UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

If the average recession causes stocks to fall 26%, then the current correction (as of June 4th) in stocks forecasts an 18.8% chance of a recession. We get that number by dividing the current losses by 26%. One issue with this simple calculation is it doesn’t account for valuations. If stocks are very cheap, then they might not fall 26% from their peak in a recession. If stocks are very expensive, like in the late 1990s, stocks can fall more than 26% even in a small recession. The 2001 recession was short lived and shallow, but the market fell over 50%.

One great thing about this calculation is it uses 26% as the base case decline. This reminds investors who listen to doom and gloomers that stocks don’t need to fall 50% in a recession. Not every recession is as bad as 2008 and not every market starts as expensive as the one in the late 1990s was. The best part of this calculation is it puts every correction in terms of how likely a recession will be. That’s important because often times new investors get skittish about news events that don’t affect earnings or the economy. Every correction prices in a moderate chance of a recession. Corrections occur during economic slowdowns because when economic data is weakening, the odds of a recession increase.

Pessimism Grips Wall Street

Usually, pessimism is good for the bulls and optimism is good for the bears. As you can see from the NDR sentiment poll, when most investors were pessimistic in late 2018 it was a buying opportunity.

When investors were optimistic in early 2018, it was good a time to sell stocks. However, keep in mind that when economic data is weak and catalyzes a correction, pessimism is naturally going to happen. It’s part of the process as investors get bearish because of the weak data and traders follow the momentum.

You can only start slamming the buy button and holding stocks for the intermediate term if you think the slowdown is over. An 18.8% chance of a recession isn’t that high; the JP Morgan model is above 40%. By buying stocks, you think, even though there has been weak economic data, there’s less than an 18.8% chance of a recession. To be clear, it’s not wrong to suggest the slowdown will end shortly; it’s just bold.

Negative Yields Popular

Depending on who you ask, the inversion in the short maturity part of the treasury curve is either calling for a recession or just saying the Fed will cut rates soon. The 2 year yield being at 1.88% screams that rate cuts are coming. The 10 year yield being at 2.12% suggests economic growth will slow. The good news is the 10 year yield is 24 basis points higher than the 2 year yield, which suggests there won’t be a recession soon.

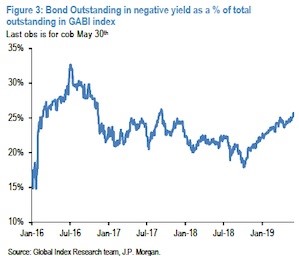

There has been a global decline in interest rates which has pulled US treasury yields lower. The U.S. economy is more globalized than ever. It is being hurt by the cyclical downturn in the global economy after it avoided such an impact last year because it was helped by the fiscal stimulus. As you can see from the chart below, the percentage of global bonds outstanding with a negative yield has increased to above 25%.

The percentage of negative yielding bonds outstanding peaked at around 32% in the summer of 2016 which is also when the U.S. 10 year bond yield troughed.

Manufacturing Matters

Some investors wonder why we pay any attention to the manufacturing sector since it is a relatively small part of the economy. We follow it because it is highly cyclical. It can lead the economy lower or it can be a false alarm. The chart below shows even though manufacturing’s employment share has fallen in America, its production share is second to China. Less than 5% of jobs are in manufacturing, but about 20% of production share is in this sector.

Weak Manufacturing ISM

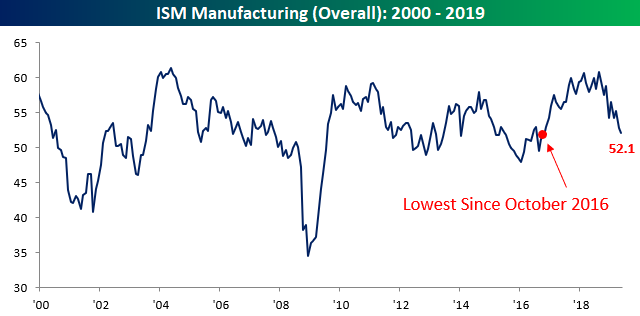

This brings us to the weak May manufacturing ISM PMI report. The PMI fell from 52.8 to 52.1 which missed estimates for 53. As you can see from the chart below, this is the weakest PMI since October 2016 which was the beginning of the recovery from the last manufacturing recession.

The good news is the new orders index was up 1 point to 52.7 and the employment index was up 1.3 points to 53.7. The bad news is the production index fell 1 point to 51.3 and the backlog of orders index fell 6.7 points to 47.2.

This PMI is consistent with 2.7% GDP growth. That’s highly unlikely as estimates are for 1.7% growth. Even with this report showing a big decline from last year, it still expects high growth. That shows how optimistic it was in 2018. Tariffs are a big issue for manufacturing companies as a chemical products firm stated, “The threat of additional tariffs has forced a change in our supply chain strategy; we are shifting business from China to Mexico, which will not increase the number of U.S. jobs.” That business could be impacted by the trade war with Mexico.

Bullard Signals Cut

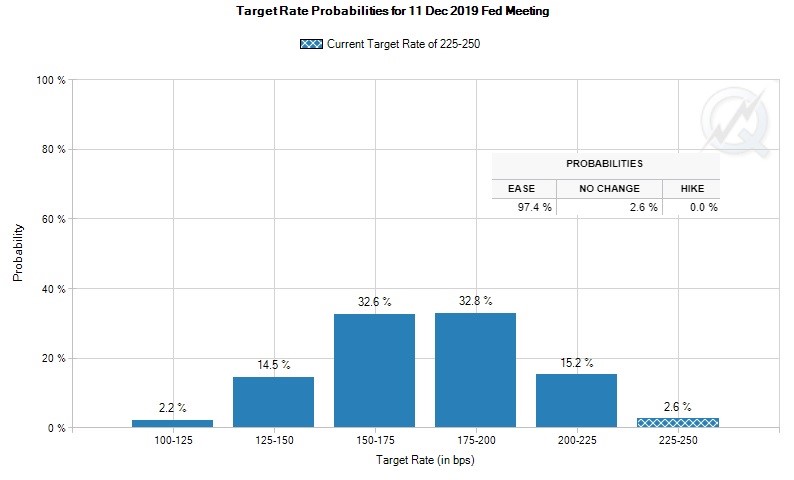

The Fed is way behind the treasury market and the Fed funds futures market as it took until Monday for St. Louis Fed President James Bullard to state, “A downward policy rate adjustment may be warranted soon to help re-center inflation and inflation expectations at target and also to provide some insurance in case of a sharper-than-expected slowdown.” This dovish tone is obvious to those who follow the Fed fund futures market as the chart below shows the market is already pricing in 2 cuts this year.

The futures market expects a 24.2% chance of a hike on June 19th. To be fair to Bullard, the Fed has a better track record than the Fed funds futures market at predicting long run rates. However, the data is on the side of those expecting cuts as the ISM PMI hit a 31 month low.

Conclusion

The stock market predicts there is an 18.8% chance of a recession. The bond market is calling for rate cuts, but the yield curve is far from completely inverted. Stock market investors are getting pessimistic which doesn’t necessarily mean you should buy stocks if you have a 1 year time horizon. The percentage of bonds with negative yields is increasing. The ISM PMI was weak even though its consistent with 2.7% GDP growth. Bullard was dovish. The Fed funds futures market is already predicting a 2nd cut this year even though the Fed hasn’t guided for one yet.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.