UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

In a previous article, we commented on how surprised we were by the weakness in consumer sentiment in February given the coming reopening and stimulus. That changed with the preliminary March sentiment reading. The overall index rose from 76.8 to 83. That was caused by a 6.8 rise in the expectations index which got to 77.5. Somehow expectations are still 2.2 points lower than last year. We are confident the next six months will be better than the six months following the March 2020 sentiment report.

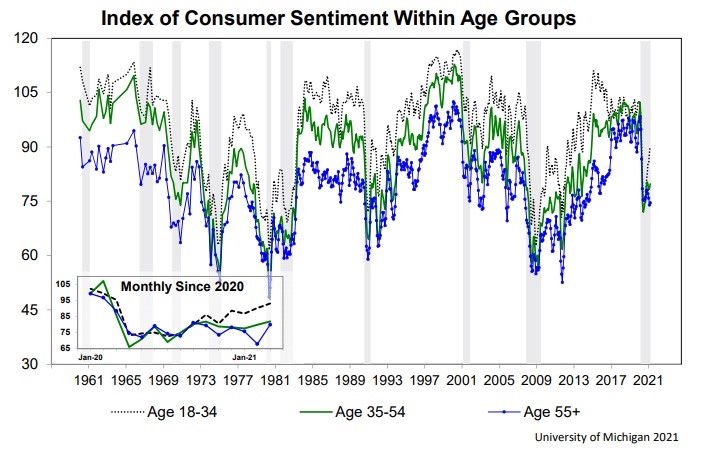

The current conditions index rose from 86.2 to 91.5. The largest monthly gains were from those in the bottom third of income and those 55 years and older. It’s no surprise those in the bottom income group are more confident given the spike in job creation in the leisure and hospitality industry. The March jobs report should be very strong. The increase in confidence from older people is coming from them catching up to younger folks and because most have been vaccinated. You can see in the bottom left of the chart above that younger people led us out of the downturn. Now older people are understanding the coming improvement in the economy.

Spending Is Perking Up

The most updated spending data is all before the stimulus has gone out. We have no data on the stimulus because it just started going out at the end of last week. Stay tuned for that. It will be interesting to see where consumers spend their money. We think it will be at restaurants, on clothes, and on vacations. Even though the stimulus hadn’t gone out yet in the first week of March, the Redbook sales growth reading was very strong. Same store sales growth in the week of March 6th rose from 4.6% to 8%.

Furthermore, the Chase spending data below shows strengthening. As of the week of March 8th, card spending growth was -7.9% relative to the pre-pandemic trend. That’s one of the highest readings since the pandemic started. We have now reached the point where yearly growth is irrelevant. Of course, yearly growth will be strong in March because that was the beginning of the pandemic in America. Every single economic print will show strong yearly growth from March. Yearly retail sales growth is going to be insane in March because of the stimulus and the weak comp.

Will Something Break?

The 10 year yield has been rising quickly. Some investors are shocked by this, but they shouldn’t be. We had one of the fastest recoveries in the stock market ever. If anything, investors should be surprised the rise in the 10 year yield took so long too start. It was obvious four months ago that the 10 year yield wouldn’t stay this low with the coming reopening and additional stimulus. The initial increase in November due to the vaccine news and Biden winning the election was just the beginning of what was to come.

As you can see from the chart below, the 10 year yield’s increase is now the second quickest ever.

Many investors are waiting for something to ‘break’ because such a rise is usually indicative of a major shift. The most obvious candidate of something breaking is high multiple tech stocks. Any expensive stock is at risk of weakness. In addition, many tech stocks face tough comps along with less demand due to the reopening. This situation is much different from 1994. The economy isn’t breaking; it is healing. It’s a positive to see the yield rise because it means the vaccination process is going smoothly. 109 million doses have been administered. The country should be 75% vaccinated within 5 months at this rate.

