions in terms of changing probabilities.

Very Expensive Software Valuations

Low yields combined with people working from home and ordering goods online due to COVID-19 have caused the software stocks to do really well. As you can see from the chart below, the SaaS EV to sales to growth rate is 2.6 times the historical average.

Don’t fall into the trap that this is the new normal. These are the same companies everyone had a small allocation to in prior years. With the increase in demand comes higher competition. If the economy were to reopen, rates would rise and software sales growth would slow. Luckily for software investors this period of increased demand and low rates has stayed in place long enough for them to generate amazing returns. These are the types of returns that allow people to become rich in a few months. Speculators are chasing that dream.

Conclusion

The Fed’s Beige Book stated the economy is barely growing which sounds harsh compared to the coming great Q3 GDP growth reading, but it is fair considering the spike in COVID-19 cases and the lack of a stimulus. The Fed is actually pleading Congress to pass a stimulus with its statements. That hasn’t been working. Restaurants are facing a miserable next few months as the weather gets colder and COVID-19 cases ramp up. The entire market is a duration trade. SaaS stocks are 2.6 times more expensive than the historical average. As everyone is betting on software and tech, they are actually betting against the real economy improving, thus making them implicitly bearish on the economy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.