UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

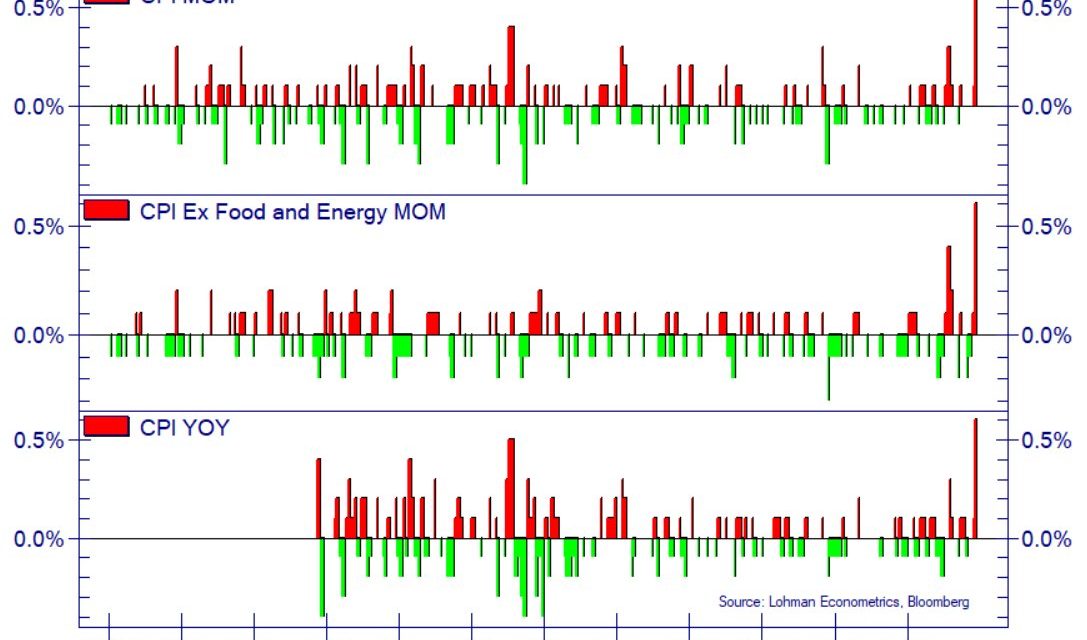

It’s weird to see anyone legitimately surprised that the CPI report showed there was significant inflation in April. Virtually every prices index has been jumping off the charts in the past couple months. Almost every single company mentioned on their earnings call that input costs are rising. How could anyone be surprised CPI is rising sharply? Month over month CPI was 0.8% which destroyed estimates for 0.2%. That was a pretty strong reading since the comp was 0.6%.

Core CPI was up 0.9% monthly which tripled estimates and the comp. This was the highest core CPI monthly growth since September 1981. We’ve been seeing diffusion indexes show we are experiencing the highest net percentage of firms raising prices since the 1970s. Now we have the most important data point on inflation showing prices are rising as much as when inflation was very high. As you can see from the graphic below, this CPI report beat estimates by the most ever across the board.

Year over year CPI was 4.2% which beat estimates for 3.6% and March’s reading of 2.6%. Out of 47 estimates, the highest was only 3.9%. We have mentioned in the past that economists usually miss big changes because they are scared to predict huge jumps or declines even if the early indicators show they will occur.

Obviously, CPI had a very easy comp. In fact, the 2 year inflation stack is only 4.5%. That’s the highest 2 year stack since July 2019 which isn’t a big deal. The highest 2 year stack since 2018 was 5% in February 2018. We wouldn’t be surprised to see the 2 year stack rises above that temporarily. Inflation is going to stay elevated for a few months, but the intermediate term rate is more important.

The inflation rate should be lower when the supply chain disruptions go away. On the other hand, the initial surge of global demand for commodities hasn’t begun in earnest because the pandemic isn’t over. It seems close to over in America. The 7 day average of new cases has fallen to just 36,805. However, the 10 city average occupancy rate in office buildings was only 27.1% in the first week of May. People haven’t gone back to work yet.

Finally, core CPI was 3% which was up from 1.6% in March and beat estimates for 2.3%. The Fed’s 2% goal has finally been exceeded. Now let’s see if the Fed was serious about average inflation targeting. Will the Fed stick with its dovish tone at its next meeting in June? We think the Fed will stay dovish. It will use the weak BLS report to support its perspective which was going to dovish no matter what. The Fed won’t react to a few months of high inflation, but if it stays high, the Fed will need to hike rates next year.

Unlike the April BLS report, the CPI report was treated seriously by the 10 year bond. The yield rose about 8 basis points to 1.7%. This isn’t a technically important reading. We need to see it hit a new high before we get excited. The high for the year is 1.78%. It should push towards 2% in the next few months.

Details Of The CPI Report

Headline CPI was largely driven by energy prices. Energy CPI was up 25.1%. Oil hit negative briefly last April. The macro picture has completely changed. Energy commodities were up 47.9% yearly. Gas was up 49.6%. A few states in the south are currently experiencing gas shortages. Food inflation was only 2.4%. Food away from home inflation was 3.8% and food at home inflation was 1.2%. There are obviously large base effects in these readings. Last year at this time there were toilet paper shortages (food at home equivalent).

As you can see from the chart below, hotels, auto rentals, and used autos were the main drivers of core inflation.

The other categories collectively saw a decline in monthly annualized inflation. In fact, used cars alone added 35 bass points to core CPI which is a lot because its weighting is only 3.48%. These are the types of very large readings from small groups that the Fed loves to point out as temporary. The Fed will say it doesn’t want to raise rates just because this small portion of the CPI report had an undo impact on the overall reading.

Core commodities inflation was 4.4% and core services inflation was 2.5%. Medical care commodities prices actually fell 1.7%. Used car and truck inflation was massive. It was 21%. People haven’t gone back to public transportation. Plus, automakers are having a tough time producing new cars because of the chip shortage (partially driven by crypto mining). Core service inflation was mostly driven by transportation. Transportation services inflation was 5.6%. Medical care services inflation was only 2.2%.

Shelter inflation was 2.1%. This was a very rare report where core CPI was strong even though shelter inflation wasn’t high. Rent inflation is about to rise this summer. Home price inflation is already high regardless of what the CPI report says. As you can see from the chart below, 71% of consumers believe local home prices will rise in the next year which is the highest reading ever. That’s 1 point higher than in 2005 which was right before the bubble peaked. It’s interesting how a group of people saw the housing market turning in 2006 which was right before the market blew up.

Conclusion

CPI exploded in April which is consistent with almost every economic metric we have reviewed and almost every earnings report we’ve read. For some reason, this was a big surprise to economists. This report was the biggest positive surprise ever. The housing market is overheated even though shelter inflation is just 2.1%. If inflation stays high for the next few quarters, the Fed might consider hiking rates in 2022. Higher inflation and rates are bad for stocks. The S&P 500 can’t trade at above a 20 PE multiple in that environment.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.