UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Speculation In Stocks

With interest rates falling, speculation into anything which promises a high return is in vogue. The Trump Trade promised a higher yield environment, but that ended in early March. The 10-year yield has fallen from 2.64% to 2.16%. Even at the recent peak in yields, interest rates were low, but for a short time some expected the low interest rate environment to end. Falling yields goes against the global central bankers’ actions. After pouring trillions of dollars into the bond market, the balance sheets are expected to collectively shrink in 2018, interest rates are falling despite the increased supply of bonds. This may be because investors are worried about economic risk and see inflation diminishing.

As was mentioned at the onset of this article, risk taking is expanding. This goes against the uncertainty that the rally in the 10-year bond yield suggests, but it is supported by ‘TINA’ (there is no alternative) investing. There isn’t an option to generate a decent return in a treasury bond or a CD. Usually low stock market volatility like there is now is a harbinger for future volatility because the market has historically rarely stayed in one place for a long time. However, in this market investors see the low volatility as a sign that they should be investing because the market is now supposedly safe. Low volatility doesn’t imply low risk. The best way to avoid risk is to pay less than an asset is worth.

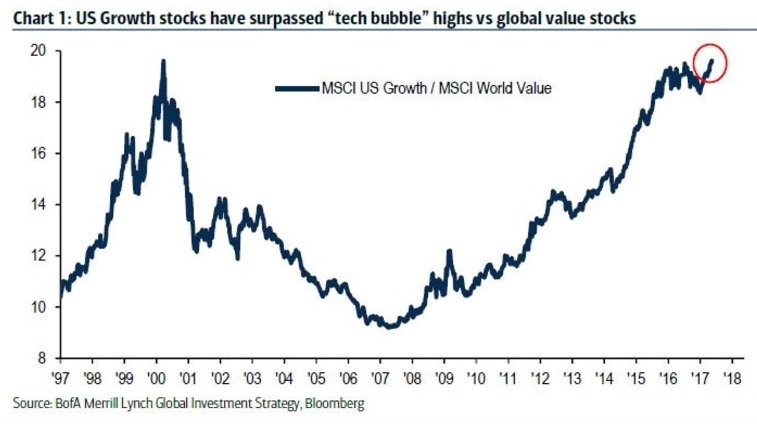

This safety in value approach has been thrown out the window. As you can see in the chart below, the ratio of U.S. growth stocks to the MSCI World Value index has passed the tech bubble high.

This is not suggesting growth stocks are as expensive as they were in the late 1990s, but it does show the change in asset allocation. Forecasting the trend in asset allocation can be as valuable as forecasting earnings growth. As you can tell, the movement towards buying American growth stocks is probably in its late innings.

It’s not just growth stocks which are in a perilous situation. As you can see from the chart below, corporate return on equity for non-financial companies has hit a record low.

The return on equity is a measure of how much profits each dollar of shareholder equity generates. Even though corporate profits are at their record highs for S&P 500 firms, high debt levels are hurting the return on equity. Corporate debt to GDP is at a new record high. Return on equity measures how efficiently corporations can use investor’s capital to generate new profits. This low level explains why firms are shirking investments into capital expenditures and instead putting the money into buybacks and dividends. Management teams are effectively saying that they can’t properly invest the capital at a good return, so they’re giving the money back to shareholders. In this new leverage scenario, firms take in investor’s capital, lever up their balance sheet with cheap debt and then return the capital back to shareholders. Buying stocks in these highly levered companies is a bet on this strategy, not the underlying business.

