UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

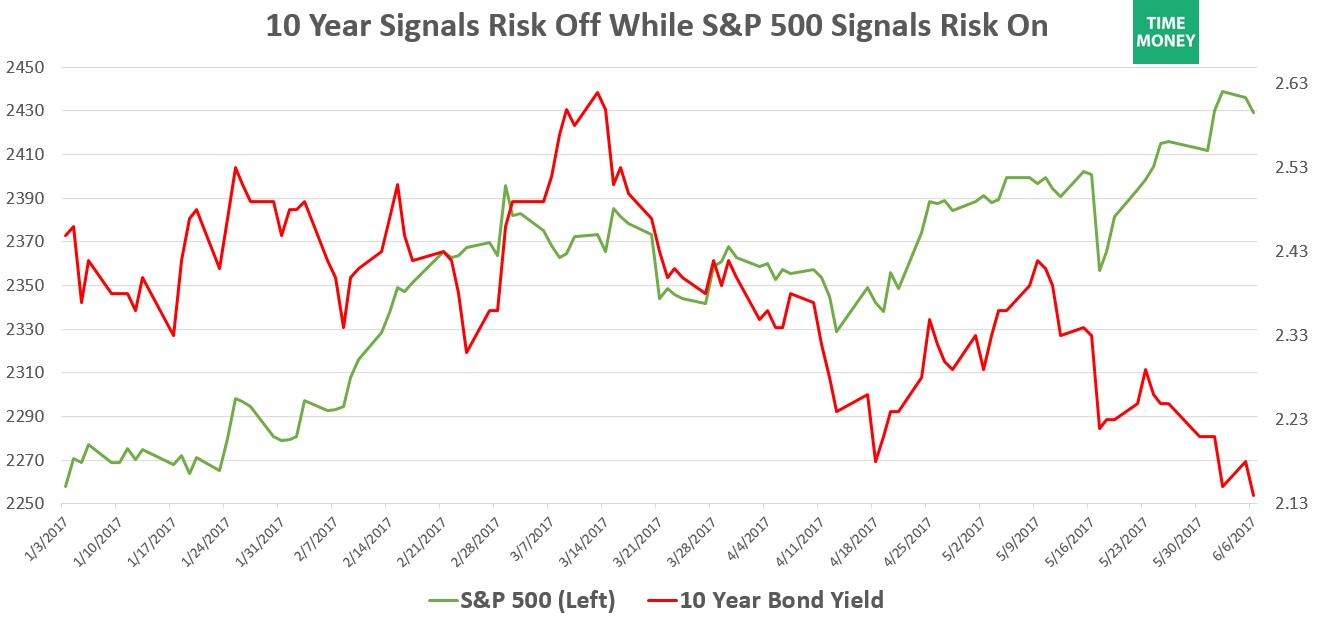

The biggest debate among traders and investors is whether the 10-year bond or the S&P 500 is telling the truth about the economy – both can’t be right. As you can see from the chart below, the S&P 500 has rallied this year while the 10-year bond yield has fallen.

Remember, when yields fall, investors are buying that debt security. Investors are buying both long-term bonds and stocks. Stocks are considered to be risky bets while treasury bonds are perceived as the safest bet you can make, meaning they are telling different tales about the economy. Saying treasuries are safe assumes the system is stable. If the U.S. debt got out of control and the Fed had to print currency outright to pay the debt, inflation would increase and treasuries would crater. While that scenario is more likely than some economists would have you believe, it’s still an unlikely event in the next few years.

International Earnings Skyrocket

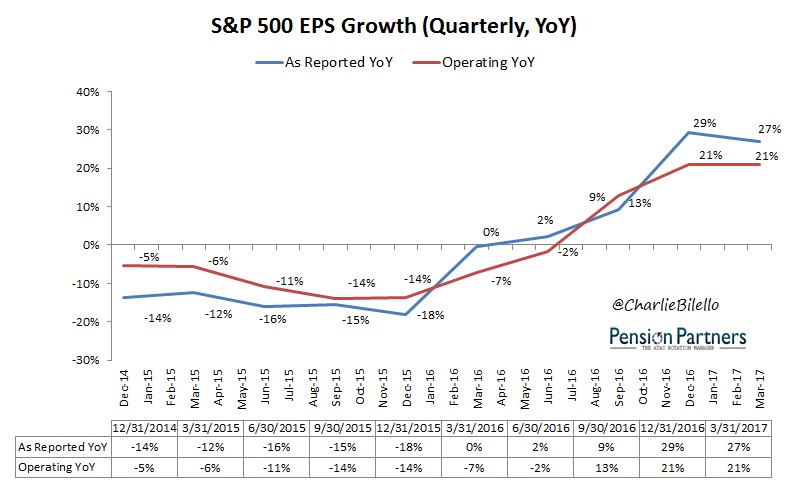

The question of which market to trust can be answered if you look at why each market is moving the way it is. The S&P 500 is moving higher because the bottom up earnings growth was fantastic in Q1. As you can see from the chart below, the “as reported earnings” grew 27% year over year. To be fair, it was lapping a weak number as Q1 2016 earnings were flat and Q1 2015 earnings were down 12%. This isn’t the only reason why stocks are outperforming. Stocks didn’t fall nearly as much in 2015 as earnings fell. Stocks had 2 corrections of over 10% during the earnings recession of 2015, but they ended up flat by the end of that soft period. Stocks generally have a bias to the upside because interest rates are low.

