UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Personal income in January exploded due to the $600 stimulus checks that were paid out early in the month. Monthly income growth was 10% which beat estimates for 9.4% growth and last month’s reading which was 0.6%. As we mentioned previously, when Trump delayed the bill for a few days, it pushed the benefits into January which made the impact clearer in the monthly data. The chart below maps out the change in income by category. Real personal income was 11.5% above its pre-COVID-19 level.

The $600 checks made January the 2nd largest month for transfer payments since the pandemic started. The checks went out a little quicker than the last stimulus. There probably won’t be much transfer payments in February. However, in March the 3rd round of checks should go out. As you can see, unemployment benefits also increased due to the extra $300 in weekly benefits in the last stimulus. That will be raised to $400 per week when the 3rd stimulus becomes law (the House passed it). 90% of the 11% boost in real disposable income growth came from the checks and 10% came from unemployment benefits.

Other income was negative and compensation growth was positive for the first time since the pandemic started. The hope is compensation starts increasing by April because at that point all of the checks should have gone out (depending on when the 3rd stimulus payments go out). We don’t think there will be a 4th round of stimulus checks.

If the labor market begins to recover on its own this spring/summer, this fiscal response will be used as a template on how to deal with future recessions. Some worry checks will create persistent inflation. So far, they haven’t. Most of the inflation will come from the reopening of the economy and dislocations in supply.

Consumption Growth Lags Heavily

Consumers saved and paid off debt with the stimulus money. That’s why monthly consumption growth was only 2.4% which rose from -2.4% last month and beat estimates by 2 tenths. As you can see from the chart below, durable goods spending is up 18% from before the pandemic. Non-durable goods spending is 6% higher. The stimulus checks went to durable goods, but that won’t be the case with the next round. People will use the next round of checks on concerts, the movies, traveling, and dining out.

As you can see, services spending is down 7.1% from before the pandemic. There was little bounce from the stimulus and there hasn’t been much change in the past few months. There are now 47,352 people in the hospital due to COVID-19. That’s below the prior peaks, but still about 17,000 above the prior troughs. Of course, this time we are hoping it heads towards zero instead of bottoming.

