UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

You’ve heard of fat fingers when it comes to trades. It’s when someone types in the wrong amount in a trade or buys instead of sells. It’s debatable if that actually happens to investors outside of retail traders. Now we have a fat finger jobless claims report. The mistaken figure might not have mattered to stocks in the short term because we have seen stocks rally on quite bad reports in the past few weeks. We were disappointed in the rate of change increase, until we found out it was a mistake. We need to wait to see the adjustment next week, but we already know what will happen.

In the week of May 9th, initial claims fell from 3.176 million to 2.981 million which was a small decline of 195,000 and was above estimates for 2.5 million. If this was the correct number, it would be pretty bad. In the prior 5 weeks, the average decline in claims was 740,000. You can see in the chart below, the red line showing initial claims had its slope fall at a much more gradual rate. The fat finger mistake was that Connecticut said it had 298,700 claims even though it actually had 29,800 claims. That’s a massive difference for the state; it means the actual national reading was closer to 2.6 million. That’s a big switch because now it was very close to estimates and it continues the strong decline in initial claims.

We don’t know the official time this update was made, but there is a tweet around noon with the adjustment. Anecdotally, there were a few responses saying they haven’t gotten aid yet which is a bad sign. Stocks opened lower and then recovered much of their losses by noon. Regardless of how the algos responded to this news, it’s a big positive. Ignoring the update from Connecticut, on a non-seasonally adjusted basis the number of uninsured Americans fell 629,189 to 24.143 million. The percentage fell from 14.9% to 14.5%. We usually look at seasonally adjusted data, but the non-seasonally adjusted data has a lot of validity because seasonality plays no role in this current unprecedented recession.

The unemployment rate could be close to its cycle peak in the May report. That’s predicated on there not being a 2nd wave of COVID-19 this fall. While the initial claims data is flawed, continuing claims are fine because it’s delayed by a week. The number of continued claims increased 456,000 to 22.833 million in the week of May 2nd. That’s a massive decline on a rate of change basis as there was a 4.366 million increase last week. On the negative side, 39.5% of the labor market in Georgia was on unemployment insurance. It’s the worst state. The 2nd worst is Kentucky at 38.1%. The 3rd worst is Connecticut which has the mistaken data.

Housing Is Slowly Recovering

The housing market was on fire prior to this recession. As you can see from the chart below, purchase applications this winter were higher than at any point in the prior 5 years.

During the all-important spring selling season, purchase applications were briefly the lowest out of the prior 5 years. We’ve already started to see a rebound as buyers might be looking for a deal and taking advantage of the low rates. Applications are now above where they were in 2015, 2016, and 2017. In the week of May 8th, the refinance index fell 3% weekly and the purchase applications index rose 11%. Yearly growth troughed at -35% and is currently at -10%.

Small Businesses Are Hurting

Small businesses are hurting badly. That’s what the rise in the stock market ignores. Since March 13th, 74.9% have requested financial assistance from the PPP program. All the data we cite is from a survey from April 26th to May 2nd. 29.3% requested financial help via economic assistance loans. Only 17.3% of small firms haven’t requested any sort of financial assistance. The bad news is only 38.1% received PPP money and 53.6% haven’t received help from any federal assistance program.

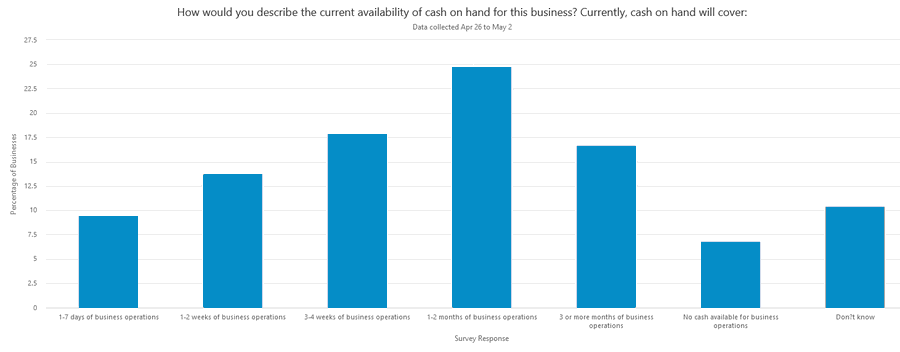

As you can see from the chart below, 9.5% of small firms only have 1-7 days worth of operations in cash on hand. Slightly less than 7.5% have no cash. 24.8% have 1-2 months of cash. The scenario where we determine how much cash small firms have to survive is going to shift to figuring out if the business can survive operating at 25% or 50% capacity since there are restrictions being put in place when firms open.

51.4% of small firm said COVID-19 had a large negative impact on business. 38.5% said it had a moderate negative impact. 2.5% said it had a positive impact. The hardest hit state was Michigan as 64.5% said it had a large negative impact. The 2nd and 3rd worst were New Jersey and New York as you’d expect since they have had the most cases (62.7% and 62.2%). The worst hit sector was accommodation and food services as 83.5% said it had a large negative impact. The least impacted was utilities at 6.7%.

Headed In The Right Direction

As you can see from the map below, from May 4th to May 11th most states saw either a decrease or steady change in the 7 day average of new COVID-19 cases.

Georgia, New York, New Jersey, and Michigan are all headed in the right direction. 11 are headed in the wrong direction with South Dakota being the worst. The hope is all the states start showing declines and there isn’t a 2nd wave. It’s interesting that NYC will be shut down until June 7th even though the situation has been improving for about a month. The city has been very cautious because it was hit the hardest by the virus.

Conclusion

The jobless claims report was lower than the headlines indicated because Connecticut accidentally multiplied their initial claims by 10. Initial claims have been steadily falling for 6 weeks. At this rate, the unemployment rate might end up very close to its peak in the May report. The MBA housing purchase applications index implies the market is heading up again. Small businesses are in a lot of pain. Most states are either in a steady state or seeing a decline in new COVID-19 cases. This is as many are reopening for business at least partially.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.