UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

We are constantly given case studies on how various regulations and restrictions impact the economy and the spread of COVID-19. At each facet of this pandemic, people claim winners and losers, but then those reverse soon after. We aren’t here to state the best policy, because there is no silver bullet that gets rid of the virus and has no impact on the economy. The silver bullets are better treatment and a vaccine.

The current case study is the difference between America and Europe. Both had outbreaks in the fall. Europe’s was worse. Europe went with lockdowns and America didn’t. Cases are peaking in most European countries, while cases are still rising quickly in America. The positive rate and hospitalizations are also up. Whatever stat you look at; it’s getting worse in America in November. On the other hand, Europe is set to have a contraction in GDP, while America will have growth.

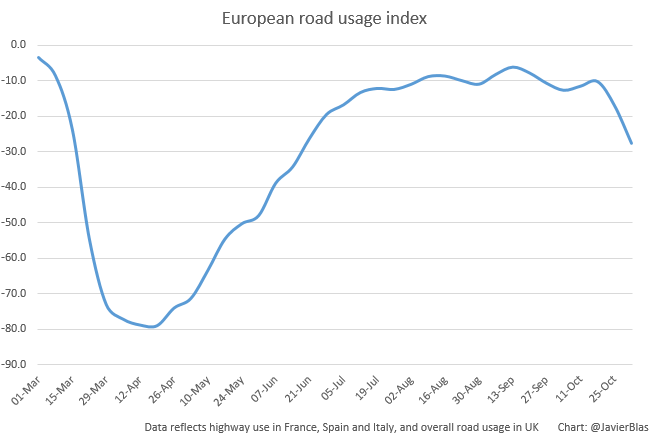

As you can see from the chart above, European road usage has been cratering. American movement has also slowed as the chart below shows. It’s possible America is headed for a similar contraction later in the year if the outbreak spreads further even if lockdowns don’t occur. Experts don’t recommend lockdowns, but no one said the economy wouldn’t be hurt without them. Lockdowns cause a steep abrupt decline, but we will see more gradual decline in activity if COVID-19 gets worse. This is yet another reminder that no policy is perfect.

Weaker ADP Report

The ADP report has been too negative in this recovery, but it has been more accurate recently and is currently our best guess on how the labor market did in October. The ADP report showed private sector job creation of only 365,000 which missed estimates for 600,000 and fell from 753,000. As a reference point, the BLS report is expected to show 650,000 private sector jobs added. The unemployment rate is expected to fall to 7.7%. Imagine if someone in April told you there would be two more waves of COVID-19 and the unemployment rate would fall to below 8%. You might not have believed them!

As you can see from the chart below, ADP payrolls are 7.78% off their record high.

The financial crisis recession troughed at -7.4%. Even after the fastest recovery ever, we’re not even at the start of the last recovery. The difference here is when the economy reopens, we will get another strong jump in job creation from the most affected industries. It won’t take as long to recover the losses as last expansion did if COVID-19 is resolved in 2021. If it’s not, thousands of leisure and hospitality jobs won’t come back.

Within the report, small business job creation was 114,000, mid-sized job creation was 135,000, and large job creation was 116,000. Goods producing firms only added 17,000 jobs. Construction only added 7,000 jobs which seems too low based on the euphoria among home builders. Manufacturing created 7,000 jobs in this report which is different from the ISM manufacturing employment index which rose 3.6 points to 53.2. Manufacturing added 66,000 jobs in the last report and is expected to add 50,000 in this one.

In the ADP report, there were 348,000 jobs added in the service sector. This was driven by leisure and hospitality which added 125,000 jobs. The industry is still hurting, but since it lost the most jobs in the recession, it can keep adding the most back. Education and healthcare added 79,000 jobs. Remember, in September there were fewer education jobs added because kids went back to school later than usual. There should be a big increase in hiring in this category in the BLS report. These results are manipulated by seasonal adjustments gone wrong because COVID-19 transformed the normal seasonality of the economy.

Tale Of 2 Services PMIs

The ISM services PMI fell from 57.8 to 56.6 which missed estimates for 57.6. It missed the lowest estimate which was 57. The Markit Services PMI was almost the same as the ISM PMI, but it did much better on a rate of change basis. It increased from 54.6 to 56.9. Since the ISM PMI is more volatile than the Markit PMI, the same result is decent for ISM and amazing for Markit.

Within the ISM report, the employment reading fell 1.7 points to 50.1. That’s very low for the amount of job creation we will likely see. As you can see from the chart below, this index was below 50 when the economy was creating millions of jobs. There will probably be fewer jobs added in October than September, but job creation will be better than most months in the previous expansion despite what this index shows.

The business activity index fell from 63 to 61.2. The new orders index fell 2.7 points to 58.8. The prices index spiked just like in the manufacturing report, giving the reflation trend more credibility. It was up from 4.9 points to 63. The only commodities that dropped in price were dairy, personal protective equipment, and software.

This PMI is consistent with 2.7% GDP growth which seems accurate. According to the Atlanta Fed Nowcast, Q4 GDP growth will be 3.2%. Within this report, an accommodation and food services firm stated, “Business has improved, but greatly reliant on COVID-19-related restrictions. Supplier’s inventories and lead times are longer and spotty with outages due to keeping lead times lean as a cash flow measure, but putting consistent supply at risk.” Restaurants will be in deep trouble in the next 3 months. It’s too cold to eat outside in most of the country and indoor dining is restricted.

Best Confidence Since April 2018

In the October Markit report, business expectations were the best since April 2018. Remember, despite the similar PMI, this one was much better than the ISM. Confidence improved because of hopes for looser virus restrictions within the next year and hopes for a stimulus. Those hopes might be dashed now that we have more data on COVID-19. The chart below shows according to Markit, GDP growth was 1% in September which means if GDP stays flat for the next 3 months, SAAR growth will be 3.3%. Since the October PMI was strong, it might be better than that.

According to the Chief Business Economist at Markit, “Growth of business activity accelerated markedly in October, indicating that the underlying health of the US economy continued to recover at the start of the fourth quarter.” This report showed business activity increased at the fastest pace since April 2015. We wonder if the pace will stay this strong in November with the outbreak of COVID-19 even worse.

Conclusion

Europe and America have different COVID-19 strategies, but they both might lead them to weaker economies and a bad outbreak of the virus. The ADP report wasn’t great, but at least job creation continued. We are only almost in the first inning of this recovery in terms of the 2010s cycle. The ISM and Markit services PMIs were decent, but everyone wonders if the economy will fall off in November.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.