UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

In the week of January 31st, the MBA applications composite index increased 5% weekly after increasing 7.2%. The purchase index fell 10% after rising 5%. On a yearly basis, growth was higher as it was 11%. In the past 3 weeks, average yearly growth has been 12%. The housing market looks to be continuing where it left off last year. The refinance index was up 15% weekly after increasing 5%. Low rates are motivating people to refinance again. In the week of February 6th, the average 30 year fixed mortgage rate fell to 3.45% which is just 14 basis points above the record low in November 2012.

As you can see from the chart above, the difference between the current mortgage rate and the effective rate on debt outstanding (with a 1 quarter lag) implies refinancing will increase. That’s exactly what’s happening according to the MBA report we just reviewed. As homeowners refinance, they gain extra spending power which improves their confidence. As you can see from the Gallup poll below, only 10% of Americans mentioned economic issues as the most important problem facing America which is the lowest ever (since 2001).

Services PMI Improves

The Markit services PMI increased just as the ISM non-manufacturing PMI did. The final January Markit services PMI was 53.4 which was up 0.6 from December and 0.2 from the flash report. This was a 10 month high as you can see from the chart below. This improvement pushed the composite PMI up from 52.7 to 53.3. The Chief Business Economist at Markit commented on the economy’s momentum by saying, “Growth has gained some momentum from the lows seen in the fall as the service sector enjoys stronger growth and manufacturing has also shown signs of the trade-led downturn easing.”

Within the service sector, new business growth was moderate as it was the same as last month. Demand has increased since November because firms are adding new customers. New business from abroad fell for the 5th time in 6 months. The employment index rose to the highest level since last July, but the workforce still only barely increased. Backlog growth hit a 6 month high as it was above its historical average.

1 year expectations were subdued again unlike what was shown in the manufacturing report even though the manufacturing PMI was lower. Firms are seeing demand increase because of higher spending on marketing, but they don’t know if it will last. The prices index increased for the 4th straight month and was the highest since July. That’s despite the Bloomberg Commodities total return index falling 8.1% this year. Inflation came from wages and supplier costs. The price index was still below the historic average and where it was in 2019. Output inflation was low as even though costs increased, only some of the pricing pressures were pushed to customers. Essentially, margins fell as firms tried to stay competitive.

Job Cuts Spike In January

Job cut announcements spiked in January similar to last winter. They increased from 32,843 to 67,735 which was the most since last February. Monthly growth was 106% and yearly growth was 27.8%. Remember, this report is volatile, so one month of weakness doesn’t make a trend. As you can see from the chart below, the 6 month average yearly change is negative.

Tech caused the sequential increase as its cut announcements rose from 719 to 13,869. Don’t worry about the percentage increase because it’s not worth comparing it to a low month. Last year tech also had a lot of job cut announcements which isn’t good because the information industry pays high wages. Last year tech cuts increased from 14,320 to 64,166.

In the whole economy, 22,424 of the cut announcements were for restructuring, 18,943 were for closing, and 5,407 had no reason provided. Retail had the 2nd most cut announcements as there were 10,444. 2,631 of the 3,852 cut announcements due to bankruptcy were in retail. 6,924 of the retail cuts were because of store closings. Industrial goods manufacturing firms had 6,098 cuts. Challenger highlighted the manufacturing recession which is curious because many recent soft data reports show manufacturing is rebounding.

There were 23,229 hiring announcements in January which fell from 26,313 last month and 74,040 last year. This was the lowest number since November and the lowest in a January since 2016. There was a spike in job cut announcements and a dip in hiring announcements. Luckily, this report is volatile which means this could be a one-off.

No New Low In Initial Claims

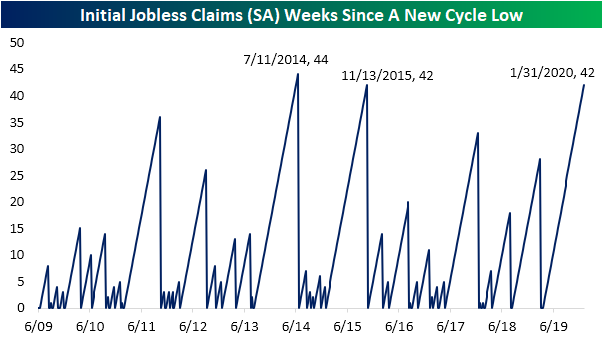

The jobless claims report showed strength in the labor market similar to the ADP report, but not like the Challenger one. There were 202,000 initial claims in the week of February 1st which was down 15,000 from the prior week. The 4 week average fell 3,000 to 211,750. There hasn’t been a new cycle low in initial claims in 42 weeks. The longest streak in this expansion without a new low was 44 weeks which ended in 2014.

The good news is claims are the 3rd lowest of the cycle. They are 9,000 above the cycle low. While it’s tempting to believe a recession is coming because there hasn’t been a cycle low in almost a year, don’t try to be a penny wise and a pound foolish. This means you shouldn’t act as if initial claims are warning of a recession when they are close to their record low as a percentage of the population. This is an example of a signal that likely has a good track record, but needs to be contextualized.

Conclusion

Consumers aren’t worried about the economy because the labor market is sound as jobless claims are low. They are helped by low rates; when a household refinances, it gets extra discretionary spending power each month. The services PMI hit a 10 month high just as the manufacturing sector is also showing signs of ending its recession. The Challenger jobs cuts report is out of sync with most economic data, but we won’t throw it under the rug. It’s worth highlighting the intermediate term average because it’s a volatile report. That shows there’s nothing to worry about.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.