This Is New

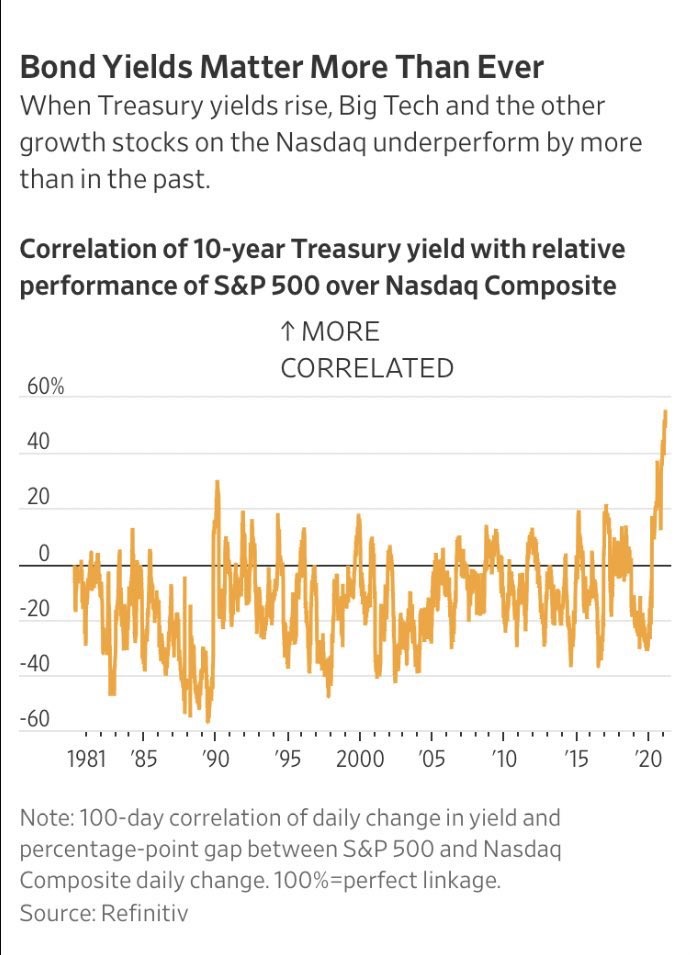

The rise in the 10 year yield has caused the Nasdaq to underperform the S&P 500. This sounds like an obvious relative performance because speculative growth stocks don’t like rising rates. The financials and energy stocks in the S&P 500 have been doing well. While it sounds obvious, the correlation between the 10 year yield and the S&P 500’s outperformance is at a record high. This must be because the Nasdaq has never been this much of a long duration play. If you looked at the relationship between the Nasdaq 100 and the Dow Jones, the difference would be even starker.

Some investors are questioning whether the FAANG stocks should be grouped in with the long duration trade. It’s a fair point because many are GARP stocks rather than growth names. They certainly aren’t losing money either. There might be another factor impacting them such as regulation worries or growth concerns. As they grow larger, they are encroaching on each other’s territory. When you are a $1 trillion company, it’s hard to find new markets that will move the needle.

Stock’s Don’t Always Go Up

Investors in 2009 would be shocked to hear the level of euphoria among investors today. It helps to have actually been following markets 12 years ago. There were news reports about how retail investors might never get involved in the market again. We had just come off the financial crisis which was fairly close to the Nasdaq bubble burst. Many investors didn’t think we could have a long term bull run.

As you can see from the chart below, from 2000 to 2004 the real annual S&P 500 returns were -5%. The market runs in long term cycles. We are in the midst of a powerful rally that started in March 2009. Typically, this type of euphoria doesn’t last long. If you are a long term investor with a 10 year time horizon, you smartly expect weaker returns than we had in the prior 10 years.

Conclusion

Spending and consumer sentiment are spiking. That spike in spending happened before the stimulus. Spending in the 2nd half of March will be above the pre-pandemic level. The 10 year yield is wreaking havoc on growth stocks compared to the rest of the market. It hasn’t been as dramatic as it can be because the overall market has been rising. This trend could get ugly in a correction. The stock market moves in cycles. On a multi-month timeframe, we are closer to the end than the beginning of the current bull market given the yet to be seen change in macro, high valuations and the historic retail investor participation.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.