UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

It’s incomplete to say American markets have only been on a good run in the past decade. Of course, America’s valuation gap (more expensive) is higher than usual because of its big internet stocks, but US stocks have also done well in the past 100 years based on gains in the economy and corporate profits. The real annual returns are great. It’s also worth considering why most of the big internet giants are in America to begin with.

The answer is the people: specifically, immigrants to America. Inventors come to America to take risks and become successful. If you have more people taking risks, more will succeed as long as regulations aren’t too harsh. Economies need new firms to become dynamic. Of course, old companies can still innovate, but they should certainly face as much competition from new firms as possible. This makes old companies innovate faster.

The American ethos doesn’t look down on failed start up ventures. That’s probably why so many inventors come here. As you can see from the chart above, the net number of inventors from 2000 to 2010 who have immigrated to America is several fold higher than other countries. America’s economy won’t be as dynamic in the future if this trend reverses. Great demographics don’t make a vibrant economy. If that was the case, the countries with the highest population growth would have the strongest economies. Instead countries need to have an environment that encourages innovation. We don’t want an unfair playing field where bad practices from monopolies are rewarded.

The people who take the trek to America are leaving their lives behind. It proves they have the motivation and tolerance for change and risk, both of which are important in starting and running a business. At least 30% of all American innovation since 1974 came from immigrants who are less than 15% of the population. If all immigrants were replaced with natives, America would have 13.4% less innovation. It’s not a particular nationality that drives risk taking; it’s an idea.

Being Big Isn’t So Great

Because the large cap growth firms have done so well in the past few years, people are more willing to invest in them. They have shown they can grow at scale, but let’s not act as if they can grow indefinitely. A dose of reality is needed. When companies have gotten big historically, it has been bad for future returns. That makes sense because eventually every company dies. If it’s really large, it’s closer to its end than its beginning. There is nothing wrong with investing in cash cow old companies, but the largest companies tend to either be overhyped or are over-earning. Over-earning means they have too large of a market share or make too high margins. Once competition kicks into high gear, these advantages disintegrate. The large cap tech bulls genuinely don’t think their moats will ever fail. Confidence is very high.

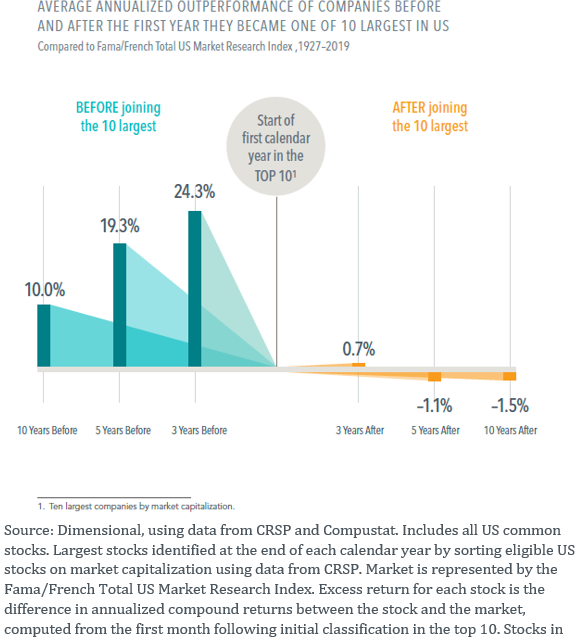

As you can see from the chart above, annualized compound returns are amazing before a company gets into the top 10 largest firms in America. That’s obvious because the firms in this group needed to beat out every other company to make it here. Returns go from about average to massive as they are 24.3% per year in the 3 years before reaching the top 10. Once getting in the top 10, the returns are bad. Will the FAANG stocks be different? The results are weak as after getting in the top 10, these firms gain 0.7% per year in the next 3 years. You’re fighting history by going long these large cap tech names. Plus, we are in a low interest rate environment which can reverse, sending them falling.

Value Cheaper Than Growth

As we have stated a few times this year, growth stocks are much more expensive than normal. Value stocks are a decent buy based on valuations. The chart below shows the Russell 3000 growth index has gotten significantly above its normal valuation range for the 2nd time since 1995. This is the first tech bubble of most trader’s lifetimes. If we had a bubble recently, there wouldn’t be one now. That’s why there isn’t a housing bubble to follow the last cycle.

It’s notable that the trendline earnings growth of growth firms is only 1.19% higher per year than value. Value firms are typically thought of businesses in decline, but that’s actually not true. Deep value investing on the other hand is when the company is priced for bankruptcy (below cash or significantly below asset value), but they have a little life left in them. Value stocks actually aren’t incredibly cheap as a whole. You need to look at energy and beaten down banks to find cheap stocks. Even still, it’s much easier to find cheap value stocks than cheap growth stocks. Furthermore, if the tilt changes against growth, virtually all of them will fall. It’s tough to swim up a river or against the tide. Just think of trying to invest in value stocks in the past year. It hasn’t been impossible to make money, but it has been extremely difficult to beat the market with that positioning.

We find it interesting that this chart depicts value stocks as expensive in the late 1990s and early 2000s because value did so well versus growth after the tech bubble burst. It’s possible value does even better from 2021 to 2023 than it did from 2000 to 2002 because it’s cheaper now. Those years are just examples. We don’t know when the tilt will shift from growth to value, but it will happen when we have rising real economic growth (rising real interest rates). The biggest potential catalyst for value stocks is the reopening of the economy when COVID-19 is vanquished.

Conclusion

The US economy/stock market has a great historic track record because of the innovation created by immigrants. This helps explain why America’s tech sector is so much stronger than every other country’s tech sector. Big companies tend to underperform. Getting into the top 10 has been a death sentence for stock returns. They fall 1.1% on average after getting in the top 10. Value stocks are reasonably valued and growth stocks are the 2nd most expensive since 1995. This period is like the dot com bubble. Most traders don’t remember that bubble because they are younger than 50. To be 28 in 1998 when the bubble started, you need to be 50 now.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.