UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The market believes the high CPI readings in April and the next few months will be temporary. It’s not a contrarian opinion to bet inflation will fall. The reflation trade has become more popular than last year, but last year was an extreme example. You can’t anchor yourself to 2020 in which a bubble formed in innovation stocks. It’s best to take a longer term approach.

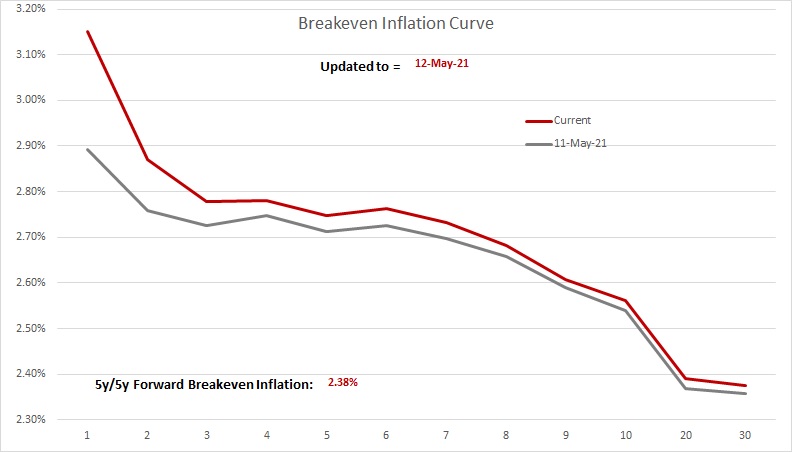

As you can see from the chart below, Wednesday’s CPI report caused the 5 year forward breakeven inflation rate to rise sharply in the near term and rise slightly in the long term. Every high CPI report causes slight changes to long term expectations. We think each strong CPI report in the next few months will cause economists and investors to challenger their own views of long term inflation. That doesn’t mean the long term rate will actually change though. The pandemic lowered the birthrate which hurts the inflation cause.

On the positive side (for CPI), it has become more acceptable for the government to spend more on transfer payments. If there has been a long term shift in policy, we might see higher inflation. Furthermore, more economic support for families could push the birthrate up. Finally, Fed policy has certainly shifted towards being extremely stimulative. The Fed isn’t concerned with inflation at all. There should be a point where low rates allow inflation to sustainably increase. If there was ever a time for inflation to be strong, it would be when fiscal policy is stimulative, rates are low, and the economy reopens.

Higher Inflation Bad For Stocks?

In short, higher inflation is bad for stocks especially growth ones. As you can see from the chart below, the S&P 500’s highest PE ratio occurs when CPI is between 1% and 2% which is where it has been for much of the past 10 years. The good news is when CPI rises to 2% to 3%, the S&P 500’s average PE ratio only falls from 17.7 to 17.1. That’s not a huge deal.

On the negative side, inflation uncertainty and volatility cause multiple compression. Those have both increased in the past few months. No one truly knows where inflation will settle at following this period of high inflation due to base effects, supply chain issues, fiscal & monetary stimulus, and the economic reopening. While April had very easy comps, much of the economy still isn’t fully reopened. That will occur sometime this summer. People will go back to work and traveling will pick up.

High Income Spending Growth

The stimulus checks increase spending growth for the people who got them. We know this isn’t surprise to many. The chart below shows the 2 year change in Bank of America card spending growth for those making less than $50,000 per year has been elevated since the checks were distributed.

One of the reasons growth has stayed high is that the checks were distributed over a few weeks. Whenever low-income people get money, it goes right into the economy. They spend a high amount of their income because they don’t have room to save. This is why most of the bottom 50% doesn’t own stocks. It’s not that they don’t have the knowledge. It’s that they don’t have much capital.

The chart shows those making over $125,000 also are spending much more than they did at this time in 2019. That’s because of the reopening. Upper income people still have room to increase their spending further once restaurants and hotels have zero restrictions. We should be about 1-2 months from this big spike in spending. They will unleash their pent-up demand which will be supported by all the money they saved up in the past year. Extra money will no longer be piled into the stock market. Higher inflation and less investing could suppress stock returns.

Jobless Claims Fall Again

As you remember, jobless claims fell last month but most of that decline was caused by Ohio’s data normalizing. Essentially, jobless claims never were terrible in March even though they looked elevated. This was the point we were making then. However, we still missed the April BLS report. We were too optimistic. Now, lets look at the latest jobless claims numbers. In the week of May 8th, seasonally adjusted jobless claims fell from 507,000 to 473,000. The prior week’s reading was revised up 9,000.

Non-seasonally adjusted claims fell from 514,000 to 487,000. That’s the 2nd decline in a row and the lowest reading of the expansion. PUA claims rose 2,000 to 104,000. The PUA program will go away this fall. The 4 week average of initial claims will fall below 250,000 by the end of the year. Continuing claims fell following 2 weeks of increases. In the week of May 1st, they fell 45,000 to 3.655 million.

Surprisingly, in the week of April 24th, the total people on all benefits programs rose 696,000 to 16.86 million. This is either wrong or the country still has a major problem. It seems like if people left these programs, they could get a job because there are so many openings right now. 9 states have opted out of the federal government’s unemployment assistance program. This means the $300 weekly checks will end early. If states don’t opt out, the checks will go until September 6th.

Conclusion

The market doesn’t expect inflation to stay as high as it was in April. Keep that in mind before you short the reflation trade. Higher inflation is bad for stocks, but it’s not bad enough to cause a crash. The rally in value stocks has lessened the impact of the crash in the innovation stocks. The S&P 500 is barely down from its high, while the innovation stocks are down over 30%. Lower income people spent more after they got their checks. Upper income people still have room to spend more when the pandemic is fully over this summer. Nine states are ending their participation in the government’s pandemic assistance program. That might help increase job creation.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.