UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The consumer is headed in the wrong direction which shouldn’t be a surprise. It’s actually surprising that it hasn’t weakened further. The two main negative catalysts are the increased economic restrictions due to the recent COVID-19 flare ups in the south and the west and the anticipated end to the weekly $600 unemployment insurance checks. If you are getting $600 per week from the government and know it is ending this week, you probably are feeling nervous. These people are likely saving for the potential income decline. These people hope they can get a job or that the government can pass another stimulus, but hope doesn’t pay the bills. They will save what they can until a stimulus gives them cash. Even still, we need to see COVID-19 cases start falling nationally again before there is a sustained recovery.

Redbook same store sales growth in the week of July 18th fell from -5.5% to -7.5%. We expect negative monthly retail sales growth in July due to the tough comp and weakening sentiment. The preliminary July University of Michigan consumer sentiment index fell from 78.1 to 73.1. This report missed estimates by the most on record (by about 6 points). That reversed the recent trend of positive economic surprises. The current conditions index fell from 87.1 to 84.2 and the expectations index fell from 72.3 to 66.2.

As you can see from the chart above, Chase consumer credit spending growth has stagnated in the low negative double digits. Economists started calling for a Nike swoosh recovery in May. This doesn’t look like a swoosh. The rate of change was supposed to slow, but this is stagnation which is different. Yearly growth hasn’t improved in about a month. This will show up in the July retail sales report. With Congress wasting time, the data might get worse before it gets better. July 25th is the end of the $600 weekly checks. There won’t be a stimulus plan passed by then.

Labor Market In Big Trouble

We said the consumer is holding up better than you’d think because the labor market has been weakening. The household pulse survey has weakened for 4 straight weeks as you can see from the chart below. From the May to June survey week, employment was up 5.6 million. From the June to July survey week, employment fell by 6.7 million. The July BLS report is about to show net job losses. That’s not what you want to see when there is double digit unemployment. If this trend continues, either the entire period will be considered a recession or this will be a double dip recession.

The chart above shows the household pulse survey has the adult employment rate falling from about 54.3% a month ago to 51.7%. The past week of data was the biggest decline. If the data doesn’t improve, the BLS report will matter more even though it doesn’t include results from the 2nd half of the month. We say that because it will detail a worsening trend in that case. If the household pulse survey and jobless claims unexpectedly turn around, the bulls can say the BLS reading is old data. In response to a weak report, we think the bulls will point to the decline in COVID-19 new case growth.

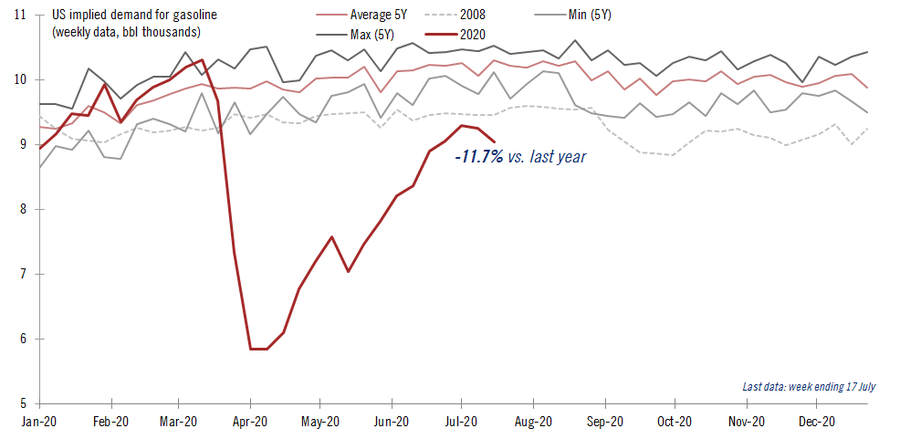

Driving Falls

The trend this spring was towards more driving because it is safer than public transportation. The trend has changed with the latest spike in COVID-19 cases. As you can see from the chart below, yearly gasoline demand growth in the past 2 weeks fell for the first time since April. The recovery has reversed. Demand is down 11.7% from last year.

The key figure to watch is COVID-19 cases in California. Cases in Arizona peaked a couple weeks ago which should signal a coming improvement. So far, the results in California are still terrible. There were 12,137 new cases on Wednesday which was a record high. There was also a record high 156 deaths on Wednesday. California passed New York as the state with the most cases. California’s economy is the largest in the country. We can’t have a full recovery without California.

Changes To Rent

With the job losses and pandemic, many people have stopped paying rent and have delayed mortgage payments for a few months. The commercial real estate market is also in trouble. As you can see from the chart below, San Francisco rents have fallen the most due to this pandemic as they are down about 4% since the start of the year. Even with all the fears of people leaving NYC, rents there are only down about 1%. San Francisco is a hotbed for tech which has been the hottest sector in the stock market, but this has had no impact on the asking rate for rent.

Another Record For The Nasdaq

The Nasdaq has had a few interesting records because this recent rally has been so amazing. The latest record is the longest streak without a 2 day losing streak. It’s tied for the longest with 48 days. The last 2 day losing streak was in mid-May as you can see from the chart below. The Nasdaq needs to increase on Friday after Thursday’s decline to break the record. Interestingly, the record streak it is tied with was in 1978. There never even was a streak of 30 days in the late 1990s which was the hottest tech market ever. The top 5 stocks in the S&P 500 (the internet stocks) have gained more in market cap on a yearly basis than the peak in the late 1990s.

Conclusion

The consumer and the labor market are in trouble. The Nasdaq has been acting as a reverse indicator as it rallies in times of economic hardship. It has done so well that it tied a record long streak without 2 declines in a row. Besides weakness in consumer spending and the labor market, growth in gasoline sales has been falling. Rents aren’t being paid on time which has led to the decline in asking rates. The city with the largest decline is San Francisco.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.