Leverage In The Credit Market

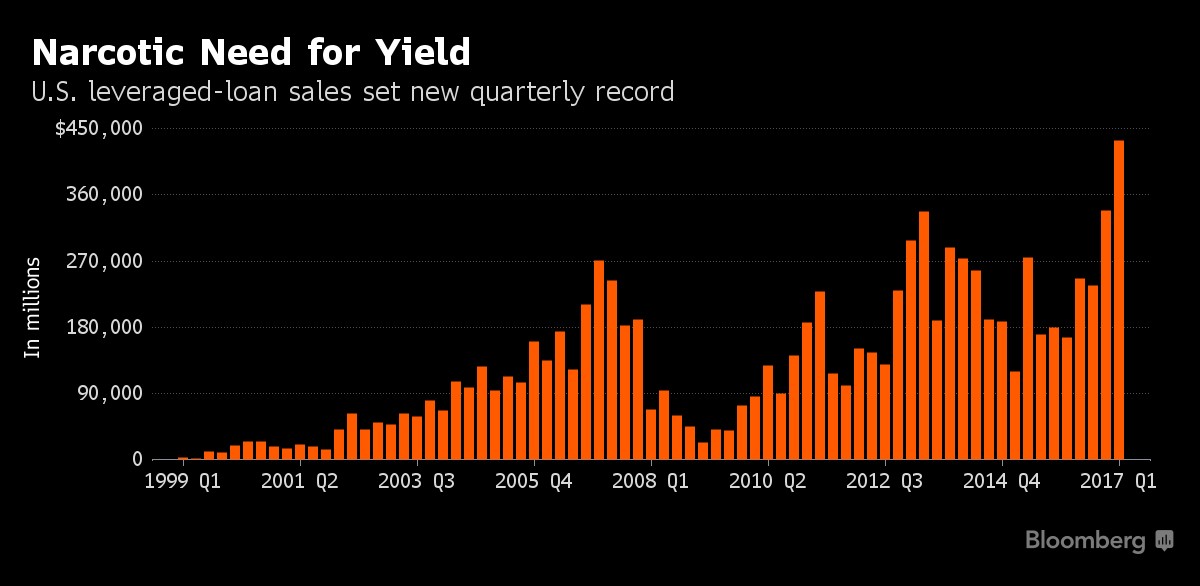

That was the equity side of the leverage equation. Looking at the debt side of the equation, Levered loans are more popular than ever before, as you can see from the chart below.

Besides pushing investors into stocks, low treasury yields put investors into riskier debt instruments. Leveraged loans are simply loans to borrowers who have less than ideal credit ratings. Their chance of defaulting or not paying off the loan are higher than those with pristine credit. To make up for this excess risk, borrowers pay higher interest rates. At this point in the cycle, the appetite for any returns is so high that investors are ignoring the potential for economic weakness to spur defaults. When buying any risky debt, it’s important to come up with a stress test scenario to see what would happen in the event of a weak economy. Debt investors are throwing caution to the wind.

The chart below shows the leveraged loan default rate.

As you can see, the default rate is very low as it’s below 2%. The current default rate will give you an idea of where interest rates will be, but doesn’t tell you where they’re heading. The lagging 12-month default rate should be as meaningless in investors as last year’s earnings are to stock investors. Stock valuations are measured by future cashflows, not the past.

In the leveraged loan market, it’s best to buy when default rates are high because you get high interest rates. The premise is that default rates usually don’t stay high for long. It takes in depth economic research to come to that conclusion as well as nerves of steel. The current low interest rates don’t imply that default will necessarily rise, but trading profits come when they fall and there’s not much room for them to fall. The potential losses are high while rates are low, so you’re not getting a great deal on that front. The reason why investors keep buying these loans is the search for yield and because they don’t see default rates rising in the intermediate term.

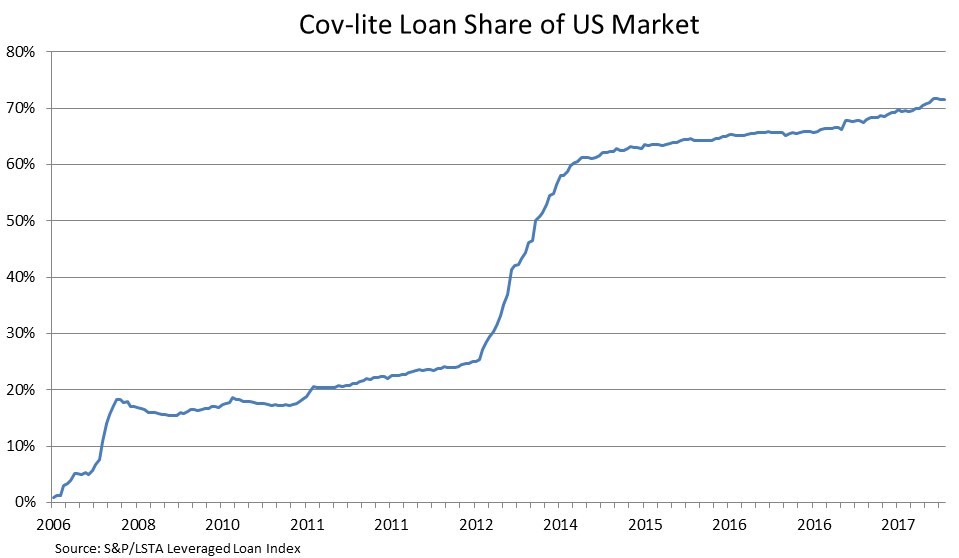

Another risky behavior investors are particularly taking in this business cycle is buying into cov-lite loans. As you can see, these loans barely existed in 2006, but now they dominate the market.

Cov-lite stands for covenant light. Covenants on loans are restrictions on borrowing. For a consumer loan, there’s no restrictions because usually the asset is expected to depreciate. For businesses, there are restrictions to protect the lender. If a firm is recklessly taking out new loans as its profitability wanes, lenders have restrictions to prevent the situation from getting out of control. It’s great for a lender to ask the company to explain why it needs the money to avoid lending money for a risky project. Cov-lite loans leave lenders in the dark as there aren’t these restrictions. For this risk, these loans pay higher interest rates. Warren Buffett was quoted as saying “Only when the tide goes out do you discover who’s been swimming naked.” In this case, when defaults rise, we’ll see what the borrowers were doing with this capital. It may not be great things because return on equity ratios are low.

Conclusion

Risky behavior has occurred because treasury yields are so low. The takeaway from this article is to understand that when you buy stock in a company with high debt, you’re betting that this risk taking environment will continue. Buying the stock is less about how the business will do than ever before. Buybacks are pushing stocks higher; without them, highly indebted firms’ stocks will fall. Think about how your portfolio jives with the information in this article.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.