UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

To be a great investor in all cycles, you need to be good at understanding businesses and macroeconomics. This is a macro world and we are all just living in it. Most major asset classes are being driven by one thing: negative real yields. The S&P 500 is often accused of not following the economy. In the prior cycle, sometimes stocks would rally on bad news because it meant more stimulus was coming. This market is on a whole different level. Investors take fiscal and monetary stimulus as a given. Instead, the market rallies on bad economic news because the work from home stocks, the EV stocks, and the online shopping stocks do well. Those stocks control the market. You might be confused why EV stocks do well in this new world. Look no further than Europe’s $2 trillion COVID-19 fiscal stimulus. The EU committed 30% of its recovery fund to address climate concerns. Don’t let a good crisis go to waste.

A cyclical improvement would be a bad thing for the S&P 500, a market cap weighted index. It would cause real rates to rise. The market is paradoxical in the sense that it expects unlimited Fed and fiscal support, but it also doesn’t expect higher rates or inflation. If COVID-19 was to come under control, stimulus could support growth and inflation. We’re not talking hyperinflation, but that’s not necessary to change this market dynamic. Don’t think in such a binary fashion.

A historically moderate shift in rates can make a huge difference. Convexity is important. In other words, as rates have fallen, it has created an even bigger rise in multiples. If growth stocks trade at a 2% premium to the 10 year yield, when the 10 year yield is at 2.5%, the free cash flow yield is 4.5%. When the 10 year yield falls below 1%, the free cash flow yield is 3%. That change correlates with a 50% rise in the multiple as the PE ratio goes from about 20 to about 30. In this case, if value gets a higher free cash flow premium (of 5%), its multiple rises 25%. Low rates are great for growth stocks. Growth trades at a premium when the economy isn’t growing. Every single basis point of growth suddenly comes from market share gains because the economy is stagnant.

Real Yields Are Negative

Negative real yields create an interesting environment where treasuries, precious metals, and growth stocks are rallying. On Tuesday, even the VIX joined in the rally as everything seemed to levitate. The unusual aspect of the S&P 500 in July is that no matter which sector does well, the index always manages to go up. There have been violent sector rotations under the surface as value and growth seem to take turns going up.

Gold investors and tech investors are confused why their investments are going up. If you don’t know why your asset is going up, you will not know when to sell. Record negative real yields make gold’s 0% yield suddenly not an issue. Uncertainty is difficult to measure, but it probably doesn’t hurt gold that the economy is so unpredictable. Gold fell in March because of the liquidity crisis.

Gold actually doesn’t like inflation. If these stimulus programs work and real interest rates rise, that could be a headwind for gold. Tech investors are so focused on their firms’ fundamentals, they miss the macro story. Growth is in vogue because of low rates. It always helps when a firm is doing well, but investors miss the context. These growth stocks are not rallying because of the Fed’s stimulus. They rally in spite of the stimulus, because if the Fed succeeded at getting growth, inflation, and rates higher, growth stocks would fall. Commodities and banks would rally. Another way of saying this is that economic growth is scarce, so what happens to assets that provide any growth in such an environment? They get bid up. To be clear, stabilizing the economy helps every sector. Nothing does well in a depression. That’s why assets were correlated in the initial rally off the March 23rd bottom.

In Joe Wiesenthal’s Twitter poll, 56.3% of 3,705 voters said if the 10 year yield hit 5% in 2025, stocks would be higher. Since 1960, the average S&P 500 performance in a rising rate environment is 22%, but the market has never relied on big tech growth companies this much. The banks and cyclicals would do well with rising rates, but they are a minuscule part of the S&P 500. You can argue this poll is exhibiting negative sentiment since in most 5 year periods, the S&P 500 rises.

The Growth Premium

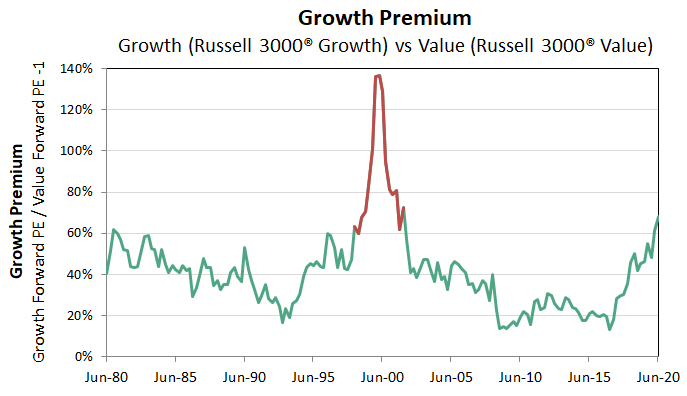

The chart below shows the Russell 3000 growth’s forward PE versus the Russell 3000 value’s forward PE. Growth stocks have relatively high forward PEs compared to value stocks on a historical basis. The current level is slightly above where the red line starts to indicate a bubble in 1998. In “Tirade of a Dinosaur” in April 1999 by Robert G. Kirby, he states, “The headlines will ring out. If you only know the future growth rate of earnings you have barely half the answer. Knowing the growth rate of the price to earnings ratio is probably more important!” He wrote a tirade about how euphoric sentiment was driving stock prices rather than earnings about 11 months before the bubble ended.

COVID-19 Causes People To Move

Everyone is trying to figure out how many people will leave the city and move to the suburbs because of COVID-19 and how long that trend will last. As you can see from the chart below, almost 40% of people who bought a house in the past 3 months named COVID-19 as the number one reason for doing so. The virus resulted in the desire or need to change living conditions. The housing market is very strong because of low rates and pent up demand.

As you can see, low rates were named by almost a quarter of recent buyers. If you can work from home, there is less of a need to live in the city near your job. This move to the suburbs correlates with millennials getting older and wanting to settle down in the suburbs with a family. The impact COVID-19 has depends on how long the outbreak lasts and impacts our behavior. The longer it goes on, the less desire there will be to live in the city.

Conclusion

Low real yields are moving all markets. The recent massive switches in sector rotation aren’t showing up in the indexes. They imply investors are deciding between betting on a cyclical recovery or staying with the FANG winners. Gold is near its all time record high. Buying gold isn’t a bet on inflation. It’s a bet on yields staying low (maybe a bet on uncertainty). Are people moving to the suburbs because of COVID-19? It’s not a shock people said COVID-19 was important to their house buying because it’s basically impacting every decision we make.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.