UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

For the first 4 months of the year, markets were giving off conflicting signals as treasuries were signaling there was going to be a big slowdown in growth while stocks were rallying as if the economy was ready to match 2018’s solid performance. In May, we’ve seen treasuries win out as yields have fallen and stocks have fallen. The global economy and American economy are slowing. The German 10 year yield hit its lowest level since September 30th, 2016.

Massive Rally In Treasuries

The U.S. 10 year bond yield hit its lowest level in 19 months as it is 19 basis points below the Fed funds rate. The 10 year yield is 12.5 basis points below the 3 month bill’s yield. Inflation estimates have cratered as the 5 year U.S. breakeven rate peaked at 1.91% on March 20th and is now at 1.62%. 10 year real yields are the lowest since January 2018. The Fed funds futures market is now pricing in 77 basis points of rate cuts by the end of 2020. As you can see from the chart below, there is now $10.7 trillion in global negative yielding bonds which is the most since October 2016.

The Adjusted Yield Curve Shows A Recession Could Occur Soon

The treasuries market is strongly in the slowdown camp and potentially even calling for a recession depending how you look at it. This is terrible for stocks. We are seeing earnings estimates fall, the Fed potentially too hawkish, the economy in worse shape than late last year, and the trade war heating up as there are new tariffs about to go into effect. All the reasons for the rally since the December low are diminishing.

The chart below shows the 10 year 3 month treasury yield curve is even more inverted than it is now when you adjust for the changes in the Fed’s balance sheet.

According to the chart, the recession countdown started 6 months ago which means we should be looking out for a recession now. That indicator called for a recession before most of the tariffs were put in place. That’s a critical point. The U.S. economy is in a cyclical slowdown which will be made worse by the trade war. It could be enough to push the economy into a recession as early as this year.

Very Strong Consumer Confidence

The May consumer confidence report was amazing. This and the solid labor market may make the Fed not want to cut rates this year. However, because of a myriad of other weak economic reports, if the Fed doesn’t provide dovish guidance at its June 19th meeting, the stock market is likely to decline. The April leading economic indicators still showed yearly growth, but with the decline in stocks in May, yearly growth will be less robust.

Getting back to the Conference Board report, the confidence index increased from 129.2 to 134.1 which was the report’s highest reading since last November. It beat estimates for 129.9. The tariffs and the volatility in stocks have yet to lead to declines in consumer confidence. The cutoff date for this survey was May 16th and the tariffs were announced on May 10th.

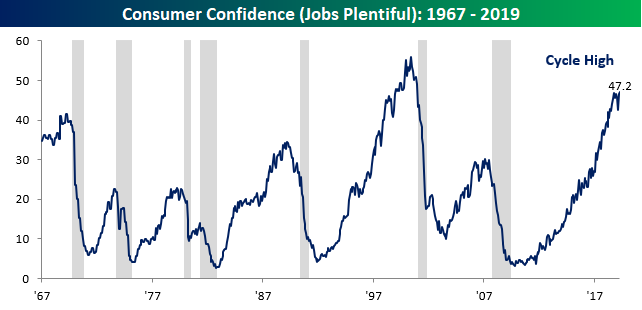

As you can see from the chart below, the consumer’s optimism about the labor market reached a cycle high.

The percentage of consumers saying jobs are plentiful increased from 46.5% to 47.2%. The only higher peak going back to 1967 was in the late 1990s. Those saying jobs are hard to get fell from 13.3% to 10.9%. Before assuming the latest round of tariffs won’t affect the consumer, let’s wait until they start affecting prices. The expectations index increased 3.9 points to 106.6 and the present situations index increased 6.2 points to 175.2. We’re not huge believers in reviewing the difference between the present and expectations indexes because both are relatively high. It’s not like expectations are far below their cycle high. That would be disconcerting.

Trade War Sectors Increasing Job Cuts

The Challenger Job cut report showed a spike in layoffs in Q1, but showed signs of improvement in April. As you can see from the chart below, the industries affected by trade have seen a spike in job cuts.

That’s not a major surprise because autos, retail, and the industrials are seeing cyclical weakness. This all can’t be blamed on trade. Auto loan delinquencies are up, vehicle sales are down, physical retailers are closing stores, real consumption growth was only 1.2% in Q1, and the manufacturing sector is potentially headed towards a recession as the May Markit flash PMI hit a 116 month low. With that being said, the trade war can certainly hurt the labor market; it’s something to watch out for closely.

Dallas Manufacturing Fed Index Goes Negative

The May Empire Fed and Philly Fed manufacturing reports were solid and the Kansas City and Dallas Fed indexes were weak. As you can see from the chart below, the Dallas Fed general activity index fell from 2 to -5.3 which missed estimates for 6 and the low end of the consensus range which was 5.

The production index fell from 12.4 to 6.3. New orders fell 7.4 points to 2.4. The growth rate of orders fell from 5.1 to 1.1. The company outlook index fell from 6.3 to -1.7. Furthermore, the 6 month expectations for production fell 4.8 points to 36.5.

A machinery company in this survey stated, “China tariffs were already causing significant price increases, and the latest escalations will raise our costs even more—probably our prices, too—and make us less competitive on the world stage where we export 70 percent of what we produce.” If the tariffs are revoked, we will see a big bounce in manufacturing sentiment.

Conclusion

The treasury market is starting to flash recessionary warning signs although the 10 year yield is still 15 basis points above the 2 year yield. At the least there will be a sharp slowdown in GDP growth from the 3.2% initial Q1 reading. The good news is the consumer is confident and optimistic about the future. The bad news is tariffs are hurting manufacturing and are about to impact the consumer.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.