UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The March labor market report was a disaster even though the numbers were only updated from the week of March 12th. Stocks sold off modestly in response to this terrible report on Friday as the bear market has priced this weakness in. Stocks don’t fall on bad news because the base case scenario is the economy bottoms in April or May and recovers throughout the year. Contrary to popular wisdom, economists are not predicting a V-shaped recovery. 1/3rd see a V-shaped. A U-shaped is the more popular position.

We are studying the labor report to see how big of a hole the economy is going to need to dig out of. Noted short seller Jim Chanos mentioned investors would throw 2020 numbers out, but remember that 2021 is going to start where this year leaves off. Plus, we don’t know how long the virus will impact the economy; some firms will be forced to close, meaning they won’t participate in the recovery.

Establishment Versus Household

The establishment survey showed there were 701,000 jobs lost which missed estimates for 150,000 jobs lost. The unemployment rate spiked to 4.4% from 3.5%. That was the biggest monthly increase since January 1975. The record long streak of job creation that started in October 2010 ended. Leisure and hospitality lost 459,000 jobs and information added 2,000. This shift caused the average hourly wage growth to increase 0.1% to 3.1% which was a rare good number in a sea of disaster.

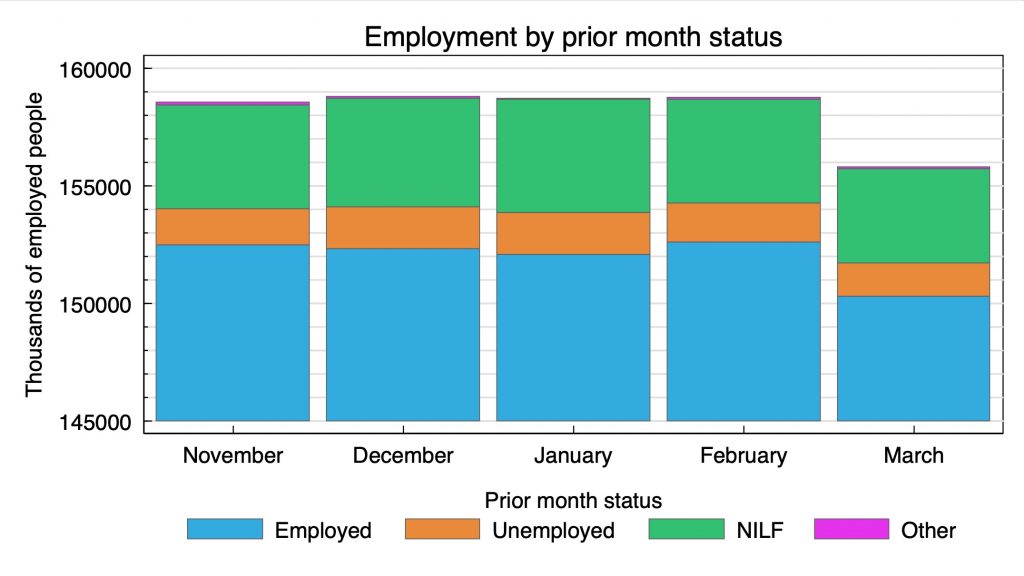

The household survey was even worse than the establishment survey as it showed there were 2.987 million less employed people than last month as you can see from the chart below. That was by far the biggest decline in employed people in a month ever. The previous worst was 1.217 million in January 2009. Both surveys cover the same time period. The household survey covers 60,000 households and businesses including agricultural workers. The establishment survey is a non-farm survey of 145,000 households and businesses. The household survey may have been more accurate this month as the establishment survey had a lower than normal response rate.

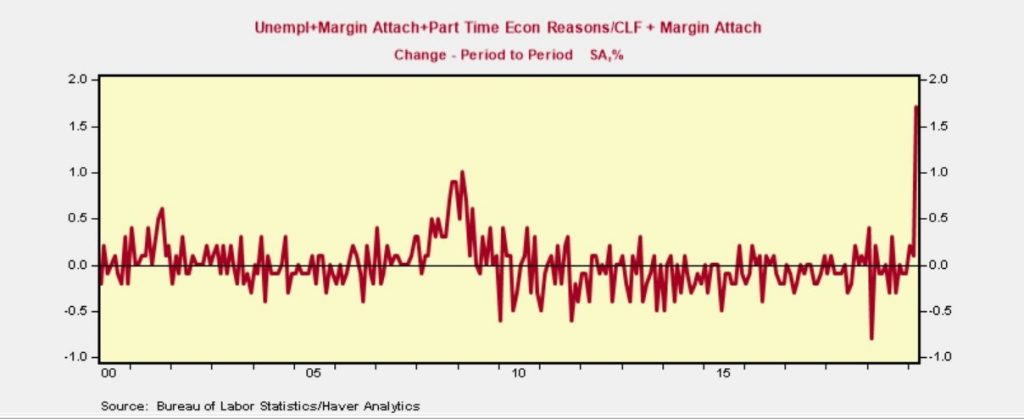

The labor force participation rate fell 0.7% to 64.3%. That was the largest monthly decline since January 1968. All the work that took years to get the prime age labor force participation rate higher will be gone in next month’s report. It fell 0.4% to 82.6% which is the lowest level since September 2019. The 1 million spike in temporary layoffs was near the financial crisis peak. It would have been higher if the 1% of workers who missed work for “other reasons” would have been included. There was a 1.4 million increase in workers who were part time for economic reasons. As you can see from the chart below, the U6 underemployment rate increased 1.7% to 8.7% which was the biggest monthly spike ever. Aggregate weekly hours worked fell 1.2% which was the biggest decline since the financial crisis. The unemployment rate for those with less than a high school diploma rose 1.1% to 6.8%.