Spending Boom Incoming

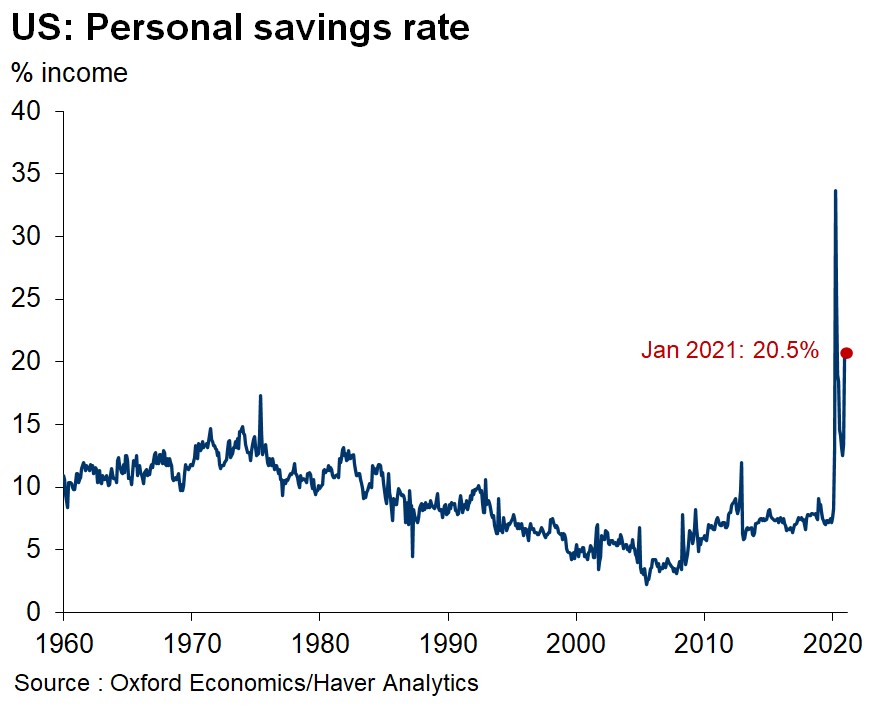

As we mentioned, consumption growth didn’t match income growth. This caused the personal savings rate to bounce up from 13.4% to 20.5% as the chart below shows. A lot of the money was saved because the options to spend it aren’t fully available because if the pandemic. Furthermore, the people who are unemployed need to spend the money over time. They can’t spend it all at once.

They might be able to spend the next round of checks all at once on vacations and restaurants if the labor market rebounds sharply in the next few weeks. We think most hotels and restaurants are aware a surge in spending is coming, but they aren’t necessarily hiring as many people as possible. That’s probably because their balance sheets have taken a big hit in the past year. Plus, they are probably underestimating the surge in demand to be conservative. Some of the biggest beneficiaries of the stimulus spending will be independent restaurants in cities.

Inflation Low Again

Yet again, inflation was low. Anyone expecting the Fed to raise rates this year is far off base. Yes, inflation will spike temporarily in the middle of the year. However, the Fed has already said it will average the recent inflation rates instead of hiking as soon as it gets above 2%. Overall PCE inflation was 1.5% which was up from 1.3%. Just using this month’s inflation rate means a month later in the year will have to get to 2.5% to cancel it out. Of course, that doesn’t include the entirety of 2020 which had low inflation. Core PCE inflation also was 1.5% which was the same as last month.

Weaker Consumer Sentiment

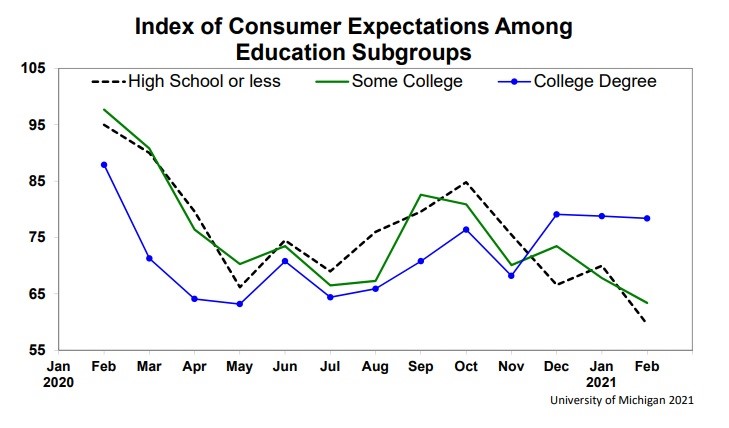

Despite the stimulus checks boosting incomes in January, the final February consumer sentiment reading was weak. Overall conditions were down from 79 to 76.8. The current index fell 0.5 to 86.2 and the expectations index fell from 74 to 70.7. That’s surprising because the pandemic is getting under control and stimulus checks are about to go out next month. Maybe consumers are weary of being too optimistic until the positive events actually occur.

As you can see from the chart below those with high school or less as education had a massive dive in expectations. Those with some college also became less optimistic. These people might not be fully anticipating the improvement in the leisure and hospitality industry that’s coming later this year.

Consumers expect inflation to be 3.3% in the next year which is up from 3% in January. That’s the right idea directionally, but we highly doubt headline inflation will average 3.3% in 2021. The last time, CPI was 3.3% or higher in a year was 2008. Since 1992, CPI was only 3.3% or higher three times.

Conclusion

The PCE report was a sight to be seen as incomes and savings increased. We want spending to increase more especially in the hardest hit areas of the economy, as this would show improved economic conditions. Look for those areas to see a spike in demand this spring/summer. Inflation is very low. There is no chance of a Fed rate hike this year even though inflation will spike later in the year. Consumer expectations were very low especially among those who are less “formally” educated.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.