UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The trade war is a big deal for the economy because it creates uncertainty causing a multiplying negative effect. Businesses hate uncertainty because it is tough to plan for it. Investors hate uncertainty because it amplifies every data point. If a company can’t predict where it will be in the future, each report is extremely critical which causes excess volatility. That explains why each trade related news item affects stocks. Firms with high visibility get a premium.

The table below from Evercore ISI shows how important the trade war is to American companies. As you can see, in April 18% of firms stated they would increase their hiring and capex spending if a comprehensive trade deal was struck.

Only 2% said they would lower capex and hiring plans if a trade deal was struck. The second column shows what would happen if talks broke down, which they did. As you can see, only 5% would increase capex and hiring plans, while 32% would cut capex and hiring plans. That means the new tariffs that were announced on May 10th potentially caused 30% more firms to cut hiring and capex plans, and 14% less firms to increase hiring and capex plans.

China Increases Rhetoric

All of a sudden, Trump’s leverage in the trade deal has diminished because of the latest weak economic reports and the 5.5% correction in the S&P 500. China knows Trump wants to make a deal soon because he is up for re-election in 17 months. The weak economy presumably increases the importance of a trade deal for Trump. That’s why China is increasing its negative rhetoric. For instance, there have been many headlines recently regarding China threatening its rare earth dominance against America. Rare earths are used in smartphones, electric vehicles, and advanced precision weapons. In other words, they are critical to the economy.

The map below shows the locations of rare earth mines and advanced projects.

China produced 71.4% of the rare earths last year and owns 37.9% of global resources. Rare earths aren’t rare, but they are expensive to mine. With such a high market share, the alleged potential for restrictions on rare earths doesn’t come as a surprise. Enacting such restrictions, however, could be complicated since rare earths are embedded in tiny amounts in many products. Restrictions could hurt the Chinese economy in the process.

Good Bye Positive Q2 EPS Estimates

The volatility in stocks in May has been catalyzed by the same issues that hurt stocks in Q4 2018. The Fed is considered to be too hawkish, the economy is slowing and at risk of falling into a recession, trade tensions are high, and earnings revisions are weak. It’s arguable that the economy and trade war are in worse shape than 6 months ago. New tariffs were enacted and Q2 GDP growth is on pace to be about 1.8%.

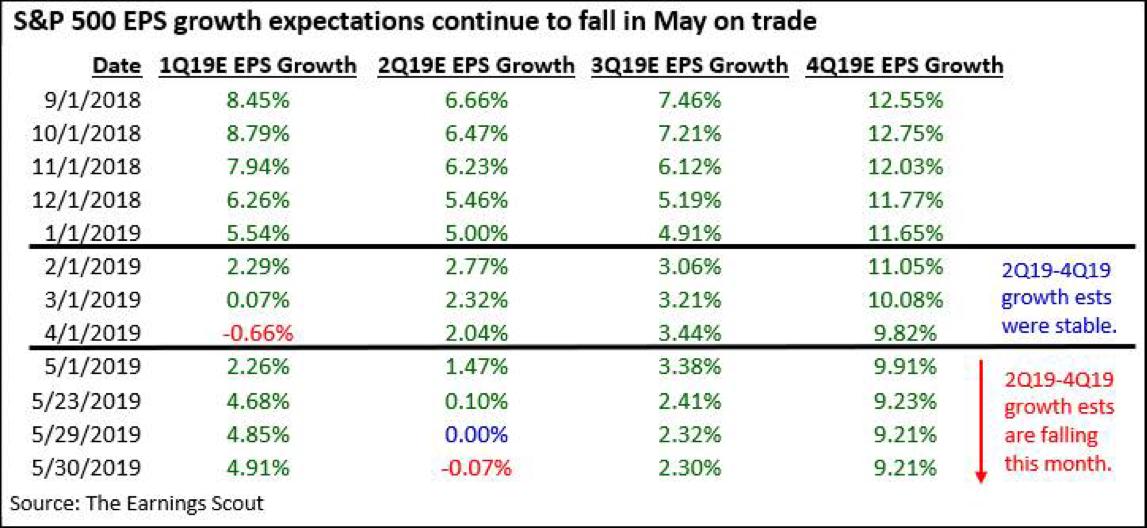

As you can see from the table below, the weak Q1 earnings estimates were more of a scare than reality as EPS growth ended up at 4.91%. However, recently we’ve seen Q2 EPS estimates plummet.

Now estimates are for -0.07% growth. If estimates fall more than 0.59% in the next month, they will start the quarter worse than Q1 estimates did. If the Q2 economic reports are accurate, it’s plausible to suggest that EPS surprises won’t be as great as they were in Q1. It’s very possible we see below 4.91% EPS growth in Q2.

Latest Update On Housing

The housing market is giving off more encouraging signs now than it did 12 months ago. Home price growth is falling, purchase applications growth is solid, and interest rates are falling. Obviously, if demand was so strong it would stop price growth from falling, but we are nearing that point if the labor market stays solid. The charts below show the falling rates, increasing affordability, increasing new home sales growth, and the improvement in the home builder sentiment index.

As you can see from the chart below, the national Case Shiller Home price index’s growth rate fell from 3.93% to 3.72% in March. That’s a 7 year low.

The weakness in price growth could be near a bottom since purchase applications and the home builder sentiment index have shown improvement this spring. In the week of May 24th, the MBA purchase applications index was up 7% year over year. In the Case Shiller index, New York prices were flat monthly, Dallas fell 0.1%, and Chicago fell 0.2%. The weakest yearly growth was 1.3% in Los Angeles, San Diego, and San Francisco. Las Vegas was the strongest at 8.2% which is down from 13.9% last August.

It’s notable that the FHFA home price index’s growth rate fell from 5.1% to 5% which is a 4 year low. The Mountain region had the best price growth at 7.1% and the Mid-Atlantic had the lowest price growth as it was 3%.

Conclusion

The trade war is a big threat to the economy because businesses stated they would lower capex and hiring if tariffs were elevated. China is threatening to stop exporting rare earths to America. Enacting that could be more complicated than appears at the surface and could hurt both economies. Q2 EPS estimates have gone negative. The housing market has had a solid spring, but home price growth fell to either a 7 year low or a 4 year low in March depending on which index you follow.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.