Looking at the cause of these great earnings reports, it’s important to understand that it’s possible that earnings can do well without the economy improving greatly. Proof of that is Q1’s results. GDP grew 1.2% in Q1 which is below the long-term average projected growth rate of 1.9%, while the S&P 500’s earnings beat their average growth rate of 7%. In theory, profit growth is limited by the growth of the economy, but in the short term, results vary. Another key point is that earnings growth is dependent on the global economy, not American GDP. International growth has made an outsized impact on profit growth in Q1.

As you can see from the chart below, the firms with over 50% of their sales coming from outside America had 21.3% profit growth, while firms with less than 50% of their sales coming internationally only had 10.6% profit growth in Q1. The takeaway from this information is that the stock market isn’t necessarily signaling that the U.S. economy is doing well. At times, the S&P 500 is only tangentially related to the economy. Another point is the domestically focused Russell 2000 small cap index has under performed the S&P 500. The Russell 2000 is up 2.78% year to date which shows the stock market isn’t as euphoric on the U.S. economy as it looks on face value.

Bonds Rally On Fed Plan To Stop Buying Them

Just like the stock market is being affected by an outside force which isn’t related to the economy, the 10-year bond is also being effected by an outside force which is the Federal Reserve. Normally, the Fed only controls the short maturity bond market, but with quantitative easing, which is the Fed buying long maturity treasuries and mortgage debt, the Fed also tries to manipulate the long-term maturity market.

The chart below is of the 10-year bond yield. The darkened rectangles are areas where the Fed has implemented its QE programs.

Even though the Fed is buying bonds during QE, yields have risen, meaning more investors sold bonds than bought them during those periods. If yields rise when the Fed does QE, then they would fall when the Fed unwinds the program. That logic is playing out this year as the Fed has put out guidance for an unwind of the balance sheet and yields have fallen. The reason investors are doing this might be because they want to take advantage of Fed policies. Think of it like the cash for clunkers program. Say the government announced it would buy all the old cars on the open market. The people would respond by offering more cars for sale than ever. It overwhelms the number of cars the government is buying and pushes the price of used cars lower.

Takeaway

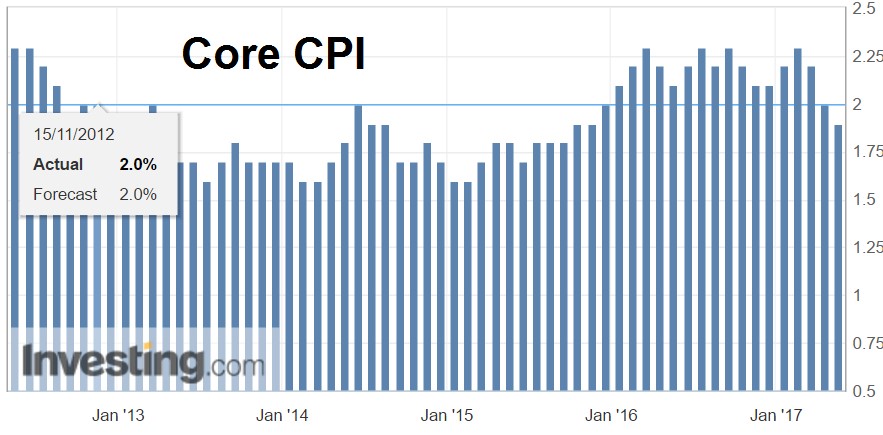

It’s important to understand that while these outside forces are affecting bonds and stocks, they aren’t the sole reason for the action. The Russell 2000, which isn’t affected by the growth internationally, is still up for the year. This increase might be because of positive investor sentiment because the large caps are rallying and because interest rates are low, pushing investors to take more risk. The ten-year bond yield is also rallying because inflation is declining. As you can see from the chart below, the core CPI has been declining in the past few months, below the Fed’s goal of 2%.

As you can tell from the explanation, the 10-year bond yield is being impacted by economic factors more than the stock market. The bond market is usually considered to be the soberer market which acts closer to reality. The stock market is impacted by the HFT algorithms and to a lesser extent ‘mom and pop’ investors which can be problematic because those investors do less research than professional money managers involved in debt markets. You can see examples throughout history of individual stocks becoming completely unhinged from reality such as Pets.com during the 1990s tech bubble. Even the hedge fund hotel Valeant was mispriced. A hedge fund hotel is a stock which is popular among hedge fund managers. Some of these hedge fund managers were buying the stock because other smart investors thought it was a great idea.

In the bond market, no investor is going to buy treasuries because he/she thinks some else has special insight into the security. Plain vanilla securities like treasuries invite less speculation. That’s not to say there isn’t speculation in that market, but the volatility is lower than in stocks. Bringing this concept into today’s stock market, many investors are crowding into the big tech stocks. This excess speculation is causing the overall indices to move higher.

Conclusion

The bond-market wins out in this battle. This means investors should be concerned with the economy. To be clear, the bond market is being manipulated by the Fed, so it’s only a starting point for your economic analysis.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.