UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The action in markets since early October suggests investors see a global cyclical recovery in 2020. The S&P 500 and the MSCI ACWI have increased 5 straight weeks for the first time since December 2017. The CNN fear and greed index hit 91 which is extreme greed (data all as of November 8th). The S&P 500’s 14 day RSI is almost at 70 which is near where it peaked the prior 2 times it corrected in 2019. 70% of S&P 600 stocks and 66% of S&P 500 stocks are above their 50 day moving average. Europe is actually more overbought as 80% of MSCI Europe stocks are above their 50 day moving average.

The bond market is also showing investors believe the economy will recover. On August 29th, the total amount of negative yielding bonds peaked at $17.037 trillion. That has since fallen to $11.938 trillion.

From October 8th, the 10 year yield is up 41 basis points to 1.94%. In that period, the S&P 500 is up 6.91%. The size of that rally can’t continue over the intermediate term. Because the Fed has stated it won’t hike rates unless inflation spikes and core PCE inflation has stayed below 2%, the short end of the curve hasn’t seen much yield increases.

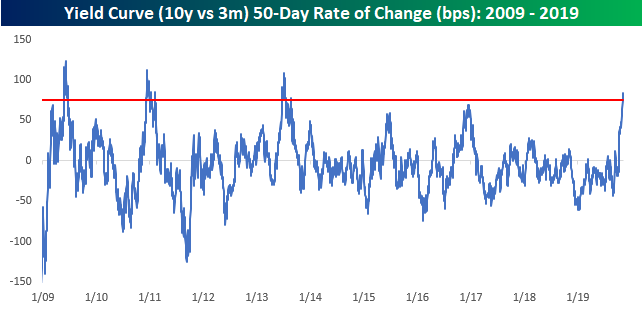

The yield curve has steepened severely recently. Either this is a sign of a recession or 2020 will be a great year for the economy. There doesn’t seem to be much in between. As you can see from the chart below, the 50 day rate of change in the 10 year 3 month curve is the 4th highest of this cycle.

The curve steepened sharply prior to 2014 and 2017 which were strong years in this expansion. The market sees 2020 as being another strong year.

It’s All Priced In Already

The current situation is a bit weird because so much of the acceleration in economic growth has been priced in with so little of it actually happening. We expect markets to get ahead of the economy, but even with that assumption, the market is really ahead of itself. The chart below shows this beautifully.

The semiconductor ETF’s yearly change is usually in line with the yearly change in the ISM manufacturing PMI. That’s because both are impacted by global growth.

The current divergence is unlike anything we have seen in the past 14 years as the SOXX is almost up 40% and the ISM PMI is almost down 20%. Either the ISM manufacturing PMI is going to spike very shortly or the SOXX index will crater. The SOXX index is up 49.29% year to date and 14.63% since October 8th. It’s clear markets are all aboard the re-acceleration train. The issue for bulls is even if the ISM increases to 55, it only confirms the rally. That doesn’t leave much room for a further increase on a yearly basis. Yearly growth in the index is already up nearly as high as it was in the 2014 acceleration. To be clear, the index can increase, but it probably won’t increase at the pace it recently has. It’s notable that soon after these large increases, there have been big declines.

It’s Not All Bad News

To be clear, we aren’t presenting the case that the economy won’t accelerate; it can do so. There isn’t full confirmation that it is already, but a trade deal and the recent rate cuts should help. We’re simply saying that a lot of the acceleration is already priced in and it’s not 100% certain to occur. The chart below gives you an idea of what the bulls are looking at.

The OECD global leading indicator, the output index in the global autos PMI, and the new export orders index in the global manufacturing PMI all appear to be bottoming near where they did in early 2016. If you look at the chart above, the semiconductor index was down year over year in early 2016. The 2016 turnaround wasn’t priced in yet and the 2019/2020 one is already priced in.

Interesting GDP Growth Estimates

Q4 GDP growth expectations are interesting for two reasons. First, we could have below 2% GDP growth if estimates are right which is in stark contrast to the stock market’s recent rally and the year to date gains. Second, the consumer might have a really strong holiday shopping season based on the Gallup poll we discussed in a previous article. If the consumer is very strong, such low growth is unlikely.

Estimates this early in the quarter aren’t that accurate, but they do summarize all the information we know about this quarter’s economy. That’s why we look at them. The median of 8 estimates sees growth at 1.5%. The average estimate is 1.7%. The Atlanta Fed Nowcast sees 1% growth. The NY Fed, which perfectly predicted Q3 growth, expects only 0.73% growth. You know the data has been very weak when even the extremely bullish St. Louis Fed Nowcast sees only 1.87% growth.

Preliminary Consumer Sentiment

As you can see from the chart below, the University of Michigan consumer sentiment index increased slightly and was strong. It was up from 95.5 to 95.7 in the preliminary November report.

Those who focus on the difference between the current and expectations indexes saw a nice positive as the expectations index increased from 84.2 to 85.9 and the current index fell from 113.2 to 110.9. The theory is that higher current conditions than expected conditions means a recession is coming. The problem with that logic is that the expectations index is near its cycle high of 91. The most notable aspect of this report is negative mentions of the trade war fell from 27% to 25%. That’s down from 36% in September. The trade war is less of an issue as phase one of the deal could be close to being signed according to the headlines.

Conclusion

Judging based on the U.S. stock market (small & large caps), the European stock market, the U.S. treasury market, and semiconductor stocks, investors see a global cyclical expansion coming in 2020. That might happen, but the problem is it’s almost fully priced in already. It’s ironic to see Q4 GDP estimates below 2% with stocks rallying this much. On the other hand, GDP growth might beat estimates because the consumer looks primed to have a good holiday shopping season.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.