Industry Breakdown Of Impacts From COVID-19

The table below is from Long Short Value on Twitter. It shows the short, midterm, and long impacts of this recession by industry. He leaves out energy probably because it is impacted by geopolitics.

If OPEC+ makes production cuts, the energy sector will face tailwinds once this recession ends. That doesn’t mean the frackers with high breakeven costs will survive though; they were in trouble before the virus and now after as there is a supply and demand shock simultaneously.

The greatness of this table lies in the fact that it adds whether survival is in question. When you are investing in extremely risky positions that are hit hard by a recession, the bet isn’t about whether the company will do well in a recovery. The bet is whether it will make it to one. The speculation is over whether it will get financing without wiping out shareholders, not if the fundamentals of the business are sound in the long term. This doesn’t mean you can’t speculate on these risky stocks; you just have to know what game you are playing. Please study the balance sheets and the appetite for more debt for the firms you are reviewing. There will always be cruises and airlines, but shareholders might not benefit from the recovery.

Staples Outperform During & Following Recession

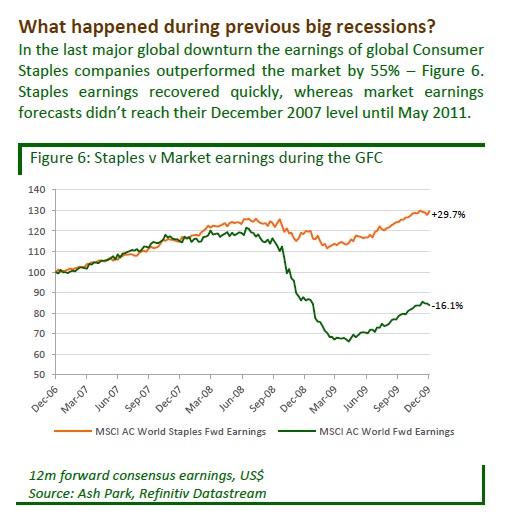

It’s no surprise staples are recession resistant as the demand for necessities doesn’t change much in recessions. As you can see from the chart below, starting in December 2006 to December 2009, (global) staples earnings forecasts grew 29.7% while the overall market saw a decline of 16.1%.

Staples’ earnings recovered quickly because they didn’t fall by much. The actual stock prices outperformed the most when the declines were the steepest and then underperformed as the recover started. Market earnings didn’t recover to their December 2007 peak until May 2011.

Recession Game Plan

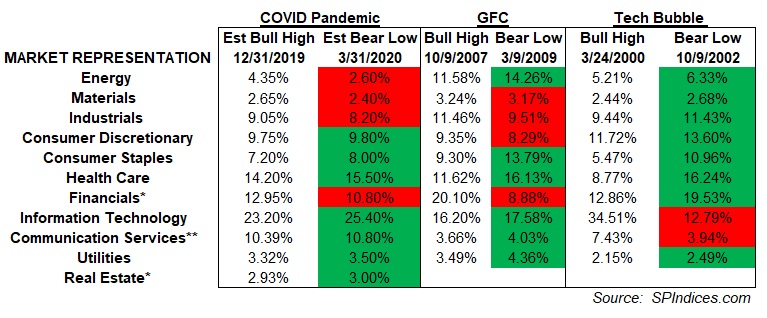

The table below compares each sector’s weighting at the bull high to the bear low in the past 3 recessions.

The tech sector was hit hard in the early 2000s, the financials were hurt in the 2008 financial crisis, and energy was hurt in the COVID-19 bear market. Some people are saying that tech is now immune to recessions. While certain industries in this sector are immune, recognize that tech is positioned well for this crisis because it doesn’t rely on person to person contact. It facilitates work from home. That means it might not be as well positioned for the next recession.

Shocking Stats On Small Caps

The stats you are about to read from @EconomPic on Twitter are shocking. This is a breakdown of Russell 2000 Q1 returns by P/E ratio. The cheapest quintile was down 47.0%. The 2nd cheapest quintile was down 41.4%. The median quintile was down 32.3%. The 2nd most expensive quintile was down 26.7%. The most expensive quintile was down 19.9%. The non-earners were down 24.3%. Energy and small banks had a terrible quarter which probably dragged down the cheap segment. Tech did well, which helped the expensive segment. Biotech stocks did really well which helped the non-earners. Since this is a virus catalyzed recession, many biotech stocks did well, such as Gilead. Gilead was up 16.15% from February 19th to April 3rd.

Conclusion

The March labor report was much worse than expected. Economists might not be as surprised by the April report because everyone knows it will be much worse. Oxford Economics sees 24 million job losses. It will break multiple records. It’s no surprise staples do well in recessions. Biotech, which is considered a speculative industry, did great in this bear market. It makes sense since this is a health crisis.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.